As an experienced analyst, I’ve seen my fair share of market fluctuations and trends in the cryptocurrency space. The current situation with Bitcoin is indeed puzzling, and IntoTheBlock’s latest analysis sheds some light on this issue.

In simple terms,IntoTheBlock has shared insights about the recent downturn in Bitcoin‘s market, leaving some perplexed.

Bitcoin Adoption Has Slowed Down To Multi-Year Lows Recently

In Q1 2024, Bitcoin experienced remarkable growth, driven primarily by increased demand from exchange-traded funds (ETFs) and institutional investors. This surge propelled the asset past its previous all-time high (ATH), marking a departure from earlier trends where ATHs were typically achieved following the Halving event.

As a crypto investor, I’ve witnessed an overwhelming demand for this digital asset, leaving me optimistic about its potential. However, despite hitting an all-time high (ATH), the cryptocurrency has merely been trading within a narrow range in the past few months, with no significant price movement up or down.

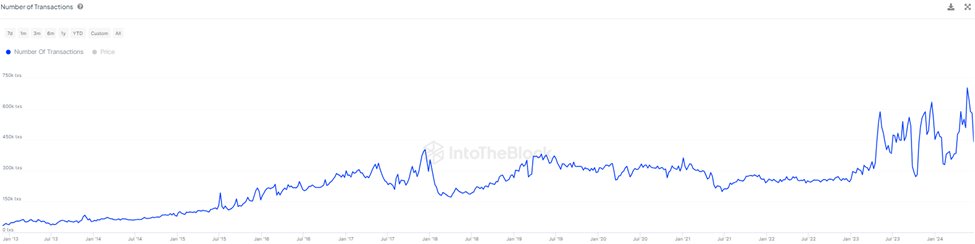

In their latest update on X, IntoTheBlock shares insights into the current state of Bitcoin. Notably, the analytics company has observed an uptick in Bitcoin network activity, with the Number of Transactions metric reaching new heights.

The latest surge in Bitcoin blockchain transactions can be attributed to the introduction of the new Runes protocol. This innovation enables users to create fungible tokens within the network with ease.

“According to the analytics firm, large institutional investors are active on the Bitcoin network, and there’s a lot going on. But why is there confusion? The explanation can be found in the behavior of new Bitcoin addresses.”

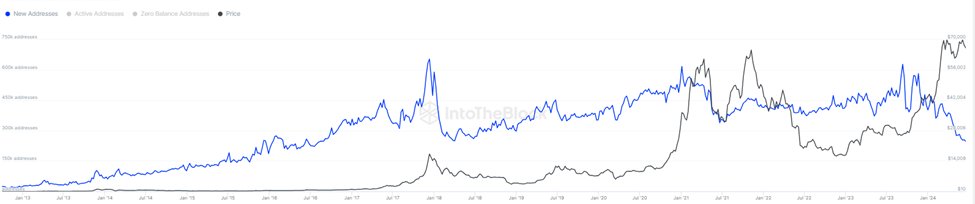

Based on its name, this metric measures the daily emergence of new addresses within the cryptocurrency network, signifying the currency’s pace of acceptance.

Below is a chart showing how this Bitcoin metric’s value has changed over the past decade.

I’ve noticed an intriguing trend in the cryptocurrency market lately. According to data from IntoTheBlock, the number of new Bitcoin addresses has been decreasing while the price has surged to reach a new peak. This could indicate that fewer people are entering the market at these high prices, potentially leading to less buying pressure and a possible price correction in the future. However, it’s essential to remember that this is just one data point and not definitive evidence of an imminent trend reversal. I’ll keep a close eye on this development and adjust my investment strategy accordingly as more information becomes available.

The data indicates that the recent increase in Bitcoin usage and whale transactions is not driven by a large influx of new users. On the contrary, the number of new Bitcoin users has dropped to a record low in the past few years, dipping even below the figures recorded during the 2018 market downturn.

Historically, bull markets have been characterized by a surge of interest in assets, drawing in new investors who are captivated by the buzz. This influx of buyers has in turn contributed to the market’s upward momentum.

Although the value of the asset has hit a record high, the network has been unsuccessful in drawing in new users. This unexpected development has left many perplexed and may be a contributing factor to Bitcoin’s recent loss of bullish momentum. Only time will tell if this trend will reverse for the cryptocurrency.

BTC Price

At the time of writing, Bitcoin is trading at around $65,000, down 7% in the past week.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-06-20 08:10