As a researcher with experience in cryptocurrency markets, I’ve seen my fair share of volatility, particularly in the meme coin sector. The latest crash of Dogecoin (DOGE) under 10 cents is just another reminder of the risks involved in this space. With its market cap plummeting under $14.5 billion and 21% weekly losses, DOGE traders have faced significant heat in the last two days, resulting in over $11.89 million worth of liquidations.

I’m a researcher studying the cryptocurrency market, and one notable development is the significant drop in value for Dogecoin (DOGE), currently the largest meme coin. At present, DOGE’s price has dipped below 10 cents, trading at $0.0984, representing a nearly 9% decrease. Consequently, its market capitalization has fallen under $14.5 billion. This decline extends Dogecoin’s weekly losses, which now exceed 21%.

As a researcher examining recent market trends, I’ve observed that Dogecoin traders have experienced significant pressure over the past two days, with substantial market liquidations taking place. According to data from CoinGlass, the total liquidation volume for DOGE within the last 24 hours surpassed $11.89 million. Breaking down these figures, approximately $10 million was attributed to long liquidations, while short liquidations accounted for around $1.89 million.

When market conditions become unfavorable, exchanges may compel traders to close their positions through a process called liquidation. Factors such as extreme market volatility, over-leveraging contrary to market trends, or insufficient margin balances can trigger this action.

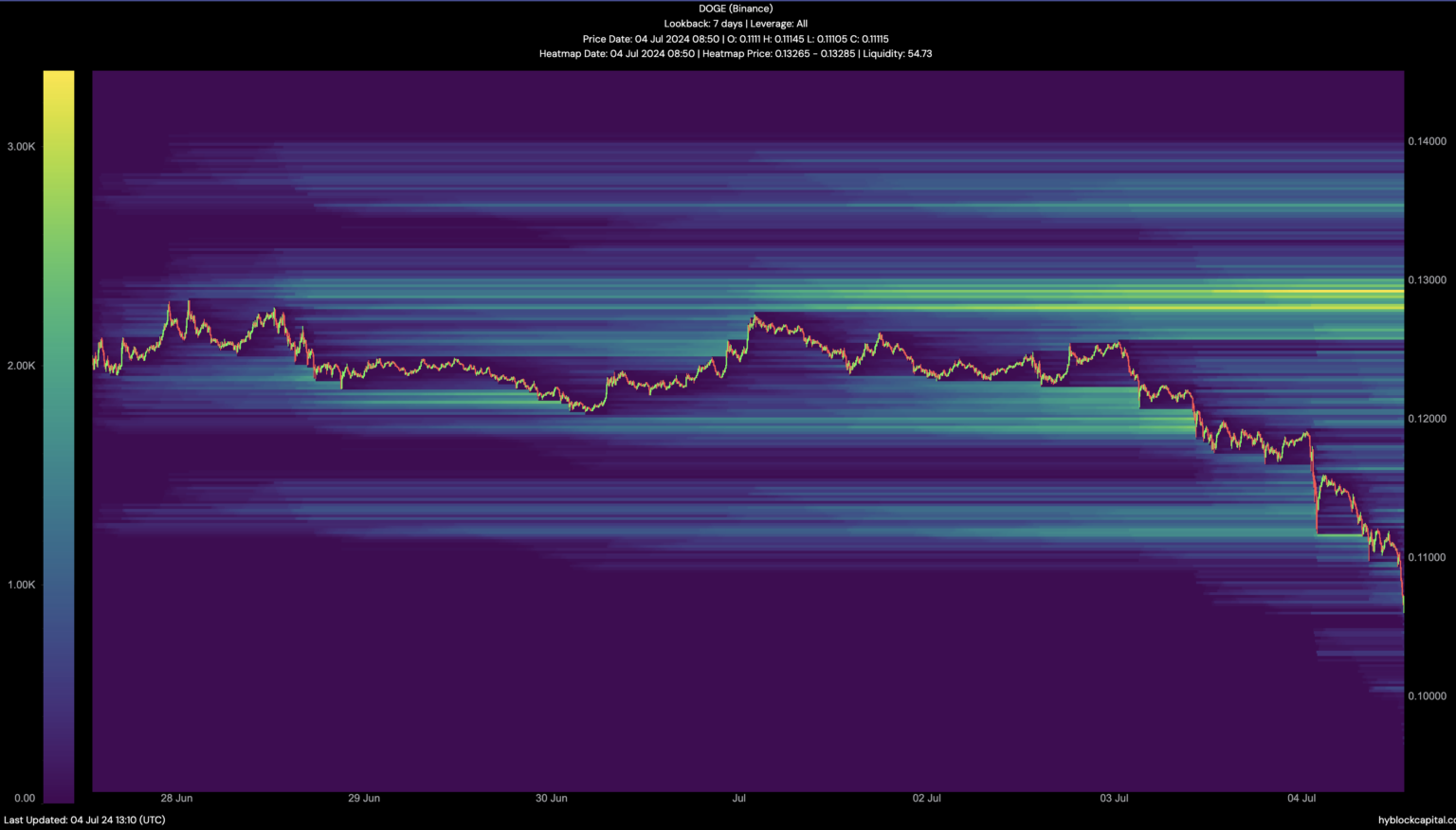

As an analyst, I would explain that a liquidation heatmap is a tool used to identify potential price levels where large-scale sell-offs, or liquidations, are likely to take place. These levels frequently align with regions of high market liquidity, suggesting possible areas for price fluctuations. Consequently, this visualization aids in forecasting market trends and determining key support and resistance points.

According to the latest Hyblock statistics, a significant amount of DOGE‘s liquidity is clustered around the $0.12 mark. This implies that if demand surges, the Dogecoin price may be pushed in the direction of this value.

Courtesy: Hyblock

Should Dogecoin Investors Buy the Dip?

As a seasoned analyst, I’ve been closely monitoring Dogecoin’s on-chain metrics, and my assessment is that the current market conditions present an opportune moment for investors to acquire more coins at attractive prices. The discrepancy between daily active addresses and the coin’s price trend suggests that it could be an ideal time for accumulation.

The Daily Active Addresses (DAA) indicator measures the correlation between the pace of price growth and network activity on the blockchain. If the price surge outpaces this metric, it often indicates a potential selling point.

As a researcher examining the current market trends, I’ve observed that the price-DAA (Daily Active Addresses) ratio has reached a striking level of 58.32%. This signifies a substantial divergence, implying that the increase in price is occurring at a faster pace than the expansion of blockchain activity with daily active addresses.

Courtesy: Santiment

The data indicates an increasing trend in Dogecoin network engagement. Should this momentum persist, investing in Dogecoin could become a profitable prospect.

Looking ahead, the coin’s value might settle near the $0.10 mark. However, it’s worth noting that investors could start amassing the coin in the coming weeks.

Meme Coin Sectorial Selloff

The widespread drop in the cryptocurrency market has had a significant impact on meme coins in particular. All of the top ten meme coins experienced a decline of around 15-20% earlier today, following news of the German government’s sell-off and Mt.Gox repayments. At present, these losses have lessened.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-07-05 17:54