As a crypto investor with some experience under my belt, I’ve grown accustomed to the rollercoaster ride that comes with investing in digital assets. The latest market shifts have been particularly noteworthy, with Bitcoin taking a hit while some altcoins seem to be gaining ground.

Recently, the Bitcoin market has undergone notable changes, driven by broader economic conditions and evolving investor attitudes. Last week alone, there were sizable withdrawals from digital asset investment funds, according to CoinShares, due to several important economic announcements.

Several significant occurrences took place, such as the unveiling of the latest US Consumer Price Index (CPI) data, the Federal Open Market Committee (FOMC) convening, and the announcement of Producer Price Index (PPI) figures. These events ignited a remarkable increase in Bitcoin’s value, bringing it close to the $70,000 threshold. However, this upward trend was short-lived as the market corrected itself, resulting in a return to approximately $65,000.

Market Shifts: BTC Faces Major Outflows While Some Altcoins Attract Investment

To date, Bitcoin’s price instability falls under the umbrella of the volatile nature of the cryptocurrency market. In just the previous week, there was a notable withdrawal of around $600 million from crypto investment funds by both institutional and retail investors.

According to CoinShares, this development might be an indication of increasing cautiousness among investors, potentially fueled by the more aggressive monetary policy stance taken at the Federal Open Market Committee (FOMC) meeting. Consequently, some investors may have chosen to minimize their holdings in risky assets such as cryptocurrencies.

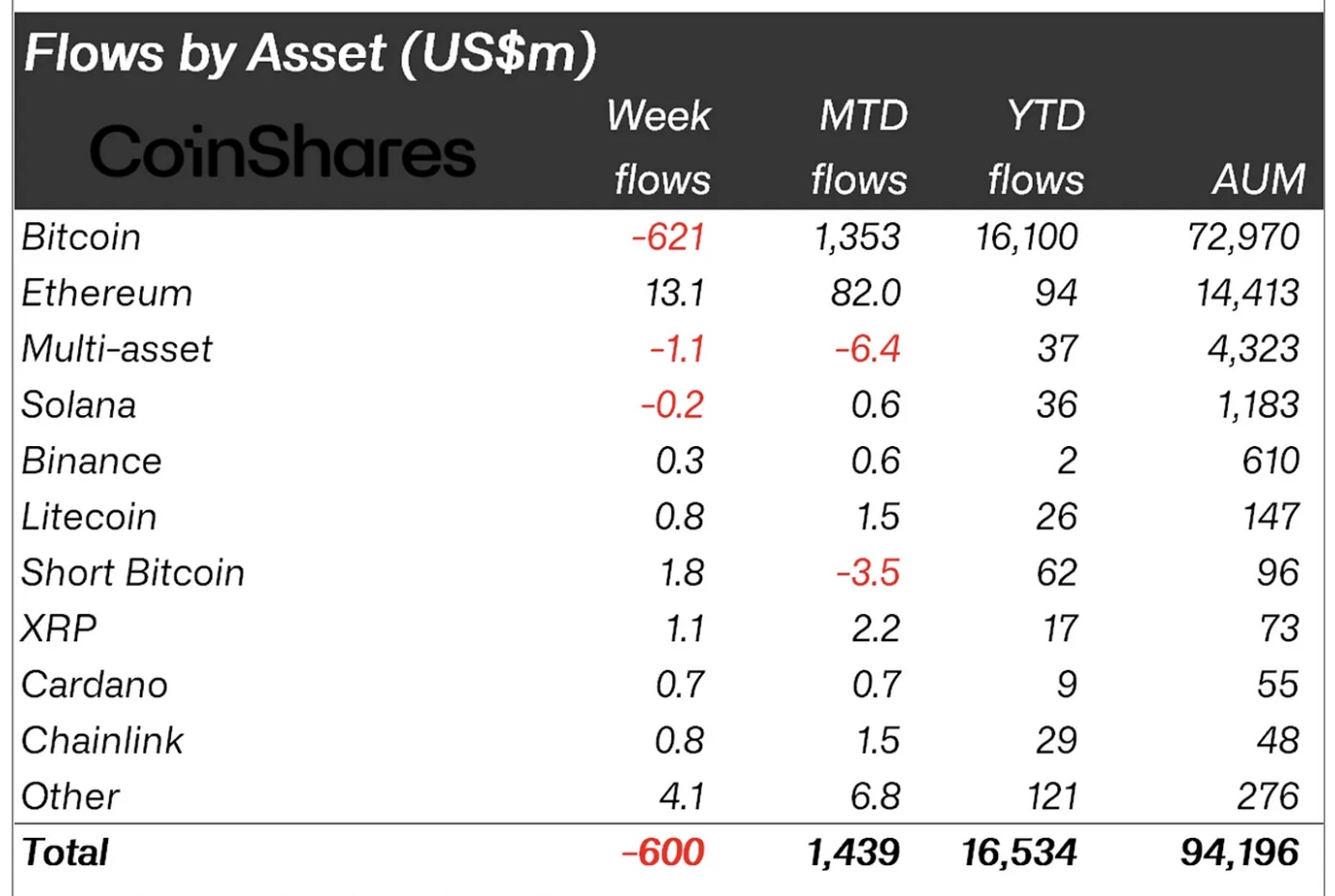

Bitcoin experienced significant outflows amounting to $621 million, making it the most affected among the cryptocurrencies. On the positive side, altcoins such as Ethereum, Litecoin, and others witnessed minor inflows. Ethereum stood out with a $13 million increase in investment, signaling contrasting confidence from investors in altcoins relative to Bitcoin.

