As a researcher with extensive experience in the crypto market, I’ve closely followed Bitcoin’s (BTC) recent struggles to regain bullish momentum. The selling pressure from miners and governments has significantly impacted the market, keeping prices within a narrow consolidation zone.

Bitcoin (BTC) has been experiencing difficulty in resuming its bullish trend lately, hovering around the significant support level of $60,000. Despite hitting an all-time peak three months back, the leading cryptocurrency dipped as low as $59,500 on a recent Wednesday due to heightened selling activity from miners.

BTC Selling Spree

The prolonged selling off of miners, the most extensive period since the summer of 2022 preceding the FTX collapse, suggests the impact of Bitcoin’s halving on supply.

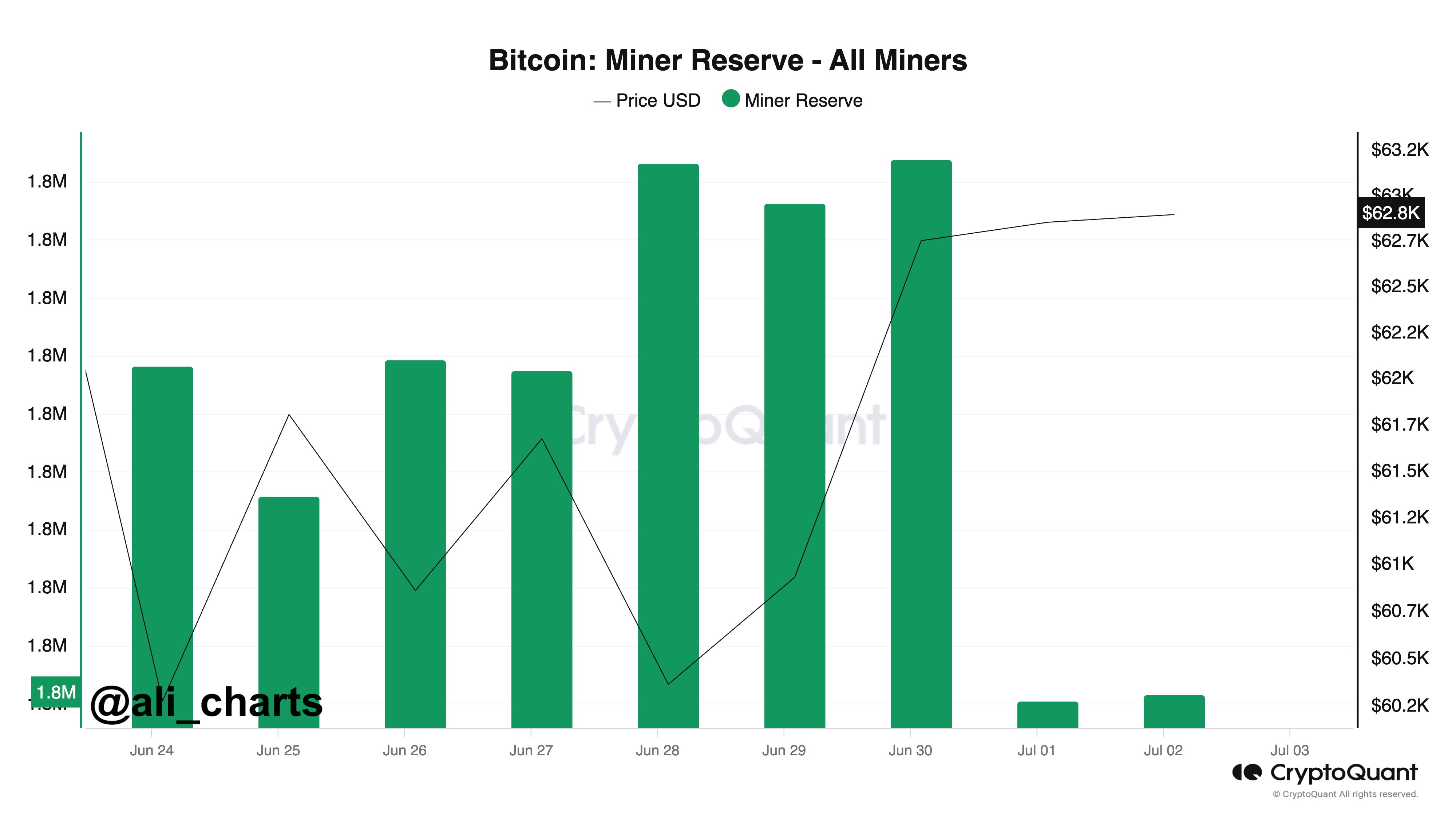

Crypto expert Ali Martinez pointed out that over the past three days, Bitcoin miners have disposed of around 2,300 Bitcoins, which equates to roughly $145 million in current value.

Miners selling Bitcoin puts additional pressure on the market, compounding recent sales from governments like the US and Germany. This collective selling has kept prices confined to the lower end of the broader consolidation range between $60,000 and $70,000 observed over the past few months.

As a crypto investor, I’ve come across an intriguing piece of information. It appears that government-linked Bitcoin addresses have transferred approximately $737 million in total to exchanges such as Coinbase, Bitstamp, and Kraken. These transactions have taken place on numerous occasions.

Over time, as selling pressure from governments and miners decreases, experts predict that Bitcoin’s price may rebound, based on historical trends following the Bitcoin halving event. These trends suggest possible new record highs for Bitcoin’s price.

Bitcoin Price Outlook

According to financial analyst Scott Melker, a significant indication might be on the horizon for the market. He explains that if the daily chart fails to close above the $60,300 threshold, this could potentially trigger a bullish divergence.

As a researcher studying market trends, I would look for the Daily Relative Strength Index (RSI) leaving its oversold region, much like it did in August of last year when Bitcoin’s price hovered around $26,000.

