As a long-term crypto investor with experience in the market, I have seen my fair share of price volatility and government interventions. The recent selling pressure on Bitcoin due to the German authorities’ large-scale sell-offs is concerning, but it doesn’t deter me from my belief in the potential of this digital asset.

As an analyst, I’ve observed a noteworthy trend in the Bitcoin market lately. German authorities have been actively selling substantial quantities of Bitcoin, putting additional pressure on the world’s leading cryptocurrency. Consequently, Bitcoin has experienced a significant decline, dropping over 20% within the past month.

Bitcoin Reserves On The Brink Of Exhaustion

Last month saw the commencement of brisk sales of confiscated Bitcoins. This action was instigated by the German government following their seizure from a digital wallet managed by the Federal Criminal Police Office, famously referred to as the Bundeskriminalamt (BKA).

In June, the German Federal Criminal Police Office (BKA) disposed of 900 Bitcoin, valued at around $52 million at that time, which had been confiscated from a closed movie piracy site. More recently, the government offloaded an extra 3,000 Bitcoin, worth approximately $172 million, and another 2,739 Bitcoin, equivalent to roughly $155 million, this week.

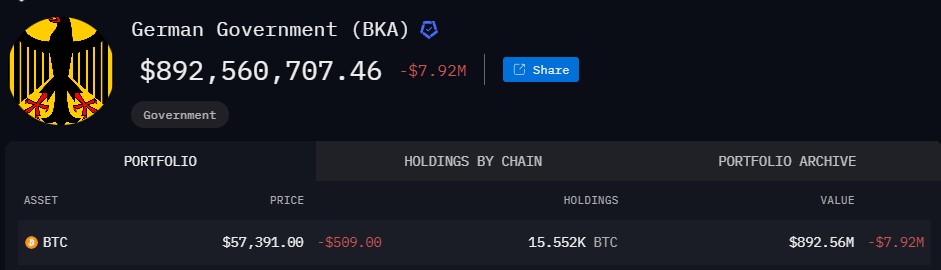

New information from blockchain analysis firm Arkham indicates that the German government’s Bitcoin holdings saw significant reduction last Wednesday, with over 5,000 Bitcoins sold, leaving them with approximately 15,552 Bitcoins remaining worth around $892 million. This sale represents a substantial disposal of about 80% of their original seizure of 50,000 Bitcoins.

Price Remains Steady As BlackRock Steps In

In spite of a substantial drop in price, Bitcoin has successfully kept its value above the vital $50,000 mark – a key support line from the previous six months. This tenacity suggests that Bitcoin’s price can withstand the intense selling pressure experienced in the market during the last month.

Lately, Bitcoin’s dip from record-breaking values has been perceived as a buying chance by numerous investors, including major financial institutions. This perspective has led to a modest uptick in the cryptocurrency’s price during the last few days. Akrham also shared on social media that while Germany is unloading Bitcoin, Blackrock is actively acquiring it.

As an analyst, I have examined the latest data and found that on Wednesday, there was a total inflow of 4,862 Bitcoins, equivalent to around $281 million, into Bitcoin Exchange-Traded Funds (ETFs). This influx helped counteract the negative effects of the German authorities’ daily sell-offs.

As a financial analyst, I’d rephrase that as: I notice that BlackRock, one of the world’s largest ETF managers with assets under management in Bitcoin totaling over $18 billion, has recently purchased an additional 2,095 BTC for its portfolio. This acquisition increases BlackRock’s total holdings to approximately 312,565 BTC. With this substantial investment, BlackRock is significantly contributing to the Bitcoin market by providing stability and support to the Bitcoin price.

Currently, bitcoin, the leading cryptocurrency, is priced at $57,430 for purchase, mirroring Tuesday’s figure with a marginal decrease of 0.4% over the past day. However, it is important to note that this represents a significant decline of more than 22% from its record high of $73,700 attained in mid-March.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Gold Rate Forecast

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- CNY RUB PREDICTION

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Delta Force Redeem Codes (January 2025)

2024-07-11 08:10