As an experienced financial analyst, I believe this trend of increasing numbers of whale wallets holding 10 or more Bitcoins is a bullish sign for the cryptocurrency market. With over 82% of the Bitcoin supply being held by these large investors, it shows growing confidence in Bitcoin among the investment community.

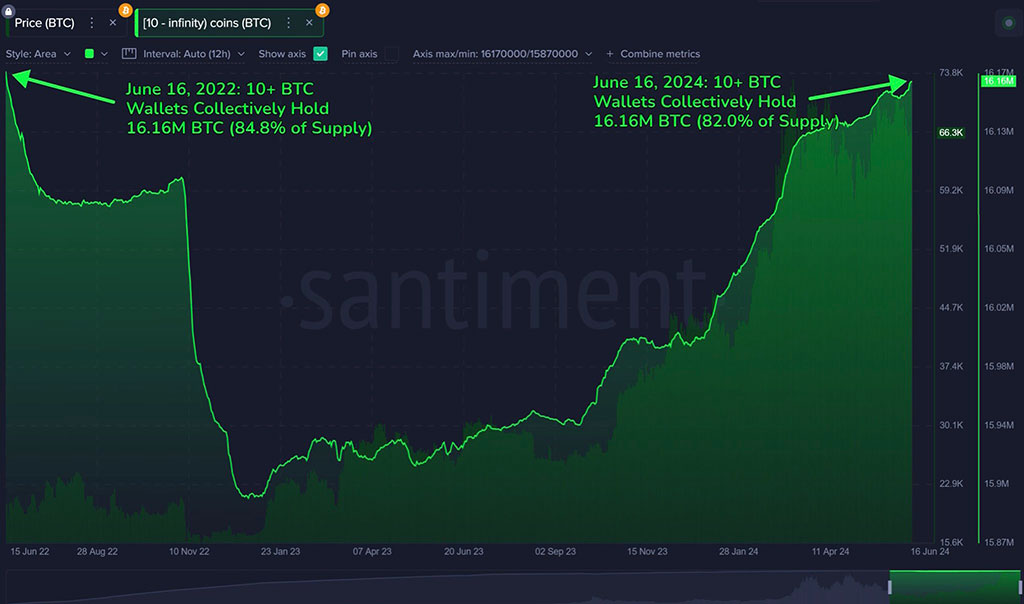

Approximately 16.16 million wallets currently contain ten or more Bitcoins (BTC), as reported on June 16. These substantial investors collectively possess around 82% of the total supply. This significant milestone underscores the increased faith among large-scale Bitcoin investors, particularly in light of recent market fluctuations over the past two years.

Observers in the cryptocurrency world have identified these tendencies, implying that the growing presence of large Bitcoin holdings, or “whale wallets,” might be an indicator of a positive market trend for Bitcoin.

Rising Market Value

According to a recent tweet from data analytics company Santiment, the count of Bitcoin investors holding over 10 coins presently mirrors the figure from June 2021. Amidst this timeframe, Bitcoin’s total worth has experienced a significant surge of approximately 226%.

Photo: Santiment / X

As a researcher studying the cryptocurrency market, I’ve observed that the quantity of Bitcoin stored on exchanges has reached a new low not seen since late 2021. Major investors, also known as “whales,” typically prefer to keep their assets in secure offline wallets for long-term storage. In contrast, Ethereum and Tether are experiencing an uptick in exchange holdings. This dynamic reduces the likelihood of a significant sell-off in the crypto market since the amount of Bitcoin available for sale is limited. Consequently, these conditions bolster investor confidence as they perceive a decreased risk of sudden price drops due to a lack of readily available Bitcoin on exchanges.

Bitcoin’s price took a significant hit starting from October 1, 2021, when it reached an all-time high of $61,000. However, following a brief uptick between January and March 2022 that pushed the price up to around $45,000, Bitcoin’s value plummeted to below $17,000 by December 1, 2022. The digital currency faced difficulties regaining its footing for most of 2023.

In 2021, Bitcoin’s value experienced robust growth and hit a fresh record peak above $70,000 multiple times, despite occasional price swings.

Positive regulatory developments, like the green light for bitcoin spot ETFs, have significantly ignited this surge in interest. An ETF’s approval has heightened institutional and retail investment in Bitcoin, thereby strengthening the faith of major investors.

Impact of FTX Collapse

The tweet from Santiment brought to light how the demise of FTX in November 2022 greatly influenced the cryptocurrency market. It’s been hypothesized that FTX was instrumental in keeping crypto prices subdued during the second half of 2022. A surprising disclosure came forth during the FTX hearing from Caroline Ellison, ex-CEO of Alameda Research affiliated with FTX, implicating Bitcoin price manipulation allegations.

As a crypto investor, I’ve closely followed Ellison’s testimony regarding Sam Bankman-Fried (SBF) and his alleged attempts to manipulate Bitcoin’s price by selling it to keep it below $20,000. However, during that period, FTX’s market influence was insufficient to control the massive Bitcoin market, which boasted a market capitalization of several hundred billion dollars.

As an analyst, I’ve observed that the recent price manipulation attempt could have carried substantial consequences for the cryptocurrency market and the value of Bitcoin specifically. According to Santiment, since the FTX collapse, there has been a noticeable correlation between the quantity of whale wallets and Bitcoin’s market worth.

Read More

- POPCAT/USD

- Who Is Finn Balor’s Wife? Vero Rodriguez’s Job & Relationship History

- The White Lotus’ Aimee Lou Wood’s ‘Teeth’ Comments Explained

- DYM/USD

- Coachella 2025 Lineup: Which Artists Are Performing?

- Who Is Kid Omni-Man in Invincible Season 3? Oliver Grayson’s Powers Explained

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Kingdom Come Deliverance 2: How To Clean Your Horse

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- General Hospital Cast: List of Every Actor Who Is Joining in 2025

2024-06-17 12:42