As a seasoned crypto investor with several years of experience under my belt, I’ve witnessed my fair share of market volatility and liquidations. This latest market meltdown, where over $170 million was wiped out in just one day, is a stark reminder of the risks involved in this space.

As I delve into the dynamic world of cryptocurrencies, I observe a tumultuous trading day where approximately $200 million was erased due to liquidations. The value of Bitcoin dipped below the $61,000 mark, instigating this financial cascade. Consequently, numerous investors and traders found themselves impacted by these unfavorable market conditions.

Market Meltdown And Crypto Liquidation

The market value in total has dropped around 2.7%, amounting to roughly $2.34 trillion, signaling increased market instability and tension.

Bitcoin experienced a 1.3% decrease over the past week, with a more significant loss of 2.8% just in the last day. This downturn has negatively impacted the value of many investors’ holdings and resulted in considerable losses for traders due to forced sales.

As a researcher examining data from Coinglass, I’ve uncovered some alarming figures. A staggering 59,816 traders met their demise through liquidations, and the overall financial toll reached an astounding $170.72 million.

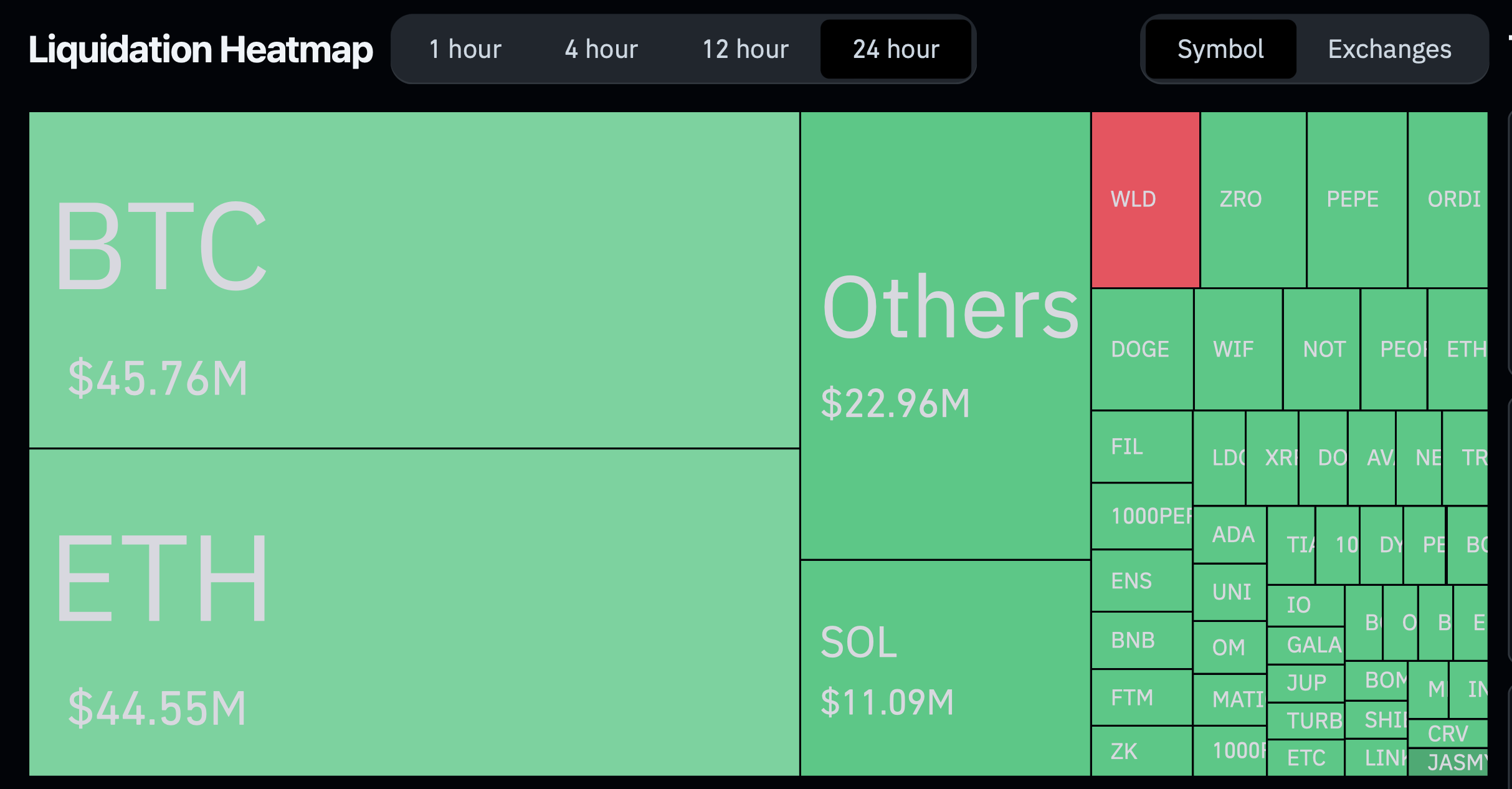

The majority of the liquidations came from long positions in the market, implying that numerous traders anticipated a price surge for Bitcoin and other cryptocurrencies like Ethereum and Solana. The Bitcoin trading community endured approximately $45.76 million worth of liquidations, while Ethereum and Solana traders experienced losses totaling around $44.55 million and $11.09 million respectively.