As a researcher studying market trends, I highlight the importance of a noticeable decline beneath the previously mentioned level, which must be followed by a distinctly upward trend in the Relative Strength Index (RSI) without touching new lows. This would necessitate a substantial correction for the RSI to dip below its June 24th value.

Androew Kang, a cryptocurrency analyst, underscores the importance of noting a potential break of Bitcoin’s four-month price range. He makes comparisons to the similar range witnessed in May 2021 after an intense surge in BTC and altcoin values.

As an analyst, I’ve observed that over $50 billion worth of crypto leverage is currently sitting at nearly record-breaking levels. What makes this even more noteworthy is the prolonged consolidation period we’ve experienced for the past 18 weeks. During this timeframe, the market has shown little signs of extreme corrections, which were quite common during the 2020-2021 bull run.

Additionally, Kang proposes that the initial cost projections in the low fifty thousands might have underestimated the actual amount, potentially leading to a larger adjustment closer to forty thousand dollars.

A significant retreat from current levels could cause turbulence in the market, potentially leading to several months of volatile or declining prices before a potential recovery and uptrend ensue.

Currently, Bitcoin (BTC) has regained the $60,350 mark following a momentary drop beneath this significant level, paving the way for potential future price increases.

In simpler terms, Bitcoin, the leading cryptocurrency, has lost all its previous gains when viewed over longer periods. At present, its value is dropping by around 12% on a monthly basis.

Read More

- POPCAT PREDICTION. POPCAT cryptocurrency

- Odin Valhalla Rising Codes (April 2025)

- Dig to Earth’s CORE Codes (May 2025)

- King God Castle Unit Tier List (November 2024)

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- The Righteous Gemstones Season 4: What Happens Kelvin & Keefe in the Finale?

- Bigg Boss Tamil 8 Finale: Did Muthukumaran emerge as the winner of Vijay Sethupathi-hosted show? Find out

- Who Is Ivanka Trump’s Husband? Jared Kushner’s Kids & Relationship History

- The Cleaning Lady Season 4 Episode 7 Release Date, Time, Where to Watch

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

2024-07-04 03:40