In this situation, Bitcoin faces significant selling pressure, causing its price to decline, while certain alternative cryptocurrencies experience minor growth. Consequently, the market as a whole has experienced noticeable repercussions, resulting in a decrease of approximately $6 billion in total assets under management within a week.

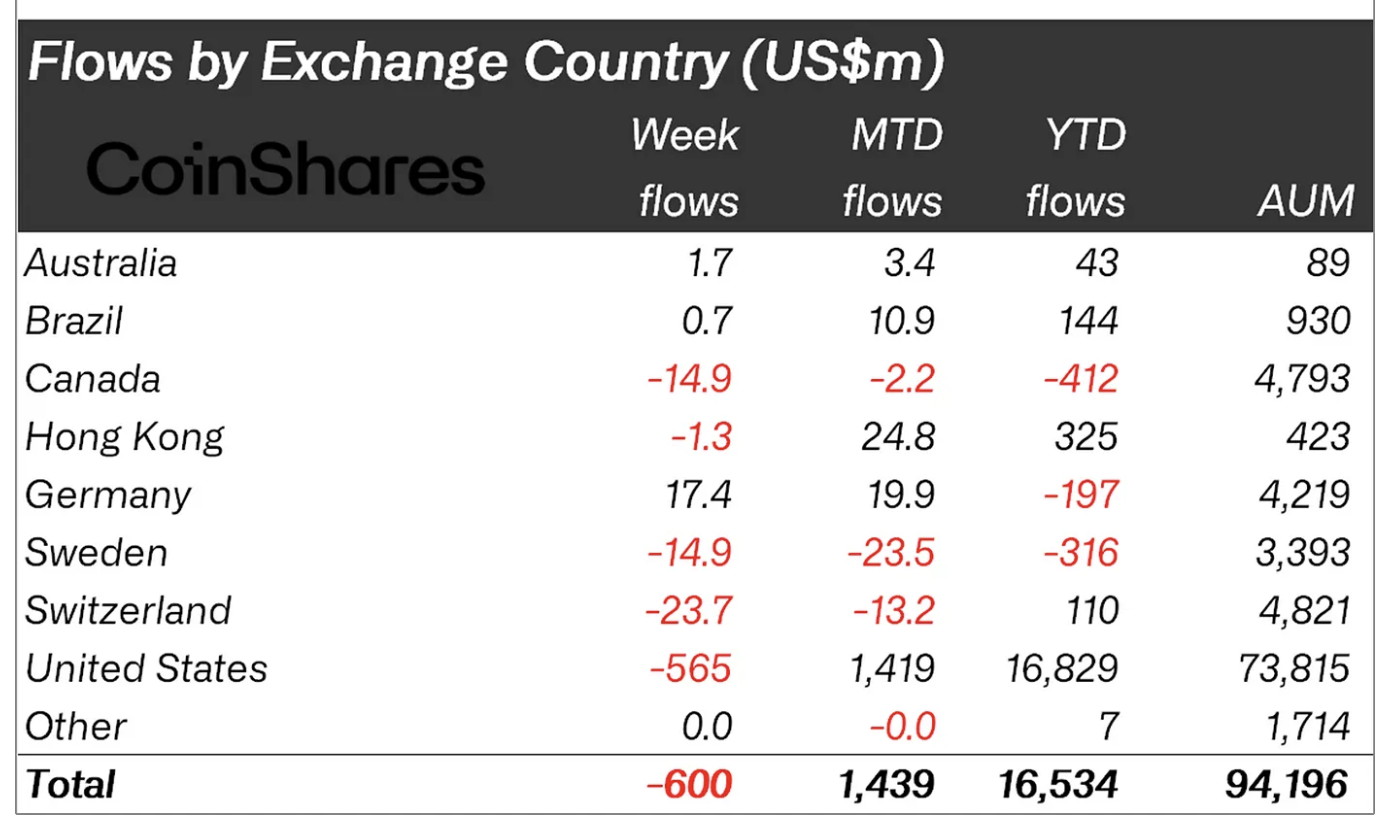

The trading volume declined substantially below its yearly average, signaling a cautious stance among traders globally. Notably, while traders in the US were net sellers, those in countries such as Germany displayed net buying activity, implying disparate reactions from different regions to the current economic situation.

