As a seasoned crypto investor with a few years under my belt, I’ve seen my fair share of market swings and trends. And right now, the trend for Bitcoin looks bearish, with prices slipping away from all-time highs. The daily chart shows bears taking control, following a period of inactivity in an overwhelmingly bearish trend.

As a crypto investor, I’ve noticed that Bitcoin‘s value at current market rates has been decreasing, moving further away from its all-time highs. The daily chart indicates an uptick in bearish activity, following a prolonged period of inactivity in an otherwise gloomy trend. At the moment, the coin is experiencing a 10% drop from its March 2024 peak, but it seems to be holding steady.

Will Bitcoin Consolidate For Two More Months?

As a crypto investor, I’ve noticed that some analysts are bearish about the current market conditions and believe they will persist in the near future. Contrary to popular belief, Bitcoin’s price may not surge dramatically following the Halving event on April 20th, as many experts predicted. Instead, bears have been dominating the market, keeping prices subdued.

To date, the coin’s price has been hovering horizontally between approximately $74,000 and $56,500, which was reached in May. From a long-term perspective, the trend is still upwards, as evidenced by the strong upward momentum observed in Q1 2024.

Despite anticipation among traders for further profits, an analyst predicts that prices may remain stationary during the upcoming trading sessions.

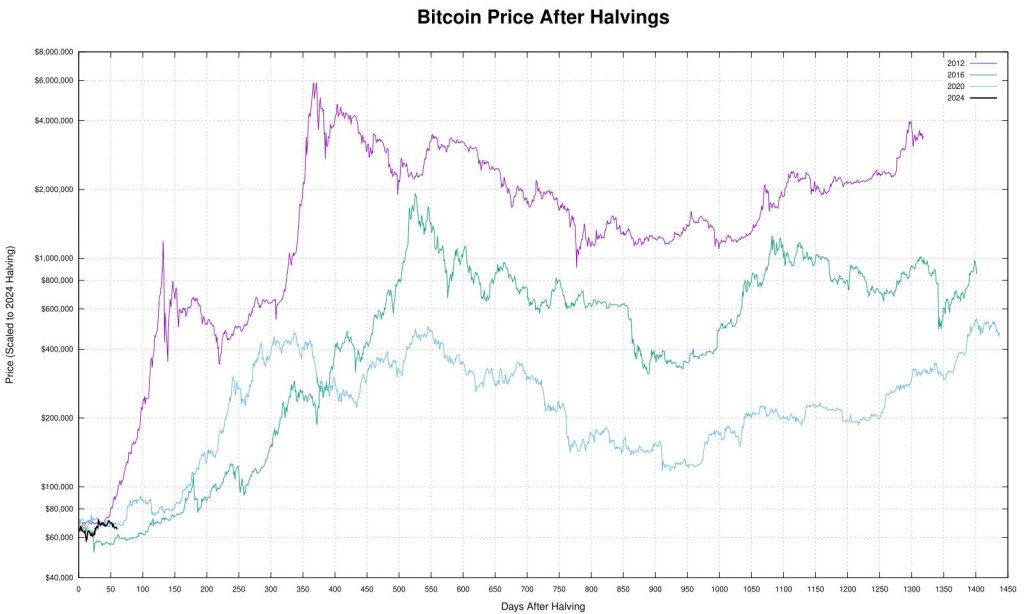

In 2020, when the network reduced rewards by half, the coin’s price remained relatively stable for a period of approximately 150 days, fluctuating between $9,000 and $11,000. At present, this price range consolidation has been ongoing for around 90 days, which is roughly halfway through the previous market cycle.

If these trends persist, prices may hold steady for the next two months, potentially dipping beneath crucial support thresholds.

So far, Bitcoin’s price action has been aligned with the lower Bollinger Band, indicating strong downward pressure. Concurrently, the gap between the middle and lower Bollinger Bands suggests heightened market volatility, favoring bearish trends.

Crypto Hedge Funds Reducing BTC Exposure As Whales Sell Via OTC

At the moment, there are signs of potential worry based on broader economic trends and cryptocurrency transaction data. One analyst noted that several crypto hedge funds have lessened their Bitcoin holdings, implying diminished faith in the digital currency.

For the previous twenty trading sessions, crypto hedge funds have reportedly reduced their Bitcoin holdings to a record low of 0.37, as claimed by the analyst, last seen in October 2020.

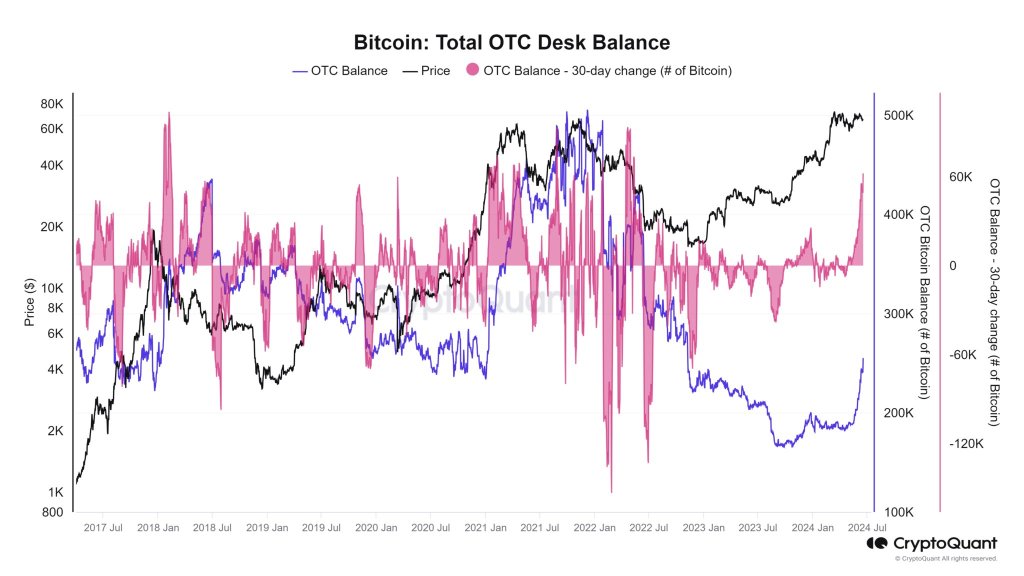

Crypto hedge funds are cutting back on their investments, but another analyst reported an increase in inflows to over-the-counter (OTC) desks following the cryptocurrency halving event.

As a crypto investor, I’ve noticed some intriguing on-chain data suggesting a possible shift in the Bitcoin market. Specifically, there has been a significant increase in over-the-counter (OTC) balances, with approximately 62,000 BTC added within the last 30 days – one of the most substantial changes we’ve seen since 2017. This could indicate that miners or large institutions are moving their Bitcoin holdings away from exchanges.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2024-06-21 00:04