As an experienced market analyst, I’ve closely monitored the correlation between Bitcoin and US stocks for quite some time. Recently, the data reveals a significant shift in this relationship, with Bitcoin showing no correlation to US stocks whatsoever. This is a noteworthy development, given their previous positive correlation that had positively impacted both Bitcoin and the broader crypto market.

New findings indicate that Bitcoin‘s performance no longer mirrors that of US stocks. Noteworthy because previously, their relationships were aligned, resulting in favorable impacts on Bitcoin and the overall cryptocurrency market.

Bitcoin Has No Correlation With US Stocks

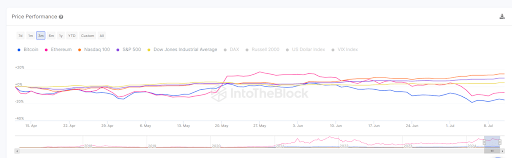

According to market intelligence data from IntoTheBlock, the relationship between Bitcoin’s price movements and those of the Nasdaq 100 and S&P 500 has weakened significantly. The correlation coefficients stand at -0.78 for Bitcoin and the Nasdaq 100, and -0.83 for Bitcoin and the S&P 500. In simpler terms, this implies that when the prices of these assets rise, Bitcoin’s price tends to fall, and vice versa.

For some time, Bitcoin has experienced a significant decline, whereas the Nasdaq 100 and S&P 500 have persisted in robust growth. According to IntoTheBlock’s recent data, the Nasdaq 100 and S&P 500 have registered gains of more than 7% and 4%, respectively, over the past month. In contrast, Bitcoin has witnessed a loss exceeding 15% during this period.

A Bloomberg analysis noted the weakening connection between Bitcoin and US equities, explaining this trend as a result of intense selling pressure in the cryptocurrency market. Joshua Lim, Arbelos Markets’ co-founder, shared with Bloomberg that such pressure, instigated by entities like the German government, has restricted Bitcoin’s growth potential while US stocks continue to reach new record highs.

According to IntoTheBlock’s data analysis, the selling pressure from Bitcoin miners is the primary reason for Bitcoin’s recent decoupling from US stocks like the Nasdaq 100 and S&P 500. Initially, Bitcoin demonstrated strong positive correlations with these indices, with correlation coefficients of 0.86 for the Nasdaq 100 and 0.73 for the S&P 500 as of early June. However, this close relationship weakened significantly as miners started offloading large quantities of their Bitcoin holdings. Bitcoinist reported that over 30,000 BTC were sold by miners during the month of June.

Towards the close of June, Bitcoin experienced heightened selling activity due to the German government disposing of some of the Bitcoins they had confiscated from Movie2k, a pirated movie platform. This selling trend persisted into July as the German authorities continued to sell off these Bitcoins.

Moment Of Truth For BTC And The Stock Market

On July 11, the highly anticipated US Consumer Price Index (CPI) inflation data will be unveiled. This data is widely expected to reveal that American inflation is easing, which could bolster the argument for the Federal Reserve to reduce interest rates. Such a move would likely benefit assets like Bitcoin and US stocks, potentially boosting their values in the crypto market and broader stock market respectively.

In the near future, a surge in inflation figures could lead to a Bitcoin price recovery, with investors looking to buy once again around the $60,000 mark. Crypto analyst Justin Bennett issues a caution that Bitcoin must maintain a value above $57,800 or risk sliding down to $50,000.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-07-11 18:40