As a seasoned crypto investor with a few bear and bull markets under my belt, I’ve learned that the crypto market is a rollercoaster ride of emotions. Bull markets are exhilarating, but they can’t last forever. The recent data suggesting a potential turning point for Bitcoin (BTC) has piqued my interest.

As an analyst, I’ve observed that bull markets are characterized by periods of excessive optimism. However, these episodes don’t last indefinitely. The crypto market, including Bitcoin (BTC), has experienced its fair share of ups and downs throughout history. Recent data indicates a potential shift in this trend, suggesting a possible turning point for Bitcoin.

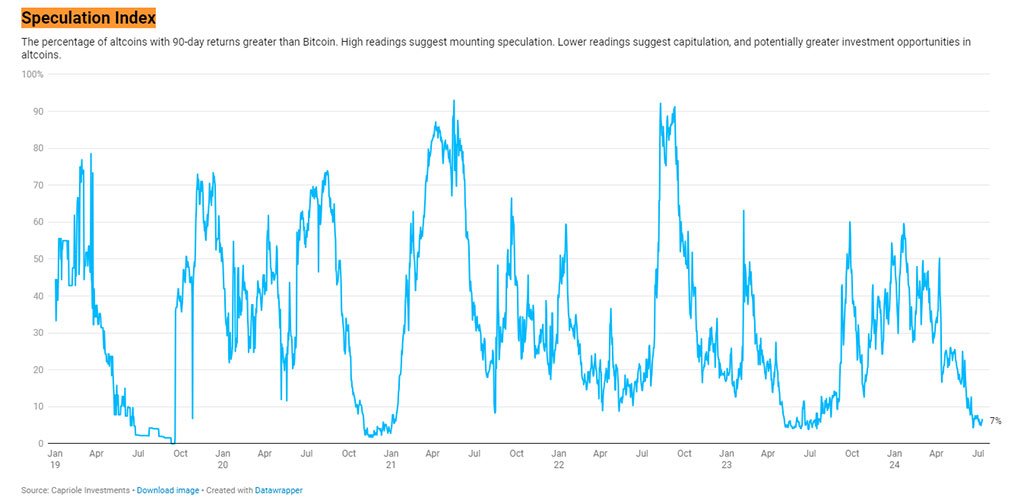

Capriole Investments’ crypto speculation index, which indicates the level of speculative behavior in the altcoin market, has experienced a significant decrease. This index calculates the proportion of alternative cryptocurrencies that have delivered better returns than Bitcoin over the past 90 days.

Photo: Capriole Investments

In January 2024, I observed a significant surge in the altcoin index, which nearly doubled, reaching almost 60%. This increase suggested an intense period of altcoin speculation. However, the frenzy has noticeably cooled down since then, with the index now hovering below 10%. This cooling off phase could be indicative of a potential resurgence in Bitcoin’s market dominance as the leading cryptocurrency.

Why Altcoin Outperformance Matters

The expansive world of altcoins, home to more than 14,800 tokens as reported by CoinGecko, frequently fuels investor speculation due to their uncertain use cases and minimal trading activity. The preferences of retail investors are significantly influenced by Google Trends data when it comes to these altcoins.

When altcoins surge ahead of Bitcoin by a large margin, some financial analysts may interpret this as a symptom of heightened investor enthusiasm, which could be a warning signal for an imminent market bubble.

Even when cryptocurrencies experiencing speculative interest see value decreases, corrections play a crucial role in the entire market. These “washouts” serve to adjust asset prices according to their essential foundations and curb overzealous speculation, fostering a more robust base for prolonged expansion.

Reflecting on past market trends, a consistent pattern has emerged regarding Bitcoin’s rallies since 2019. Specifically, notable price increases for Bitcoin have occurred when the speculation index dipped below the 10% threshold. This trend was evident in the first half of 2019, late 2020, and the second half of 2023.

Bitcoin’s Rise from Speculative Decline

On July 11, 2024, I observe Bitcoin trading at a price of $58,864, just slightly under its peak of $59,350 achieved within the last 24 hours. Bitcoin experienced a 1% growth compared to the previous day’s value. However, trading volume saw a decrease by approximately 5.9%, as investors remain cautious in anticipation of crucial inflation data. It is worth noting that buying activity in derivative markets remains relatively quiet, with the total Bitcoin futures market maintaining a steady level of $26.59 billion.

Photo: CoinMarketCap

The drop in the crypto speculation index indicates that Bitcoin may regain its leading position in the market. With less excitement surrounding alternative coins, Bitcoin could experience a resurgence as investors look for security and proven worth. Nevertheless, significant economic data and the overall market mood will continue to shape Bitcoin’s price trend over the next few weeks.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2024-07-11 17:22