As a seasoned crypto investor with a few years under my belt, I’ve seen Ethereum (ETH) go through its fair share of ups and downs. The recent predictions by prominent analyst “Bluntz” about ETH reaching an all-time high of $8,000 have certainly piqued my interest. However, I remain cautious and remember the lessons learned from past market cycles.

In 2024, Ethereum (ETH), the world’s second-largest cryptocurrency, has delivered a rollercoaster ride for investors. While some analysts remain skeptical, a well-known crypto expert, referred to as “Bluntz” on platform X (formerly Twitter), anticipates an impressive surge for Ethereum. He forecasts a breathtaking price tag of $8,000, surpassing its previous all-time high (ATH). However, Bluntz issues a caution: Ethereum must tackle certain challenges before it can reach these heights.

Key Conditions for Ethereum’s Liftoff

In a video posted on June 9th, Bluntz detailed the important milestones Ethereum needs to achieve to reach its goal of $8,000. At present, Ethereum’s price hovers around $3,000, and there’s a strong possibility it’s approaching the end of this bear market. Yet, Bluntz believes that a swift upward trajectory is an unlikely scenario. Instead, he anticipates another price decline before Ethereum experiences a significant rally.

An analyst has identified a pivotal moment for Ethereum: In order to mark the culmination of a three-wave correction, denoted as an “ABC pattern,” Ethereum needs to surpass $2,800, break below previous lows and subsequently regain this level. Reaching this price point may indicate the conclusion of the downtrend and the onset of a substantial uptrend.

In simpler terms, Bluntz’s analysis indicates that the ABC correction could push Ethereum up to $6,000, followed by a dip. This dip will be temporary before Ethereum reaches its anticipated peak of $8,000. However, Bluntz also predicts some volatility with potential sideways movement and possible new lows before Ethereum recovers.

It’s intriguing to note that according to Bluntz, Ethereum hasn’t experienced its major price surge in this market trend yet. Even though it went above $4,000 earlier in the year, analysts like Bluntz anticipate even larger increases in the future.

Spot Ethereum ETF Launch Impact

As a researcher, I’ve identified one significant factor fueling optimism in the crypto market: the highly anticipated launch of Spot Ethereum Exchange Traded Funds (ETFs). I acknowledge the potential for a price surge upon the ETF’s arrival. However, I offer a cautionary note by predicting a short-term sell-off post-launch. This could be due to profit-taking or other market dynamics that may temporarily impact Ethereum’s price.

The initial drop in Ethereum’s price, as stated by Bluntz, might signify a “cleansing” or “purging” of investors with weaker commitment. After this selling frenzy, he anticipates a robust buying trend that will propel the price upward. However, the specific launch date of the ETF is still ambiguous, adding another element of intrigue to Ethereum’s price movement.

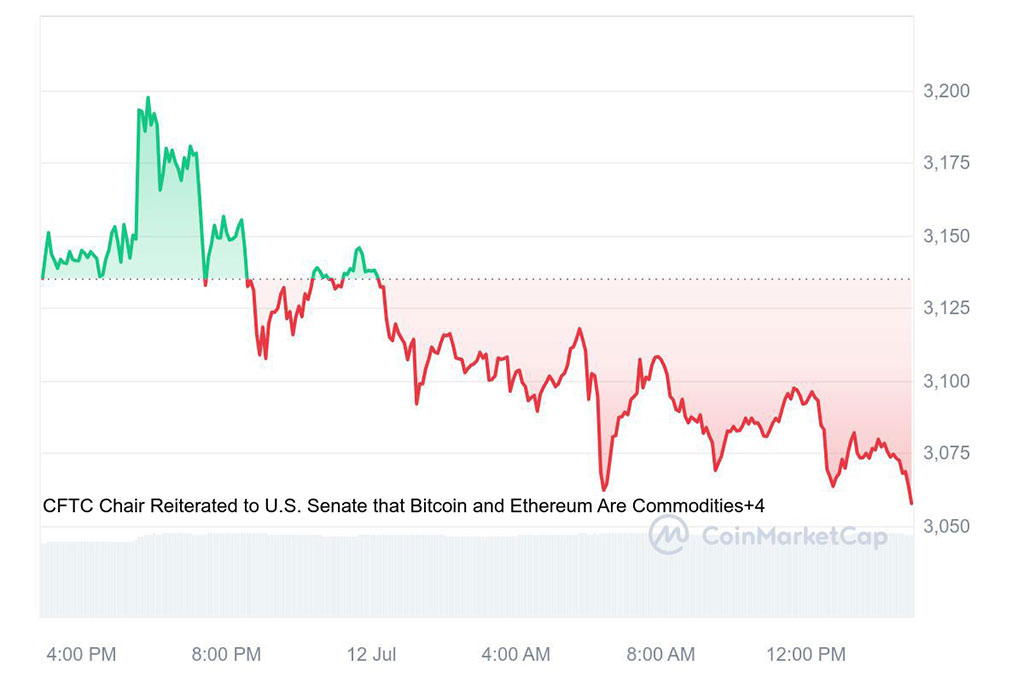

Photo: CoinMarketCap

When I penned down this text, Ethereum was being transacted at $3,068, representing a 2.30% decrease over the preceding 24-hour period. Undeniably, Bluntz’s projection of Ethereum hitting $8,000 is intriguing. Nevertheless, his plan underscores the possibility for market fluctuations before attaining that peak.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-07-12 14:21