As a researcher with a background in blockchain and on-chain analytics, I find Santiment’s latest analysis of the MVRV Z-Score for various cryptocurrencies intriguing. Based on my understanding of the indicator and its implications, I believe that Shiba Inu (SHIB) could be an undervalued asset at the moment.

Based on the given metric, Santiment’s on-chain analysis indicates that Shiba Inu has been relatively less purchased compared to its recent demand, whereas Bitcoin has experienced more buying activity than usual.

MVRV Z-Score Suggests Shiba Inu Has Been Undervalued Recently

In a recent update on X, Santiment explained that certain leading cryptocurrencies are currently exhibiting specific characteristics according to their MVRV Z-Score. The term “Market Value to Realized Value” (MVRV) signifies an essential on-chain metric which calculates the relationship between an asset’s market capitalization and its realized capitalization.

The realized cap represents a method for determining the overall value of a cryptocurrency by assuming that the true worth of any given token is equivalent to the price at which it was last traded on the blockchain.

In simpler terms, the price at which a coin was previously traded represents its initial purchase price for the current holder. Consequently, the total value representing the cost basis of all coins in circulation is referred to as the realized capital.

From a researcher’s perspective, I would explain that the model calculates the entire amount of capital invested by buyers to acquire an asset’s supply. In contrast, market capitalization represents the value held by these same investors. Consequently, the MVRV ratio, which compares these two figures, sheds light on the overall profitability or loss for investors in the given market.

When discussing the present subject, the significant measurement to focus on is referred to as the “MVRV Z-score.” This metric is calculated by subtracting an asset’s realized capitalization from its market capitalization and then dividing this value by the standard deviation of the asset’s market capitalization throughout its entire history.

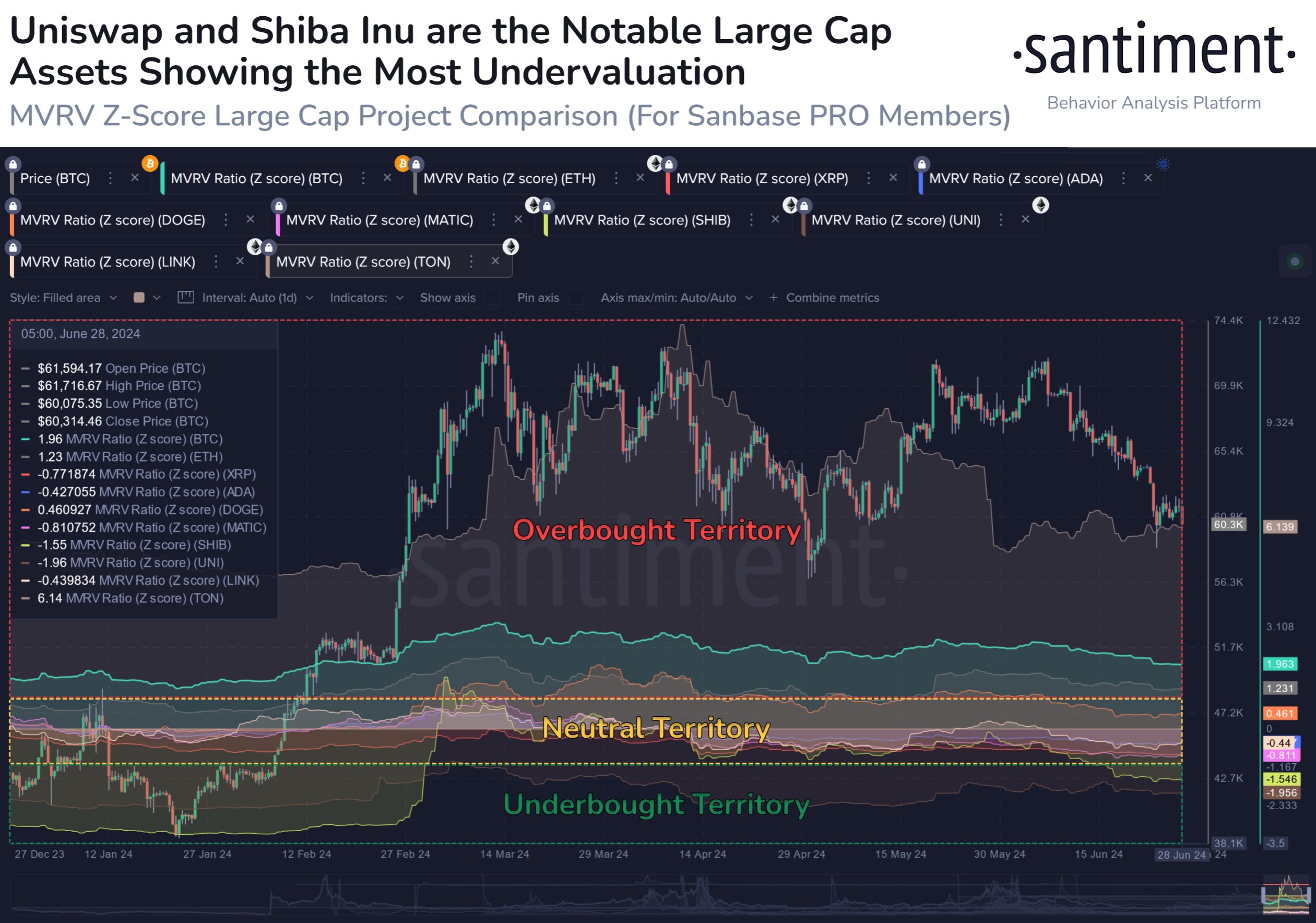

Here is a chart presented by Santiment illustrating the development of this particular indicator for numerous cryptocurrencies within the sector.

According to Santiment’s MVRV Z-Score analysis, there are three categories that indicate how much an asset deviates from its fair value. The chart illustrates that Shiba Inu (SHIB) and Uniswap (UNI) have had readings of -1.55 and -1.96 respectively, positioning these assets within the ‘underbought’ range.

When the Market Value to Realized Value (MVRV) Z-Score reaches these levels, the market capitalization is noticeably lower than the realized capitalization. Translated, this indicates that investors have incurred substantial losses. With fewer profit holders remaining in the market, potential sellers, those looking to realize their gains, become a scarce commodity. Consequently, market corrections or price adjustments may become less frequent as a result.

When the indicator reads below -1 for an asset, it’s often seen as being underestimated or undervalued in the market. Conversely, when the indicator is above 1, the asset may be considered overvalued.

Bitcoin, Ethereum, and Toncoin have lately found themselves in potentially volatile territory, implying a possible downturn in their prices. Conversely, Shiba Inu and Uniswap seem more primed for an uptick in value.

SHIB Price

At the time of writing, Shiba Inu is trading around $0.0000171, up 2% over the past week.

Read More

- Odin Valhalla Rising Codes (April 2025)

- Gold Rate Forecast

- King God Castle Unit Tier List (November 2024)

- POPCAT PREDICTION. POPCAT cryptocurrency

- Weak Hero Class 2 Ending: Baek-Jin’s Fate and Shocking Death Explained

- Jurassic World Rebirth Trailer’s Titanosaur Dinosaur Explained

- The Boy and the Heron Max Release Date Set for Streaming Debut

- First Monster Hunter Wilds updates fix a progress-blocking bug, but not the dodgy PC performance

- Who Is Carrie Preston’s Husband? Michael Emerson’s Job & Relationship History

- Who Is Kid Omni-Man in Invincible Season 3? Oliver Grayson’s Powers Explained

2024-07-01 20:46