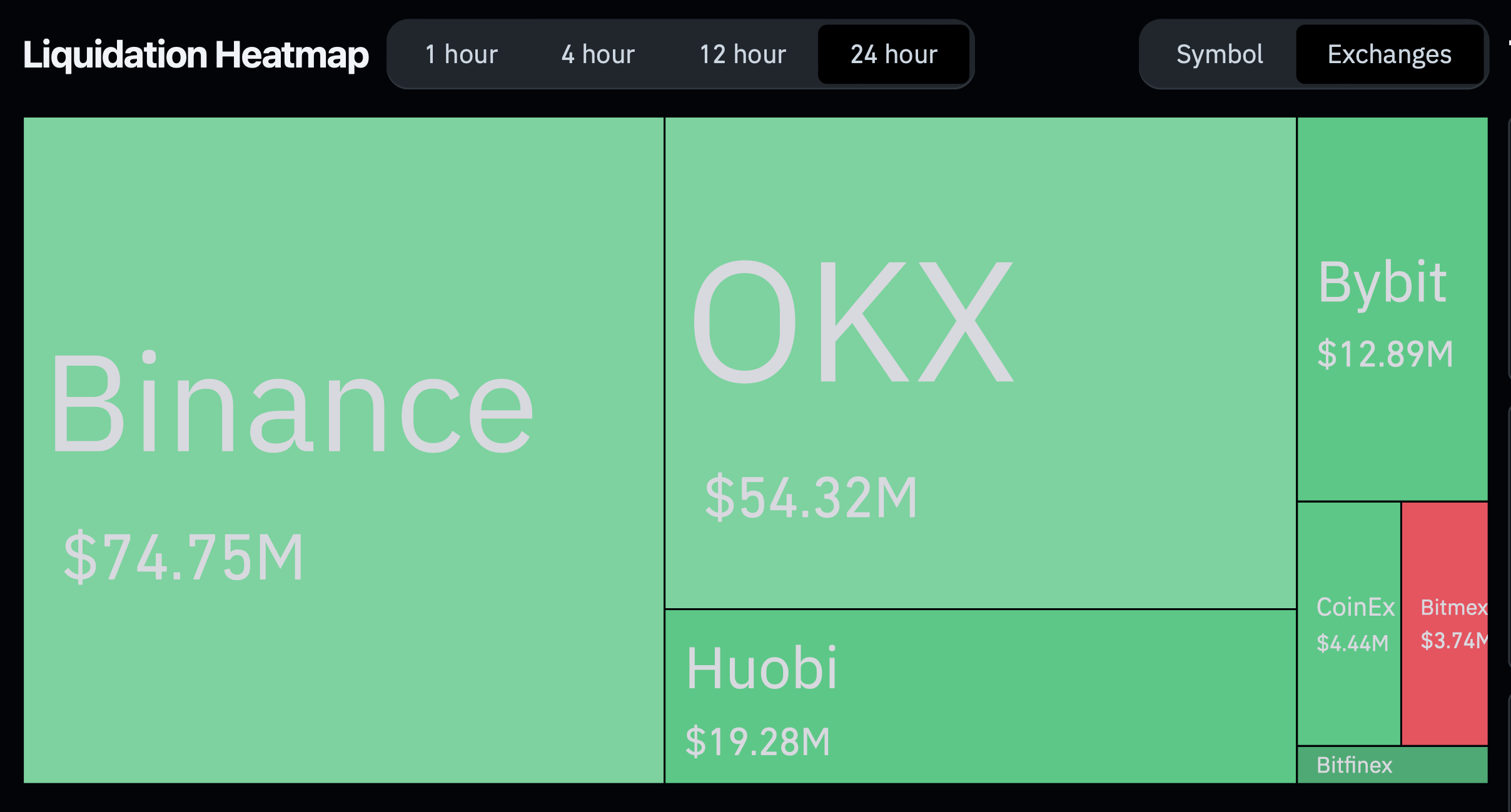

On significant cryptocurrency exchanges such as Binance, OKX, Huobi, and Bybit, a substantial amount of liquidations took place, with Binance accounting for approximately $74.77 million worth of these transactions.

During the recent market turmoil, other trading platforms like OKX, Huobi, and Bybit underwent substantial liquidation events, totaling $54.29 million, $19.28 million, and $12.93 million in losses respectively. However, even though smaller exchanges experienced liquidations as well, their impact was relatively minor.

Analysts’ Viewpoint On Bitcoin Current Performance

In spite of the present economic slump, certain market forecasters continue to be hopeful about Bitcoin’s future. Notably, PlanB, a well-known figure in the crypto world, has recently reinforced his belief that the bull market is still in progress. He bases this view on the fact that there are no unusual on-chain indicators at present that would suggest an extended bear market.

Furthermore, cryptocurrency analyst Ali expressed his viewpoint on Elon Musk’s social media platform X, proposing that it could be advantageous to acquire Bitcoin now, in expectation of an upcoming market recovery.

The TD Sequential indicator, which previously signaled a buy opportunity for Bitcoin at $60,000 on June 28 and advised selling at $63,200 on July 1, now indicates another potential buying opportunity.

— Ali (@ali_charts) July 3, 2024

