As a seasoned crypto investor with a few years under my belt, I’ve witnessed firsthand the volatile yet promising nature of Bitcoin. Willy Woo’s prediction for Bitcoin’s potential exponential growth in the coming years aligns with my own long-term perspective. The recognition and acceptance of digital currencies by traditional financial markets are undeniable signs of a shift, and I believe that Bitcoin could indeed rival the US dollar and emerge as a global reserve asset.

In the digital sphere, cryptocurrency authority and businessman Willy Woo has gained attention with his bullish perspective on Bitcoin‘s future, which he shared on Elon Musk’s popular social media X.

According to Woo, Bitcoin is starting to gain recognition in the financial world as a potential new asset class, and its value could experience significant surge.

If Bitcoin is viewed as a significant investment class on par with traditional assets worth billions to trillions of dollars, it may experience a tenfold increase in value within the next few years.

Current Market Dynamics and Predictions

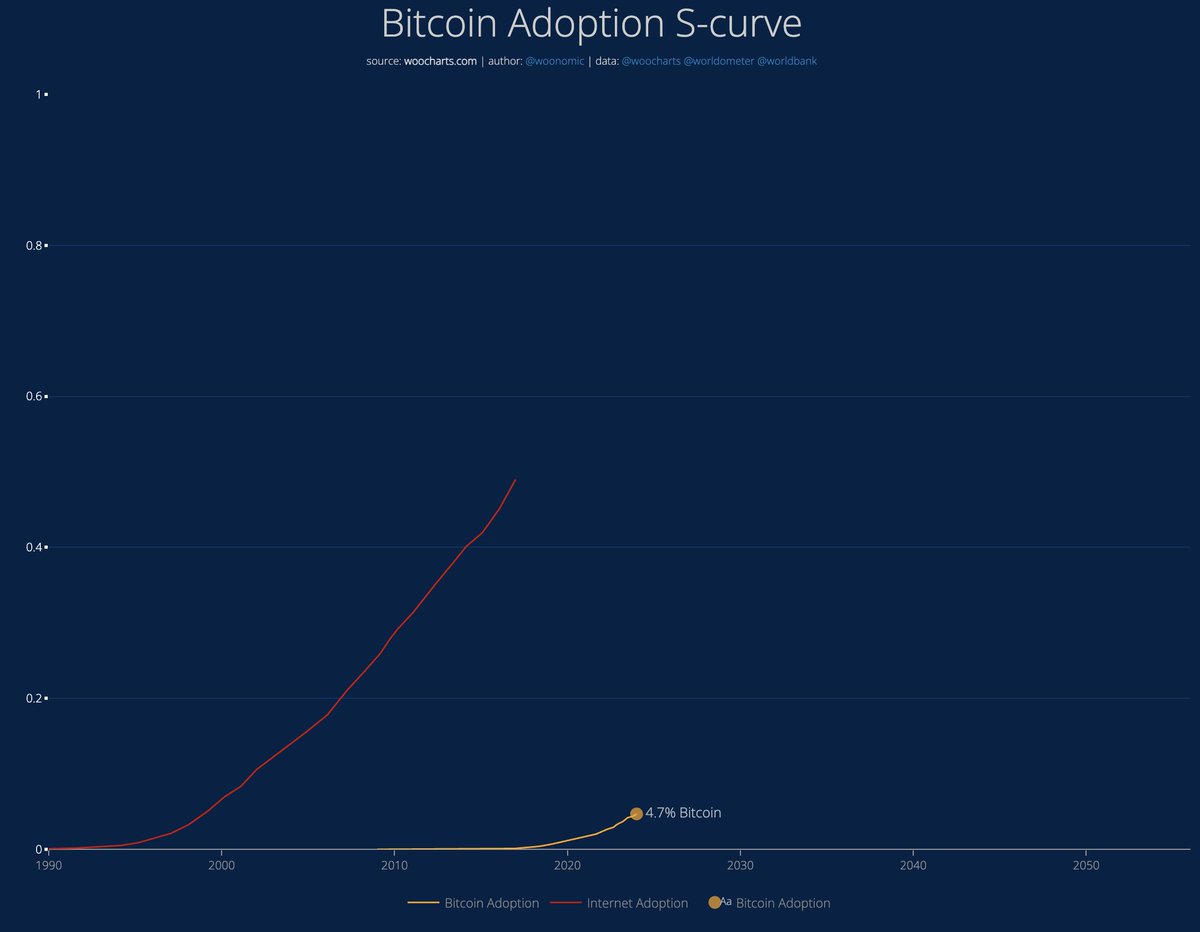

As a researcher studying the cryptocurrency market, I find Woo’s perspective particularly intriguing given Bitcoin’s present volatile conditions. Despite the current market downturn, his prediction that Bitcoin could challenge the US dollar and become a major global reserve asset by the 2030s is compelling. This forecast aligns with projected adoption rates of 25-40%, suggesting a significant shift in the financial landscape over the next decade.

The firm foundation of his position stems from the increasing acceptance of Bitcoin in the financial district of Wall Street, signaling a momentous change in the perspective of conventional financial markets towards digital currencies.

Everyone asking “when?”

I’d say when we into the range of 25-40% world adoption.

I.e. 2030s

— Willy Woo (@woonomic) June 25, 2024

Although Woo has maintained a positive outlook for Bitcoin’s future, its short-term progress is currently facing obstacles. Data reveals that Bitcoin experienced a 5.3% decrease in worth over the past week, accompanied by a minimal 0.1% decline within the last day. At present, Bitcoin is priced at $61,486 on the market.

Keith Alan, the co-founder of TeamBlacknox, expresses a guarded sense of hope. He points out that Bitcoin might dip back to its previous lows, but the overall direction could remain unchanged if the monthly closing prices fall within the range of $56,500 and $61,800.

Gauging Bitcoin Potential Rebound and Future Growth

As a researcher, I’d like to contribute to the ongoing discussion by sharing insights from CryptoQuant analyst Gustavo Faria. According to his analysis, Bitcoin could be approaching a local bottom based on certain indicators in the futures market. Specifically, there has been a noticeable decrease in open interest and a significant drop in funding rates for perpetual contracts. These trends suggest that the balance between buyers and sellers may be restoring itself, potentially signaling a shift towards increased buying pressure.

Maintaining this balance is essential for preserving a robust market structure, preventing excessive enthusiasm that can result in significant market corrections.

Signs of a Local Bottom?

Following a 15% price adjustment, Bitcoin exhibits indications of reaching a local minimum. The open interest has decreased, and funding rates are close to zero, implying a more equilibrated market situation. Upcoming significant US economic statistics are worth monitoring; could the trend be reversing? – By Gustavo Faria

Full post…

— CryptoQuant.com (@cryptoquant_com) June 26, 2024

As a researcher studying Bitcoin’s future, I cannot overlook the importance of considering broader economic indicators that could potentially impact the cryptocurrency market. Upcoming US macroeconomic data, such as Gross Domestic Product (GDP) growth rates, initial jobless claims, and inflation figures, have the power to significantly sway investor sentiment in the short term. Keeping a close eye on these factors is crucial for anyone looking to make informed decisions regarding Bitcoin investments.

Based on the Bitcoin Rainbow Chart, which now signifies a buying opportunity, as well as past market trends following Halving events, there is a strong indication that Bitcoin’s value may continue to rise.

Experts predict that Bitcoin’s price may reach a staggering height of $260,000 between September and October 2025 due to ongoing technological advancements and market trends.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-06-27 05:13