As a seasoned crypto investor with several years under my belt, I’ve weathered numerous market ups and downs. However, the trend unfolding in May 2024 has left me feeling uneasy. The sell-off of roughly $10 billion worth of Bitcoin by long-term holders is a departure from the usual holding patterns we’ve grown accustomed to.

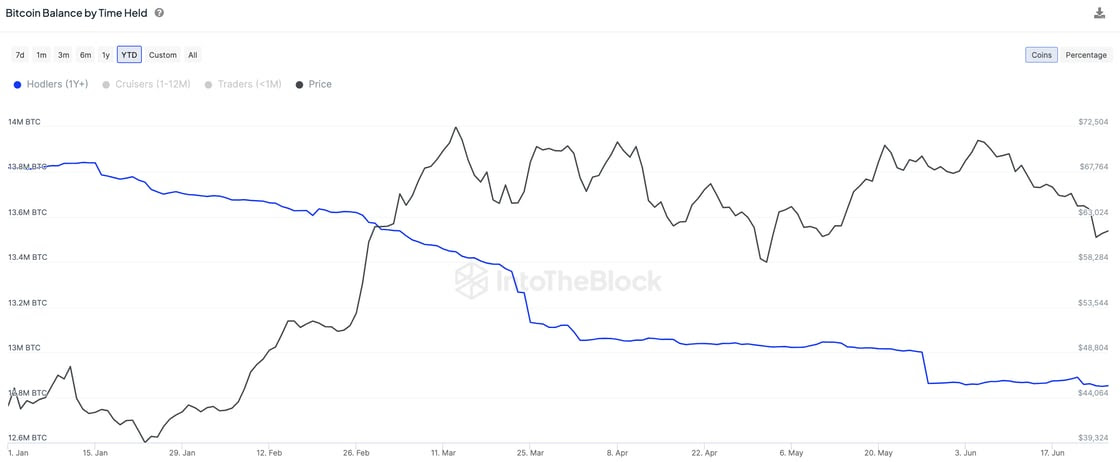

As a crypto investor, I believe May 2024 could be a turning point for Bitcoin with a significant wave of selling from long-term holders. IntoTheBlock’s recent analysis reveals that roughly $10 billion worth of Bitcoin, or around 160,000 coins, have been liquidated during this period.

Long-term investors, known for their stability in the Bitcoin market, have historically kept prices consistent during volatile periods. However, this recent trend signifies a notable shift from that pattern.

Bitcoin Stability at Risk?

Significantly, these dedicated Bitcoin investors, commonly referred to as Bitcoin’s veterans, have historically acted as a stabilizing force during market fluctuations. Their investment strategies typically mirror a strong conviction in Bitcoin’s future worth.

In May, the market saw a significant change in the behavior of some players, which could indicate a broader shift in sentiment. This sell-off is not just a sign of doubt or reevaluation, but it also raises concerns about market liquidity and price consistency.

As a researcher, I’ve delved deeper into IntoTheBlock’s findings, and my analysis reveals that Bitcoin sales saw a significant deceleration in June, with approximately 40,000 BTC being sold. This figure is notably lower than May’s frenetic selling pace. However, it’s essential to note that the trend of liquidations hasn’t vanished entirely.

The consequences of these massive disposals go beyond just affecting individual transactions. The price of Bitcoin has been unable to consistently break through the $61,000 barrier, instead experiencing frequent ups and downs that challenge the patience of investors and experts alike.

Bitcoin’s price experienced a notable rise to $62,314 today, but it has since retreated and now hovers around $60,843. This represents a 1.3% decrease in value over the last 24 hours.

Adjusting to New Realities

Following the Bitcoin Halving in April, miner rewards were cut in half, leading to a noticeable drop in mining productivity.

Based on the information from CryptoQuant, it appears that miner withdrawals have dropped by nearly 90%, implying a significant decrease in selling pressure during this quarter. The primary reason behind this reduction in mining activity is the decline in profitability, causing miners to curtail their operations and sell fewer coins as a result.

Although this change could typically imply reduced supply and a possible increase in prices, the prevailing market attitude remains pessimistic.

According to CryptoQuant’s analysis, miner sentiment appears to be at a low point, indicated by the “capitulation” state. This assessment is reinforced by the Hash Ribbons metric, which reveals that the current short-term mining hash rate is below its historical trendline.

Traders usually view these signals as bullish, implying possible buying chances. But the ongoing market response to significant sell-offs by long-term investors and declining mining production presents a more complex scenario.

These elements coming together could pave the way for a turnaround in the present downturned market situation, potentially leading to a revival.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-06-29 06:04