As a researcher with experience in analyzing on-chain data and cryptocurrency trends, I find the recent decline in Bitcoin’s Total Amount of Holders to be an intriguing development. The data from Santiment indicates that BTC investors have been liquidating their wallets amidst the bearish wave, leading to a decrease in the total number of addresses holding some balance on the network.

Bitcoin‘s on-chain data indicates a discernible trend in the total number of its holders, which historically has been associated with bullish price movements for the cryptocurrency.

Bitcoin Has Seen A Fall In Its Total Number of Holders Recently

Based on information from the cryptanalysis firm Santiment, there has been a trend of Bitcoin investors emptying their wallets during the current bearish market. The significant metric to consider in this context is the “Total Number of Holders,” which quantifies the overall count of unique addresses harboring some BTC in their inventory.

As a researcher studying this metric, I have observed that an increase in its value signifies a few significant occurrences. New investors are entering the network by creating new accounts or addresses. Conversely, some early investors who had previously sold their holdings may be re-entering the market. Additionally, existing users might be generating fresh addresses to enhance their privacy within the system.

In simple terms, an increase in the number of people holding a particular cryptocurrency generally indicates that it’s gaining popularity and acceptance within the market. This is a positive sign for the currency’s future prospects.

From my perspective as an analyst, when the indicator shows a decrease, it means some investors have chosen to sell off their assets, likely due to various reasons, resulting in them fully liquidating their holdings.

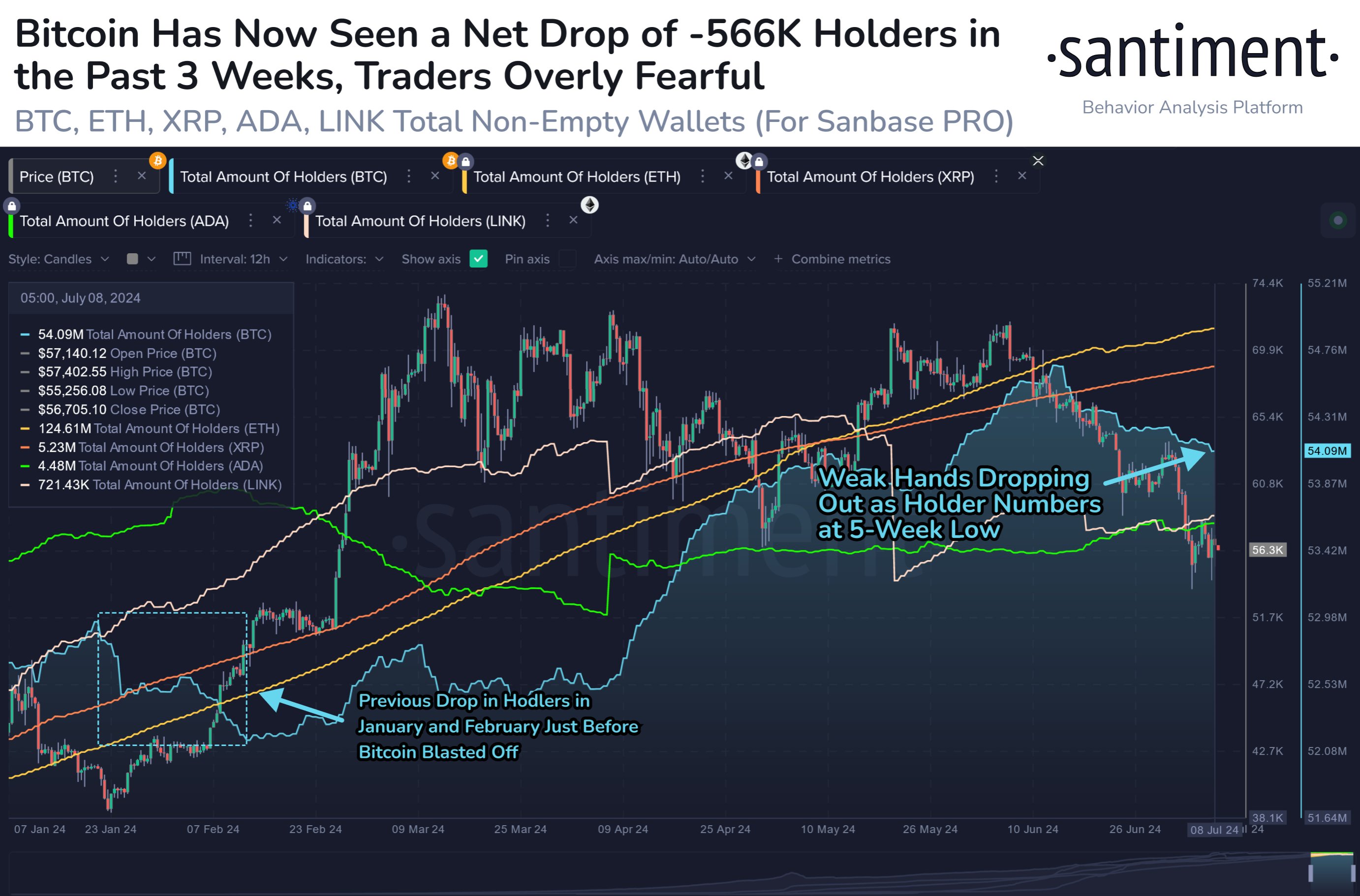

Here’s a chart illustrating the development of the total number of holders for the five leading cryptocurrencies – Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Cardano (ADA), and Chainlink (LINK) – since the beginning of this year.

In the graph before you, it’s clear that the overall number of Bitcoin holders has experienced a recent decrease. This reduction in the holder count coincides with the falling price trend of the cryptocurrency asset.

Approximately 566,000 Bitcoin wallets have been drained over the past three weeks, a figure that implies the recent bearish market may have caused unease among investors and prompted them to sell off their holdings.

It’s intriguing to note that Ethereum, Cardano, and XRP have experienced a steady rise in this metric, suggesting that the usage or adoption of these cryptocurrencies is on an upward trend.

The decline in Bitcoin’s value might indicate that some holders are leaving the network, but if fear, uncertainty, and doubt (FUD) are driving this exodus, it could actually benefit Bitcoin in the long run.

Bitcoins historical trend indicates that it typically responds in the opposite way of popular sentiment. Consequently, fear-driven news or FUD can result in Bitcoin’s price reversing and heading upward.

Observing the chart, it’s clear that the number of holders dropped in both January and February. Subsequently, there was a significant surge in the coin’s value, leading to a new record high (ATH).

In simpler terms, Santiment observes that when anxious sellers offload their holdings in a panic, creating “self-liquidating wallets,” this behavior can signal the end of a downtrend and potential market bottoms for patient bulls in the case of cryptocurrencies or other assets.

BTC Price

At the time of writing, Bitcoin is trading at around $57,400, down more than 7% over the last week.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-07-10 02:10