As a seasoned crypto investor with several years of experience in this market, I’ve seen my fair share of FOMO (Fear of Missing Out) moments, and the current situation with Bitcoin is no exception. The recent dip below $66,000 has ignited a wave of buying interest among social media users, as evidenced by the significant increase in social volume for phrases related to “buy Bitcoin.”

Based on current data, it appears that traders using social media are advocating for purchasing Bitcoin as its price dips below the $66,000 mark. This suggests that fear of missing out (FOMO) might be driving market behavior.

Bitcoin Investors Are Displaying FOMO After The Recent Decline

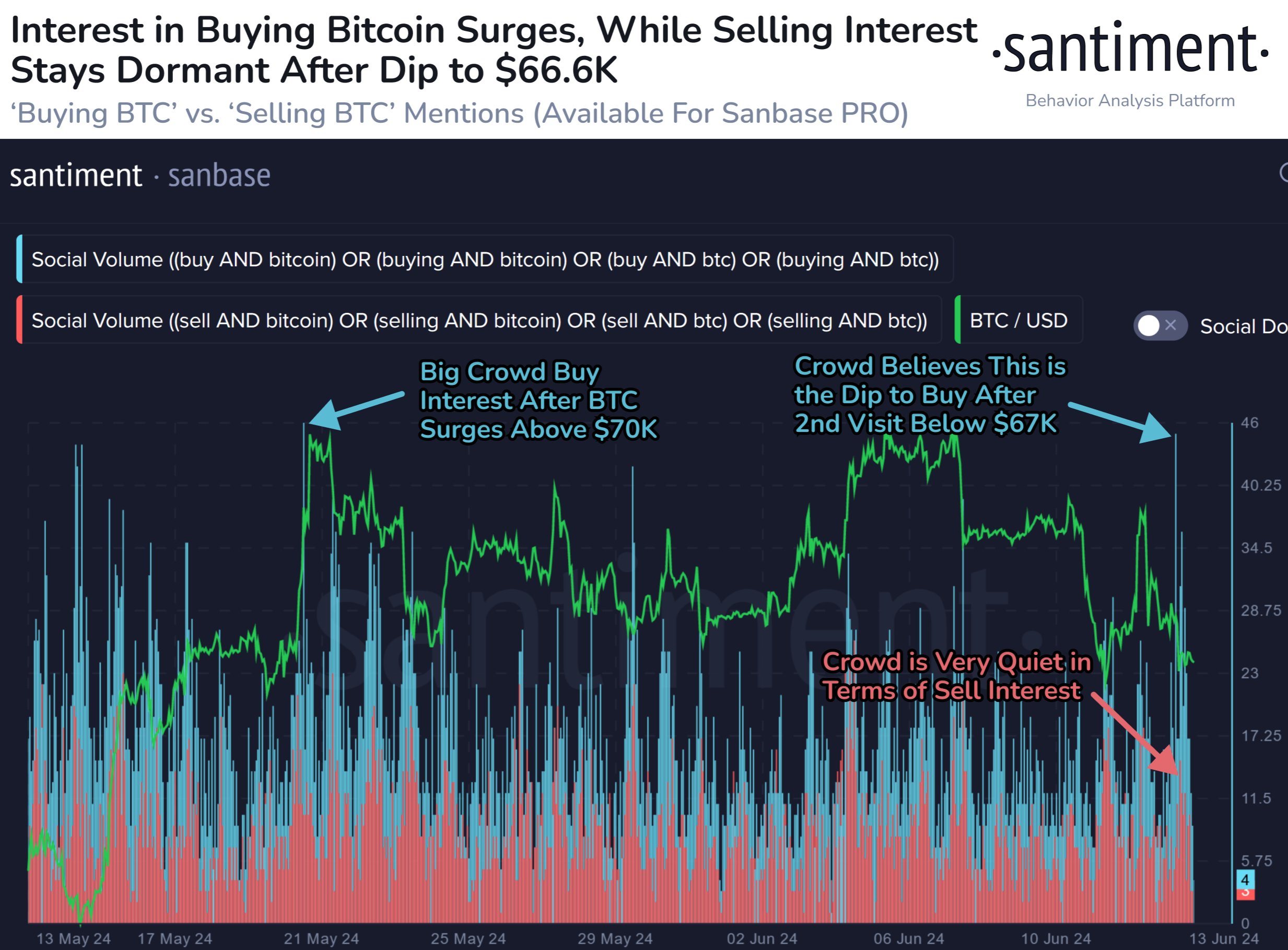

I’ve noticed an intriguing development as per the latest analysis by Santiment: the substantial decline in cryptocurrency prices has ignited the second most significant surge in social media buzz among potential buyers within the last two months.

As a crypto investor, I keep a close eye on “social volume,” a key metric that reflects the level of conversation surrounding specific topics or terms among users on prominent social media channels.

As a researcher, I would describe this metric as follows: I calculate this measure by identifying and tallying the distinct occurrences of specific keywords across various online platforms, such as posts, threads, or messages.

A post may generate numerous mentions across social media platforms. However, it’s important to distinguish between the number of posts and the number of mentions, as some mentions can originate from specific communities or niches with limited reach. Therefore, counting the posts directly provides a more accurate representation of the impact and scope of each post.

As a crypto investor, I’ve noticed that the buzz around a particular topic truly takes off when it resonates with a larger audience in the social media sphere. Consequently, tracking the Social Volume – the total number of posts referencing a keyword – can offer a more authentic reflection of the genuine level of conversation surrounding that specific theme.

In the ongoing conversation, Santiment employs this metric to identify data linked to phrases pertaining to Bitcoin purchases and sales. The graph depicts the fluctuation of social media buzz around these themes over the last month approximately.

In the given graph, the total social media buzz surrounding the phrase “buy Bitcoin” has notably surged. This significant uptick in social volume coincides with a declining trend in Bitcoin’s price.

Based on the data from social media, it appears that many users hold the opinion that this dip is a good investment opportunity. The graph indicates that the level of buying interest for this asset is currently the highest observed in the market since Bitcoin surpassed $70,000 last month.

The Social Volume surge around this period was followed by BTC reaching its peak. Typically, such a price peak occurs when fear of missing out (FOMO) intensifies among the crowd, increasing the likelihood of a correction.

As an analyst, I’ve observed that the negative impacts of Fear of Missing Out (FOMO) can be mitigated when there is a significant amount of Fear, Uncertainty, and Doubt (FUD) present in the market concurrently. The graph indicates that while there has been an increase in buzz surrounding purchasing Bitcoin, the volume related to “sell Bitcoin” has remained relatively low.

From my perspective as a crypto investor, the widespread optimism regarding the current market downturn might indicate that the cryptocurrency’s price bottom hasn’t been reached just yet.

BTC Price

As a crypto investor, I’ve noticed that the fear of missing out (FOMO) in social media seems to have intensified, leading to a bearish impact on Bitcoin’s price. After a significant increase in social volume, the cryptocurrency has dipped below $66,000 once more.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2024-06-15 04:16