As an experienced analyst, I have closely followed the recent price action of Curve Finance’s native token, CRV. The sudden 30% drop a week ago left many investors worried and caused significant concern within the crypto community. The high liquidation risk led to a massive sell-off, causing CRV to reach new all-time lows.

Last week, CRV, the native token of Curve Finance, experienced a significant 30% price decrease. This sudden drop came with major consequences, such as the large-scale liquidation of the CEO’s lending positions within Curve Finance. The instability caused by these events left numerous investors feeling uneasy. Seizing the opportunity amidst Curve’s turmoil, whales aggressively acquired vast amounts of CRV tokens worth millions.

Whales Go Shopping After CRV Dip

On the 13th of June, CRV experienced a significant price decrease and an elevated risk of liquidation, causing concern among crypto enthusiasts. Consequently, Curve Finance’s native token fell short of a notable achievement, plummeting approximately 40% in value. The token, which previously fluctuated between $0.35 and $0.37, reached its new record low (RLL) at $0.20.

As a Curve Finance analyst, I’ve observed the team’s relentless efforts to address the challenges and restore stability to our token’s value since its price fluctuations. Over the past weekend, I noticed a promising sign: the token began to rebound, regaining the $0.30 support level.

As a crypto investor, I’ve noticed that CRV‘s price dipped below my support range at the beginning of the week, landing around $0.27-$0.29. However, things looked up for Curve DAO on Tuesday afternoon as it rallied, recording nine consecutive green candles over a nine-hour period.

Around a week have passed, and CRV‘s token has surged by more than 40% since its decline. Today, it briefly touched $0.355 before settling back to trade within the $0.33 vicinity.

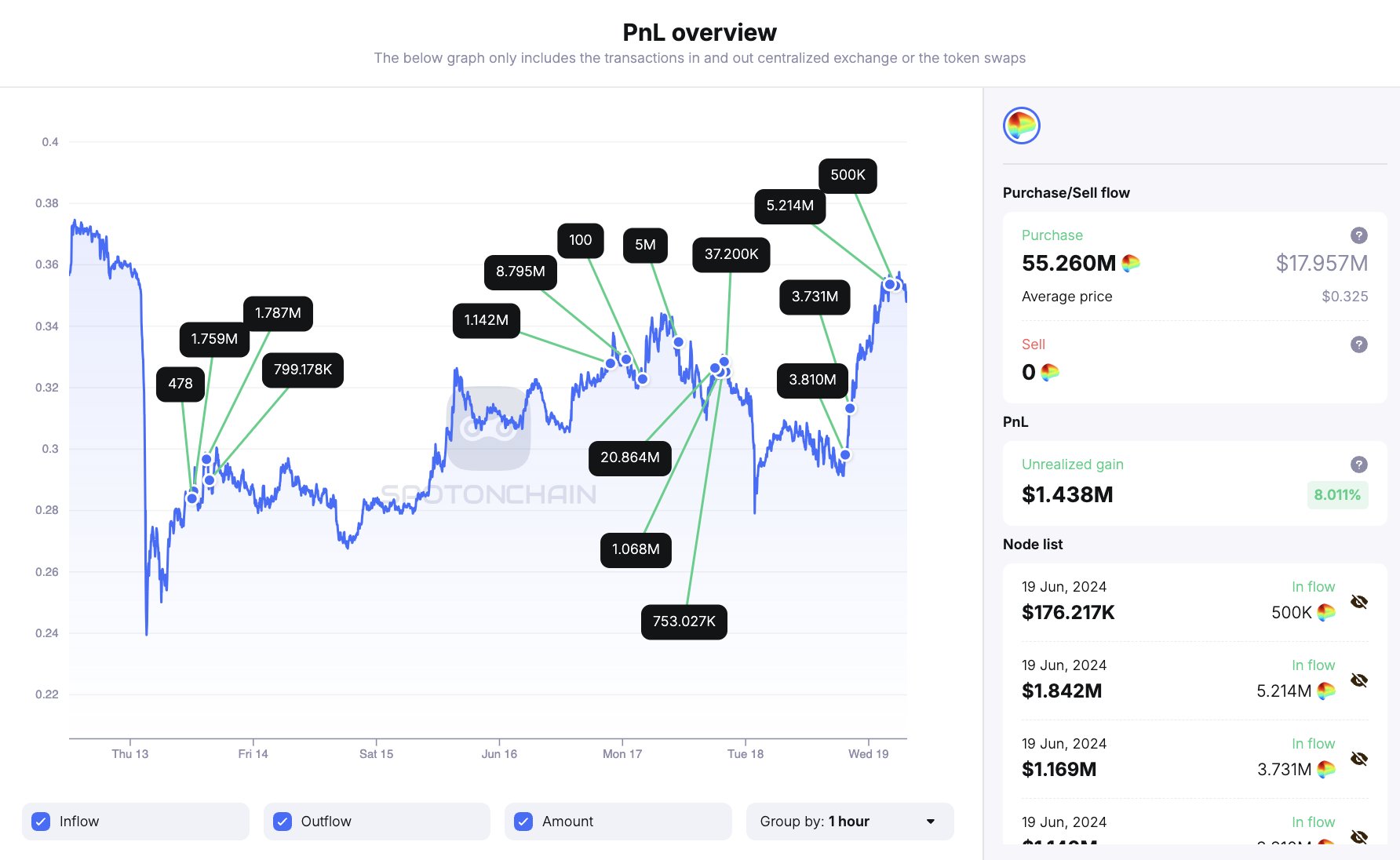

In spite of investor apprehensions, large investors, referred to as whales, seized the chance to acquire CRV at reduced prices. According to the on-chain analysis firm, Spot On Chain, these six whales amassed over 50 million CRV during the price downturn.

According to the findings in the report, I discovered that five out of the six identified whale wallets purchased a total of 55.26 million Curve tokens. The monetary value of these transactions amounts to approximately $19.4 million. Notably, these wallets represent first-time buyers of this token, contributing significantly to the recent surge in first-time purchases during this week.

After the price bounce-back, the largest investors, or “whales,” have earned approximately 8%, which amounts to $1.43 million, in potential profits. The investor with the highest return purchased 4.34 million tokens at an average cost of $0.288 each, resulting in a impressive 21.84% return on investment (ROI).

Crypto Analysts Predict Rise To $2

Multiple market analysts predict a positive outlook for CRV‘s price moving forward. With the price approaching the $0.3 mark once again, crypto trader Follis expressed optimism about Curve Finance’s token.

The trader expressed confidence that the token would be among the first altcoins to double its value after hitting rock-bottom prices. He attributed the token’s significant price drop, which was a “-40% decrease,” to Michael Egorov’s sudden liquidation. Within five days, the token had regained almost half of its lost value.

As a crypto investor and follower of market trends, I’ve closely observed the price action of Curve Finance’s CRV token. Based on my technical analysis, I identified five distinct waves in its price movement, which is a telltale sign of an impulse wave in Elliott Wave theory. This pattern indicates that CRV has a stronger underlying bullish structure than tokens such as CVX. Consequently, I’ve set a target for CRV at $2, expecting further upside based on this performance.

A fellow trader expressed agreement, commenting that CRV seems poised for a recuperation. For Sanchez, the recent price drop appeared as the final decline in a potential five-wave downtrend. He anticipates that the latest daily price movement will likely result in a substantial rebound.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-06-20 03:04