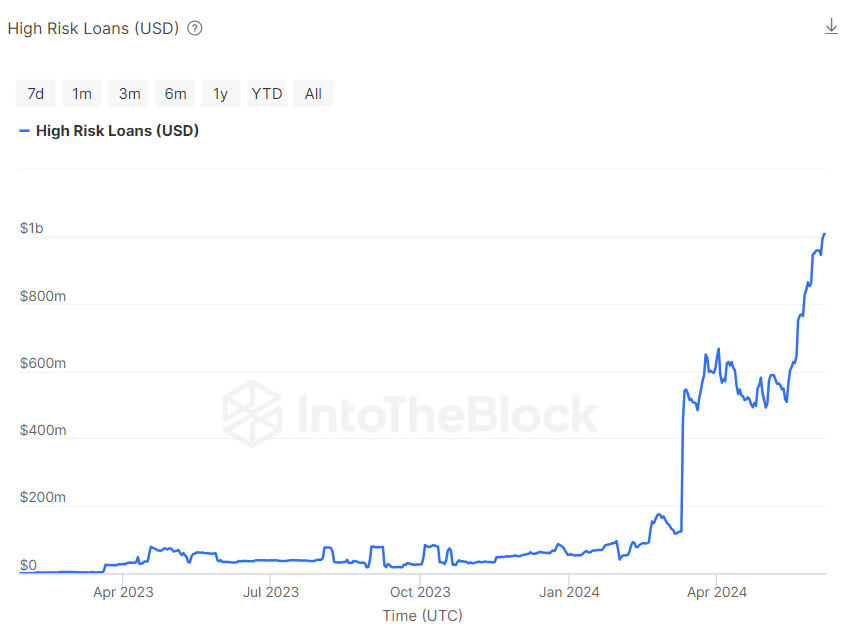

As a researcher with a background in decentralized finance (DeFi), I find the current state of high-risk loans on the Aave Protocol quite concerning. The data from IntoTheBlock indicating that over $1 billion worth of debt on Aave is categorized as high-risk loans, with their collateral assets hovering just 5% away from the liquidation threshold, is a significant red flag.

As a crypto investor, I’ve noticed that the riskier loans on the popular Aave Protocol are seeing an increase in volume, according to a report by data analytics company IntoTheBlock. This comes as the overall loan volume in decentralized finance (DeFi) is hitting multi-year highs. It seems that investors are actively seeking out diverse investment strategies in their pursuit of profitable returns during this highly anticipated bull run in the crypto market.

Aave’s High-Risk Loans 5% Short Of Liquidation Threshold

In the June 8 edition of its weekly newsletter, IntoTheBlock reports that the total value of DeFi loans currently stands at approximately $11 billion – a figure representing the highest level reached in the past two years. Notably, Aave, as the leading lending platform, is responsible for over half of this amount, with its users having borrowed around $6 billion.

Significantly, over a billion dollars worth of this debt consists of risky loans backed by unstable assets. At the moment, these loans pose a considerable danger as the value of their collateral is just 5% above their predetermined liquidation level.

As a crypto investor, if I fail to maintain sufficient collateral for my leveraged positions, reaching the predefined margin call level, my broker or lender will demand additional funds from me to prevent automatic liquidation of my assets. Ignoring this requirement may lead to the forced sale of my collateral.

In the case of Aave’s high-risk loans, when collateral assets approach a precarious level, even a small market downturn can trigger multiple asset liquidations. Consequently, the borrower stands to lose those very assets. But during sharp price drops, the borrower could incur extra losses which get added to their account balance on the lending platform.

Liquidation of high-risk loans could amplify market instability, causing more price drops and triggering additional liquidations in a vicious cycle. Moreover, massive asset liquidations at once can cause liquidity shortages, hampering the Aave protocol from functioning efficiently.

AAVE Price Overview

I’ve observed a 5.30% decrease in AAVE’s value over the last day, as it encountered significant resistance around the $98.20 mark. At present, this DeFi token is priced at $92.30 following a disappointing week where its value dropped by 11.53%.

According to the analysis by Coincodex, a well-known price prediction platform, the overall sentiment towards AAVE is favorable. The experts at Coincodex anticipate that AAVE will experience a significant recovery and reach a price of $303.87 within the next month.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-06-09 10:16