As an experienced financial analyst, I’ve seen my fair share of market fluctuations, especially in the cryptocurrency sector. And based on the current trend of Bitcoin (BTC), it seems we’re facing another downturn.

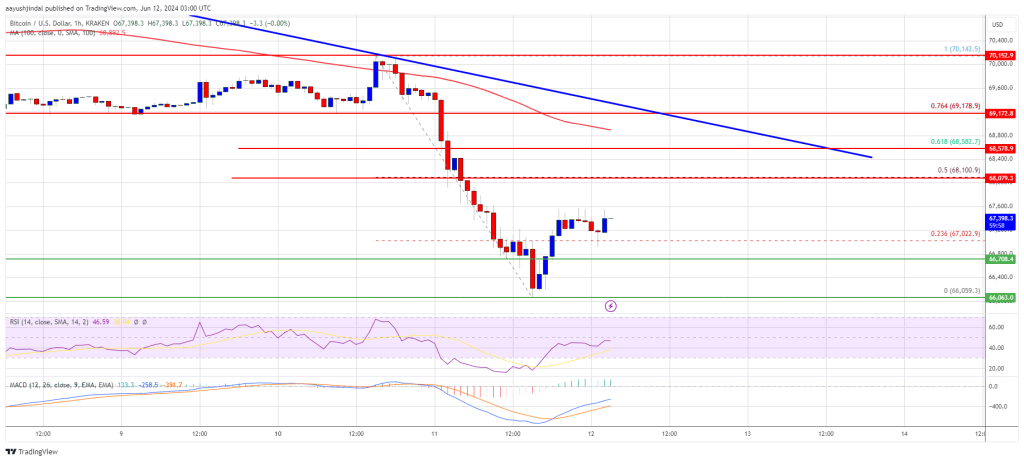

The price of Bitcoin dipped below the $67,500 mark, reaching as low as the $66,000 support level. Currently, Bitcoin is trying to rebound from this support.

-

Bitcoin started another decline below the $68,500 support zone.

The price is trading below $68,000 and the 100 hourly Simple moving average.

There is a connecting bearish trend line forming with resistance at $68,650 on the hourly chart of the BTC/USD pair (data feed from Kraken).

The pair could recover but the upsides might be limited above the $68,500 level.

Bitcoin Price Dives

The price of Bitcoin fell short of rising above the $68,500 threshold for further growth. Instead, it retreated and dipped beneath the $68,000 mark. A decline ensued, pushing the price below both the $67,500 and $67,000 support levels.

As a researcher studying Bitcoin’s price movements, I can tell you that the price dipped down to the $66,000 mark, creating a new low at $66,059. Currently, the price is stabilizing above the 23.6% Fibonacci retracement level of the recent downtrend from its swing high at $70,143 to the low at $66,059. At present, Bitcoin is trading below both the $68,500 mark and the 100-hour Simple Moving Average.

The good news is that the price is encountering resistance around the $67,600 mark. The initial barrier could be at $68,000 and the 50% Fibonacci retracement point of the decline from the peak of $70,143 to the trough of $66,059.

$68,500 could be the next significant resistance level for Bitcoin against the US Dollar. A bearish trendline is emerging on the hourly chart of the BTC/USD pair, which includes a resistance at $68,650. This trendline approaches the 100-hour Simple Moving Average as well.

If the price breaks above the $68,500 barrier with ease, it could potentially surge higher and challenge the next resistance at $69,000. Should the price continue to gain momentum, Bitcoin might even reach the $70,200 resistance in the short term.

More Losses In BTC?

As a cryptocurrency market analyst, I would interpret this situation as follows: If Bitcoin can’t manage to surpass the $68,500 resistance point, it might trigger another price drop. In case of such an event, the nearest support level would be around $66,700.

As a crypto investor, I’m keeping a close eye on the market and want to share some insights about the current price levels. Right now, the first significant level of support is located around $66,200. However, if we experience further losses, the next line of defense could be forming near $66,000. If the downtrend continues, I believe the price may head towards the $65,500 support zone in the short term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $66,700, followed by $66,000.

Major Resistance Levels – $68,000, and $68,500.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-06-12 12:51