As an experienced analyst, I find the information provided by Santiment regarding the 30-day MVRV Ratios of various cryptocurrencies intriguing. Based on this metric, Dogecoin and Cardano stand out as “very bullish” with their deep negative values of -16.7% and -12.6%, respectively.

According to the analysis conducted by Santiment, a leading firm specializing in on-chain data, Dogecoin and Cardano are two investments with a particularly optimistic outlook based on their current metrics.

Dogecoin & Cardano Currently Have Low 30-Day MVRV Ratios

In their latest update on platform X, Santiment shares insights on the current market situation of some leading cryptocurrencies by examining their Market Value to Realized Value (MVRV) Ratios.

The MVRR (Market Value to Realized Value) Ratio is a commonly used on-chain metric that monitors the relationship between a coin’s market value and its realized value. Market value signifies the total worth of an asset, based on its current price and total supply.

The realized cap is another approach to evaluating cryptocurrencies, but unlike other methods, it doesn’t consider all tokens equally based on their current market price. Instead, it assumes that a coin’s true worth equals the price at which it was last transferred on the blockchain.

In simpler terms, the price at which a cryptocurrency coin was last transacted is often considered its current purchase price. Consequently, the total sum of these purchase prices represents the realized capital for all coins in circulation.

An alternative perspective on the model is that it represents the overall capital investment from investors in buying all existing Bitcoins in circulation.

The MVRR (Market Value to Realized Value) ratio examines the current market value of investments versus their original cost, providing insights into the overall profitability or loss in the market.

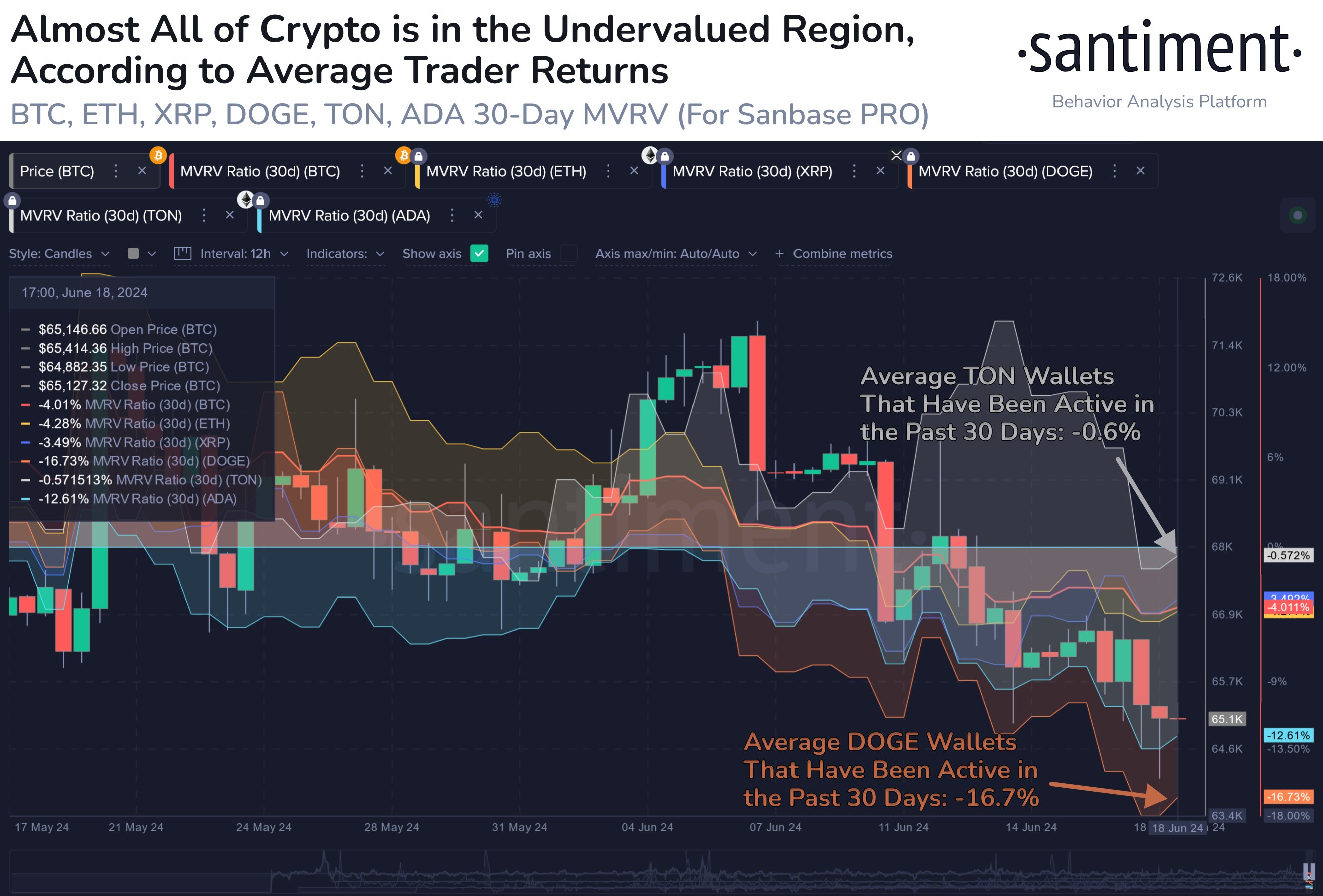

The analytics firm has provided us with a chart showcasing the latest development in the 30-day MVRV ratios for six leading cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Dogecoin (DOGE), Toncoin (TON), and Cardano (ADA).

The 30-day MVRR (Moving Average Realized Value) considers the transaction history of investors over the previous month. Consequently, it signifies the profit or loss situation for these recent market entrants.

As an analyst examining the graph, I observe that all the assets display negative levels for the given indicator. This signifies that investors who have held these assets for the past 30 days would have incurred losses. However, it’s important to note that Santiment points out that a lower 30-day MVRV (Market Value to Realized Value Ratio) increases the possibility of a short-term price recovery for cryptocurrencies.

Currently, Bitcoin, Ethereum, and Ripple (XRP) are experiencing slight decreases in value, which could indicate that these cryptocurrencies might be underpriced at the moment. However, Toncoin’s metric shows a minimal negative value of -0.6%, suggesting that TON is relatively stable and neutral in its current state.

In contrast to other cryptocurrencies, Dogecoin and Cardano present noteworthy differences with their 30-day MVRV Ratios at -16.7% and -12.6%, respectively. These substantial negative values have earned them the designation of “very bullish” coins according to Santiment’s assessment.

The future growth of DOGE and ADA is yet to be determined based on this favorable indication from the MVRV Ratio.

DOGE Price

I’ve noticed a downturn in Dogecoin’s price trend over the past fortnight, with the cryptocurrency dipping down to $0.125 at present.

Read More

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-06-19 22:16