As a researcher with extensive experience in analyzing cryptocurrency markets, I find it intriguing that major Bitcoin investors continue to accumulate despite recent price fluctuations, with wallets holding over 10 BTC accounting for a record 16.17 million BTC. This strong accumulation indicates confidence in the long-term value of Bitcoin, even though its price has dipped below $61,000.

Major Bitcoin investors are showing confidence in the cryptocurrency as more than 16.17 million Bitcoins, worth over 10 Bitcoins each, are now held in wallets. This substantial accumulation signifies a strong belief among these investors, despite Bitcoin’s recent price volatility.

According to Santiment’s latest figures, Bitcoin’s price has slid under the $61,000 mark, resulting in a 3% decrease within the past 24 hours. Despite this price drop, significant Bitcoin investors remain active in purchasing more coins. This buying behavior indicates a positive outlook on Bitcoin’s future worth.

Stablecoins and Market Sentiment

The price direction of Bitcoin in the future is significantly influenced by stablecoin owners, particularly those employing USDT and USDC. Based on data from Santiment, an uptick in purchasing activity from these stablecoin users might serve to boost Bitcoin’s value further.

The Fear and Greed Index has moved from a “greed” reading to a “fear” one, currently lingering near the “neutral” threshold. Based on indicators such as the Relative Strength Index (RSI) and Market Value to Realized Value (MVRV) ratio, the market sentiment appears evenly balanced, potentially signaling good buying prospects.

Is the Bitcoin Bull Run Over?

Bitcoins large-scale investors, or “whales,” have been purchasing more coins recently. However, some indicators don’t point to a substantial price increase in the near future. Bitcoin experienced a 15% drop from its March peak, which was around $73,500.

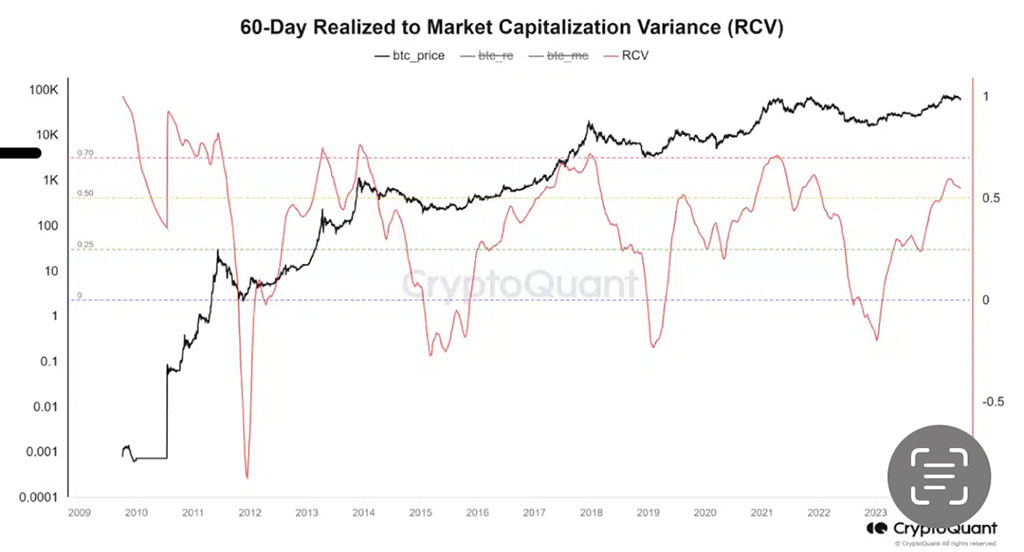

The decrease in Bitcoin’s price has sparked concerns about its long-term increase, according to CryptoQuant’s assessment. Currently, Bitcoin is in a risk area based on the 60-day Realized to Market Capitalization Variance (RCV), indicating a possible change in market conditions.

Photo: CryptoQuant

The two-month variation between Bitcoin’s current market value and the realized capitalization, which represents the amount of Bitcoin last transferred on the blockchain, sheds light on valuable information for long-term investment plans such as Dollar Cost Averaging (DCA).

In spite of the current situation, there is still room for expansion as Bitcoin hovers close to the 0.70 mark, which could lead to increased market valuations. However, analysts issue a word of warning: a sudden increase in demand around the 0.50 level might mirror past price trends from 2017, resulting in new record-breaking highs for Bitcoin.

Events Determining Price Trajectory

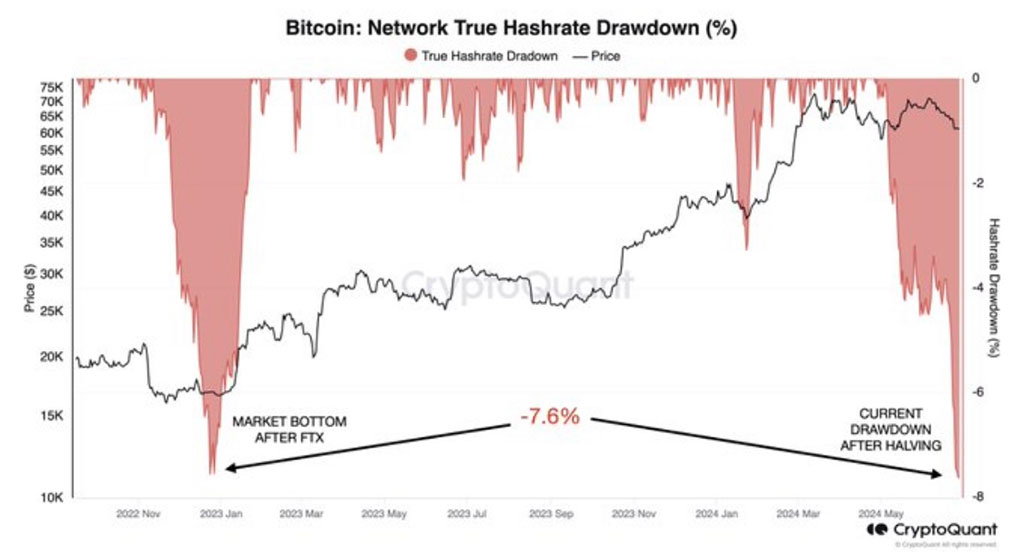

As a researcher studying the cryptocurrency market, I’ve noticed that recent advancements in Bitcoin mining have had a noticeable impact on its market behavior. According to CryptoQuant, there was a 7.6% decrease in Bitcoin’s hash rate during the previous month, a figure not seen since the aftermath of the FTX exchange collapse. This decline comes on the heels of Bitcoin’s most recent halving, which reduced miner rewards to just 3.125 BTC per block.

Photo: CryptoQuant

Miners are experiencing a drop in income from various sources due to decreased network activity. Previously, they had profited handsomely from high transaction fees following the halving event. However, with network activity dwindling, their earnings have taken a hit. Consequently, many miners have been forced to sell Bitcoin to meet expenses, thereby exacerbating the recent price drop for Bitcoin.

As a crypto investor, I’ve been closely monitoring the developments surrounding Mt. Gox, the once-dominant Bitcoin exchange. The recent transfer of approximately 150,000 BTC from Mt. Gox to various wallets has fueled speculation among investors that creditors might finally receive their long-awaited repayments. However, some analysts are anticipating increased selling pressure in the upcoming months as a result of these transactions.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-07-03 15:49