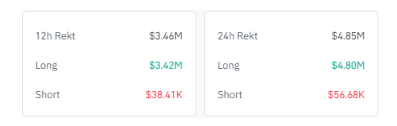

As an experienced analyst, I’ve seen my fair share of market downturns and liquidation events. The recent drop in Dogecoin (DOGE) value is concerning, to say the least. DOGE took a significant hit this Thursday, with a 14% decrease in just 24 hours. Coinglass reports that over $5.39 million worth of long positions were liquidated during this period, while short positions saw minimal liquidations at just $56,680.

Dogecoin (DOGE) has taken a heavy toll from the current crypto market slump. On Thursday alone, this meme-inspired digital currency experienced a substantial decrease in value, amounting to a 14% loss over the past 24 hours.

Long Positions Liquidated

Based on Coinglass’ data, approximately $4.8 million worth of long positions in DOGE were liquidated. This implies that investors holding the belief that DOGE’s price would rise were adversely affected as the price instead declined. On the other hand, short positions, representing bets on a decrease in DOGE’s price, experienced relatively minor liquidations totaling $56,680.

A liquidation event occurring concurrently causes a significant decrease in DOGE‘s value, reaching a three-month minimum at around $0.099 to $0.117. This critical area, identified by IntoTheBlock as a major support, hosts a considerable number of wallets. If this support holds, there’s a possibility for the price to recover, potentially reaching $0.142 again.

Dogecoin Not Alone, But A Leader In Liquidations

As DOGE experiences pressure, it’s important to note that this isn’t an isolated issue. The wider cryptocurrency market correction has led to over $321 million in liquidations for different digital currencies.

LIQUIDATION DATA IN 24 HOURS

TOTAL LIQUIDATIONS: UP TO $321.28M

Five Digital Coins with the Greatest Current Liquidation Volumes:

— PHOENIX – Crypto News & Analytics (@pnxgrp) July 4, 2024

As a crypto investor, I find it intriguing that Dogecoin (DOGE) holds the fourth position for largest liquidations despite being smaller in market capitalization compared to coins like Solana (SOL). Even newer meme coins such as Dogewifhat (WIF) and Pepe (PEPE) have faced substantial liquidations as well.

As a cryptocurrency analyst, I’d point out that although Dogecoin has faced some challenges recently, it continues to hold a substantial presence in the crypto marketplace. It runs on the Litecoin blockchain, which is a proven and reliable technology, and boasts an impressive market capitalization of over $13 billion.

A Double-Edged Sword: No Spot Market Pressure, But High Bitcoin Correlation

In contrast to the derivatives market, where there’s noticeable selling activity, the real market for Dogecoin is witnessing more buy orders than sell orders. The data indicates a buying surplus of around $1 million.

Doge’s destiny appears closely linked to Bitcoin (BTC). The two assets exhibit a strong price correlation, implying that even small-scale Bitcoin sell-offs can lead to substantial DOGE price fluctuations. Events such as potential Bitcoin sales from Mt. Gox, a defunct cryptocurrency exchange, and the German government offloading confiscated Bitcoins, could indirectly influence Doge’s market value.

Will DOGE Rebound?

As a researcher studying the Dogecoin market, I’ve noticed that the technical indicators are currently pointing towards a bearish trend. Based on my analysis, there is a predicted drop of approximately 13% by August 4th. This forecast aligns with the prevailing sentiment in the market. Additionally, the Fear and Greed Index reading of 29 adds to this bearish outlook.

Dogecoin managed to stay above the water for about a third of the last 30 days, but its unstable price movements suggest that the bearish trend might persist.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

2024-07-05 15:40