Bitcoin ETFs See Mixed Fortunes

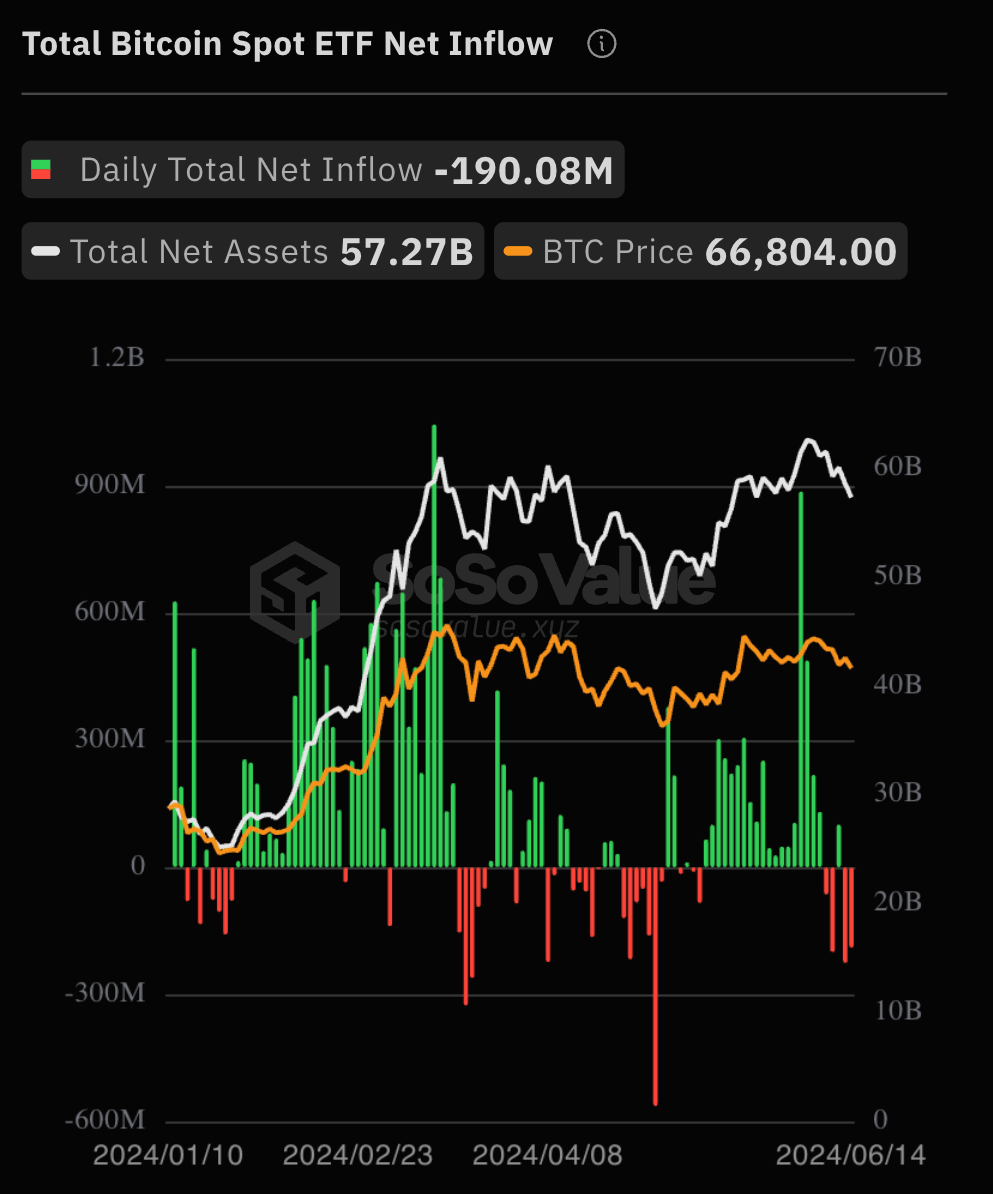

In contrast to the consistent growth in total net investments into US Bitcoin spot ETFs, amounting to $15.11 billion in recent periods, the sector underwent a decline last week with daily outflows of approximately $190 million, according to SoSoValue’s data.

As a researcher studying the cryptocurrency market, I’ve observed a significant drop in Bitcoin’s value, reaching a low of $65,398 last Friday. However, I notice that the price has slightly rebounded to $65,552 as of today. Despite this small recovery, Bitcoin still shows a daily decline of 1.1% and a weekly decrease of 5.5%.

As a researcher studying Bitcoin spot Exchange Traded Funds (ETFs), I’ve noticed a growing curiosity among investors, including BlackRock’s Chief Investment Officer, Samara Cohen. This interest has been gradually building up, despite the fact that their adoption has moved more slowly than initially anticipated.

As a researcher studying the Bitcoin Exchange-Traded Fund (ETF) market, I’ve found that about 80% of the transactions are carried out by self-directed investors. They execute these trades through online brokerage platforms.

Cohen noted that among the new Exchange-Traded Funds (ETFs) introduced this year, the iShares Bitcoin Trust (IBIT) has generated significant interest from both retail investors and institutional players such as hedge funds and brokerages, as evidenced by their recent 13-F filings.

During the latest Crypto Summit, Cohen noted that the number of registered investment advisors taking part is still relatively small.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-06-18 00:04