As a seasoned crypto investor with several years of experience under my belt, I’ve witnessed the volatility and unpredictability of Bitcoin’s price action time and again. The recent surge in mining costs, as highlighted by analyst Ali Martinez, is a concern that has been on my radar for some time now.

As a seasoned crypto investor, based on historical data, I can tell you that the average cost of mining one Bitcoin is currently hovering around $86,700. Now, let me share some insights from the past that might help us understand what could potentially happen next for Bitcoin (BTC).

Bitcoin Average Mining Cost Is Currently Notably Higher Than The Price

As an analyst, I’ve recently noted in a new post on X that the current average mining cost of Bitcoin is worth pondering over. Bitcoin’s network operates on a consensus mechanism known as “proof-of-work,” where miners serve as validators. By employing substantial computing power, these miners strive to be the first to hash the subsequent block in the chain.

As an analyst, I would put it this way: Mining operations involve continuous use of significant computing power, which inevitably comes with energy costs, primarily electricity. However, what drives the investment in these resources is the potential reward of adding a new block to the blockchain and receiving the associated block rewards.

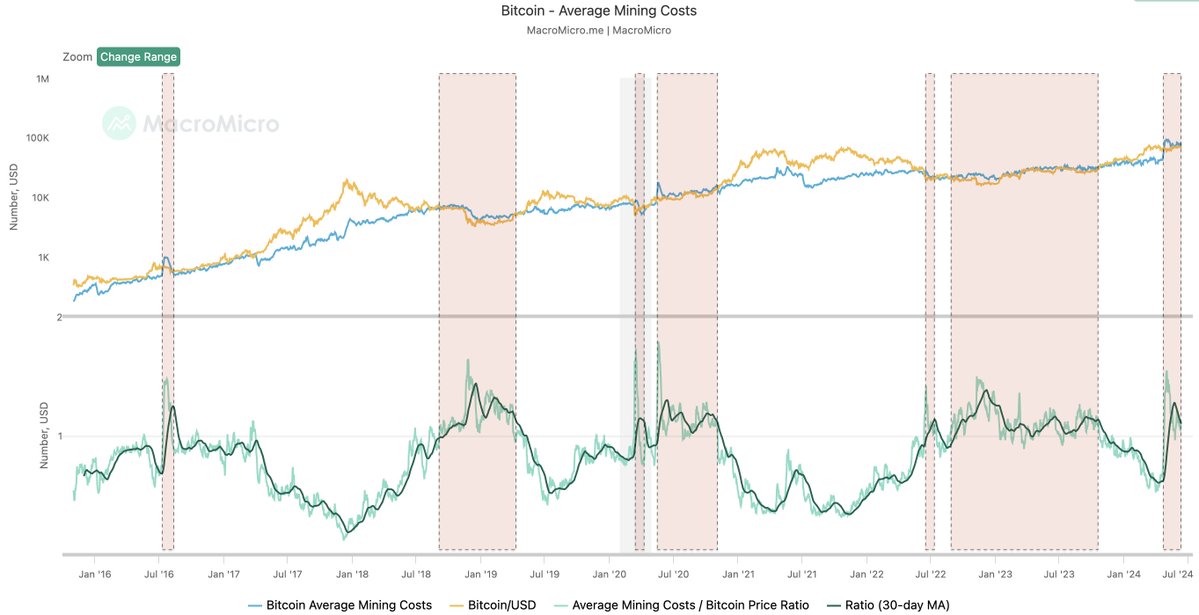

It’s clear that mining costs vary based on location due to differing electricity prices. The chart presented by Ali, sourced from MacroMicro, employs data from Cambridge University for calculating Bitcoin’s average electricity consumption.

As a seasoned crypto investor, I’ve been closely monitoring the trends in Bitcoin mining costs. The following chart illustrates this evolution, revealing how the typical expense of mining Bitcoins on the network has fluctuated throughout recent years.

In the provided graph, you can see that the average cost of mining Bitcoin, represented by the blue line, was lower than the Bitcoin price throughout much of the year. However, more recently, the cost of mining Bitcoin has risen significantly and now exceeds the current Bitcoin price.

As a crypto investor, I’ve noticed an unexpected surge in Bitcoin’s price. The cause isn’t just the usual market demand and supply dynamics. Instead, it’s because there’s another factor influencing the average cost of mining new Bitcoins: the Issuance rate. This refers to the number of new tokens being minted every day by miners.

In simple terms, the value and frequency of block rewards remain constant in the network, leading to a relatively stable daily issuance, which is just the sum of those rewards.

As a crypto investor, I can tell you that while certain aspects of the blockchain follow a consistent pattern, there are exceptions known as Halvings. These occurrences, happening roughly every four years, result in a significant reduction by half of the block reward I receive from mining new blocks.

In more straightforward terms: The most recent instance of this occurrence, which is the fourth time it has happened in the history of cryptocurrencies, took place in April. Consequently, due to the Halvings, miners now receive only half the rewards they used to get for carrying out the same level of work. As a result, the cost of mining one Bitcoin significantly increases.

As an analyst, I’ve noticed that the cost of producing the observed coin has significantly risen following the most recent halving event. Currently, this expense is estimated at $86,700 by MacroMicro’s model. Unfortunately, based on these numbers, the average miner would be operating at a loss.

As an analyst, I’ve observed Bitcoin’s historical trends and noticed a consistent pattern. Specifically, I’ve found that Bitcoin’s price tends to rise above its average mining cost.

If this trend persists during the present cycle, it’s possible that Bitcoin could soon break through the $86,700 price point.

BTC Price

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin experienced a decline of over 5% in value within a recent timeframe. Consequently, its price dipped below the $66,000 mark.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- Justin Bieber ‘Anger Issues’ Confession Explained

- All Elemental Progenitors in Warframe

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

2024-06-17 19:35