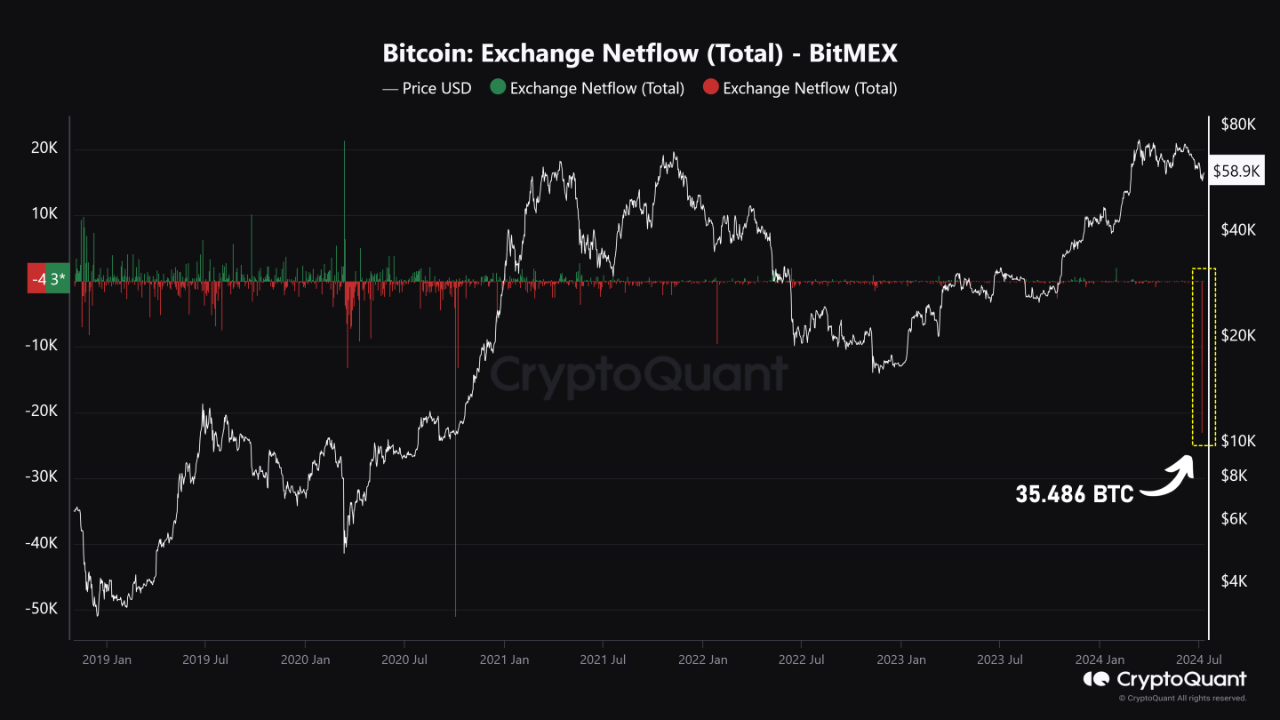

As a researcher with a background in cryptocurrencies and market analysis, I find the recent Bitcoin outflow from BitMEX of 35,486 BTC to be an intriguing development. Based on historical data and trends, this event could have significant implications for Bitcoin price movements.

In an significant turn of events, BitMEX, a widely-used cryptocurrency exchange, recorded the second-largest Bitcoin withdrawal of approximately 35,486 coins from its platform. This occurrence carries added importance given that historical data indicates a close relationship between such outflows and price fluctuations in Bitcoin using the “Exchange Netflow” indicator on BitMEX.

Based on the information I’ve gathered from CryptoQuant, I notice that substantial Bitcoin withdrawals from BitMEX have taken place recently. As a seasoned crypto investor, I interpret this trend as top BTC investors making moves. They could be transferring their holdings to secure cold storage or capitalizing on strategic selling opportunities on other trading platforms.

As a researcher studying Bitcoin market trends, I’ve observed that large transactions moving out of BitMEX can have a stabilizing effect on Bitcoin prices. By reducing immediate selling pressure on the exchange, these transactions add stability to the price and may even act as a catalyst for further price rallies. Furthermore, such movements are frequently interpreted as signs of accumulation among high net-worth Bitcoin investors, signaling their confidence in Bitcoin’s future potential.

Photo: CryptoQuant

BitMEX has garnered considerable interest from market analysts and crypto enthusiasts due to its substantial influence on the cryptocurrency derivatives sector. Notable price shifts in Bitcoin on BitMEX are often perceived as calculated moves by influential traders, leading to noticeable psychological impacts on the broader market.

BTC Price Action

Following a decline to $53,500 on Monday this week, Bitcoin’s price has rebounded by over 5% and is now trading at approximately $57,950 as of the present moment. Enthusiasts of Bitcoin are hoping for a swift increase above $60,000 in order to strengthen the ongoing upward trend.

As a researcher, I’ve observed that the German government recently sold off approximately 9000 Bitcoins, equating to around $650 million in value. Surprisingly, the Bitcoin market has yet to exhibit any significant price fluctuations following this substantial sale.

As the German government quickly disposes of its Bitcoins, there’s been a surge in investments into Bitcoin spot exchange-traded funds (ETFs) in the US. In just the past three days, US Bitcoin ETFs have attracted a significant amount of capital, totaling approximately $645 million. BlackRock’s IBIT ETF has garnered the largest portion of these new inflows.

In the past thirty days, approximately 85,000 bitcoins have been amassed by long-term owners, primarily those using custodial wallets with no recorded transactions out.

As an analyst, I would explain that these wallets do not fall into the categories of Exchange-Traded Funds (ETFs), cryptocurrency exchanges, or Bitcoin miners. Concurrently, approximately 16,000 Bitcoins were withdrawn from ETF holdings during the same timeframe.

While some panic sell, “the others” are buying.

— Ki Young Ju (@ki_young_ju) July 10, 2024

Ki Young Ju, the CEO of Cryptoquant, disclosed that over the past 30 days, permanent holders, identifiable as custodial wallets without any outgoing transactions, have amassed approximately 85,000 Bitcoin. It is important to note that these wallets differ from ETFs, exchanges, and miners. Concurrently, there was a net sell-off of 16,000 Bitcoin from ETF holdings during the same timeframe. This discrepancy in market action indicates a split in investor attitudes, with some showing signs of fear and selling off their Bitcoin, while others remain steadfast in their purchases.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2024-07-10 18:24