As a crypto investor with some experience in the market, I’m keeping a close eye on Bitcoin’s recent price movements and analyzing various metrics to gauge the market sentiment. The recent decline in Bitcoin’s price has raised concerns about a prolonged bear market, but I’m paying attention to some promising signs that could indicate a potential reversal.

Bitcoin‘s value has experienced significant volatility in the past few days. As the most widely used cryptocurrency, its price drop has sparked worries about an extended downward trend for the market. Nevertheless, certain market observers have detected subtle bullish signs that could indicate a possible turnaround.

Buying Pressure Emerges, But Can It Overcome The Downtrend?

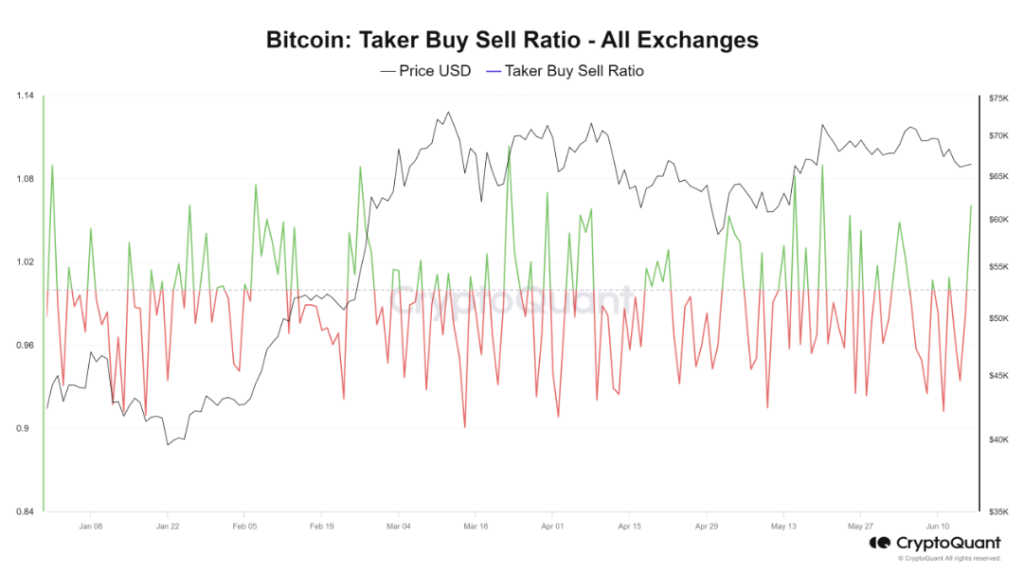

A ray of optimism emerges from the Bitcoin Buy-Sell Ratio, which measures the difference between buy and sell orders on cryptocurrency exchanges. Based on NewBTC’s assessment, this figure has more recently fallen beneath the mark of one, reflecting a predominantly bearish market attitude.

In multiple transactions, the rate at which the number of buys equals the number of sells is increasing once again. This signifies a shift in market sentiment, with more people placing buy orders than sell orders.

The data signifies a favorable turn of events: some investors are taking advantage of the price decrease to acquire more Bitcoin at reduced costs. Nevertheless, keep in mind that this single indicator does not alter the predominantly downward market direction.

Exchange Inflows: The Other Narrative

One intriguing aspect of the Bitcoin tale emerges from its exchange inflow and outflow data. This metric represents the number of Bitcoins moving in and out of exchanges. When more Bitcoins are entering exchanges than leaving, this is referred to as a positive netflow. Generally, such a situation is perceived as bearish because it may imply investors intending to sell their Bitcoins.

Although the recent inflow is smaller than previous outflows, it could indicate that the net accumulation pattern may continue.

Analysts pointed out that this part of the story presents contrasting possibilities. While an influx of exchanges could spark selling activity, the current low trading volume versus past outflows might indicate investors moving their assets to personal wallets for security. This latter scenario could be a positive sign for future market trends.

A Cautious Outlook

As an analyst, I’ve noticed a shift in optimistic views towards Bitcoin lately. However, the prevailing sentiment in the market is still wary. The Bitcoin price keeps declining, putting significant strain on the current support level at $65,000. Should this support give way, it could lead to a more substantial sell-off and potentially intensify the bearish trend.

As a researcher studying the cryptocurrency market, I can tell you that Bitcoin is currently at a pivotal point. While recent indicators such as buying pressure and exchange inflows are promising, they must be supported by a consistent price increase to carry significant weight. Until this happens, it’s essential for investors to exercise caution and brace themselves for further volatility in the market.

In the upcoming days, Bitcoin’s price trend may become clear. It is uncertain if the optimistic rumblings will grow louder and overpower the pessimistic current or if they will be overshadowed by it.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-06-17 16:34