As a financial analyst, I’ve noticed that Bitcoin advocate Samson Mow strongly believes in the role of Bitcoin in resolving underlying economic problems. In his perspective, improving monetary structures could be the catalyst for a more comprehensive economic revival.

As a researcher studying economic systems, I would argue that governments face a significant challenge in attempting to mend economic issues when the very foundation of our monetary infrastructure – the fiat currency system – may be flawed. Instead of focusing solely on economic policy adjustments, it’s essential to address the root cause: the need for sound money. Embracing decentralized alternatives like Bitcoin could pave the way for a more stable and robust financial foundation upon which governments can build effective economic policies.

— Samson Mow (@Excellion) July 3, 2024

As an analyst, I would express it this way: The insights he shares bring to light Bitcoin’s significant capacity for recovery and even further growth within the financial sphere.

Read More

- W PREDICTION. W cryptocurrency

- ZK PREDICTION. ZK cryptocurrency

- ARB PREDICTION. ARB cryptocurrency

- What Are Silo 18’s Tunnels Connected To? Juliette’s Silo 17?

- Is there preload for Path of Exile 2? Yes, but with a few caveats

- XVG PREDICTION. XVG cryptocurrency

- XRD PREDICTION. XRD cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- DEXE PREDICTION. DEXE cryptocurrency

- Over $500 Million Wiped Out From The Market As Bitcoin Price Fluctuates Heavily

2024-07-04 09:04