As an experienced financial analyst, I find the recent trend of net inflows into US spot Bitcoin ETFs truly noteworthy. This streak, lasting for 18 consecutive days, has significantly contributed to the upward momentum of Bitcoin and its approach to all-time high levels. The success of these products, managed by major institutions like BlackRock and Fidelity Investments, has made them some of the most successful ETF launches in history.

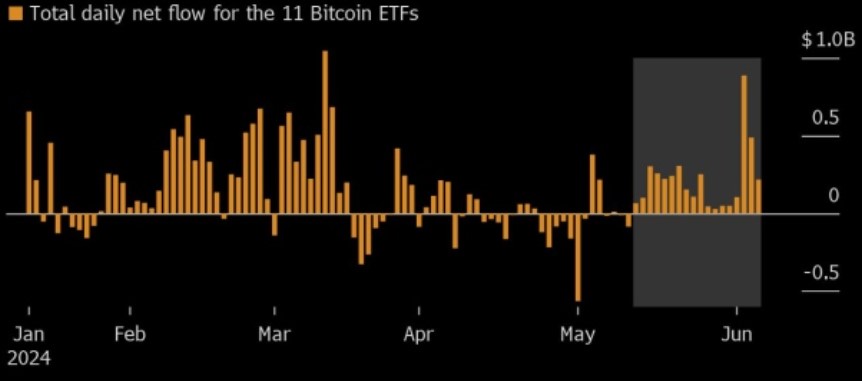

For eighteen consecutive days, US Bitcoin exchange-traded funds (ETFs) have seen significant inflows of new investments. This trend has contributed to the surge in Bitcoin’s price, bringing it nearer to its peak values reached back in March.

Based on Bloomberg’s data reporting, these ETFs, overseen by some of the world’s largest financial institutions, have seen a net inflow of approximately $15.6 billion since their inception on January 11. Consequently, their combined assets under management now amount to a significant $62.3 billion.

Record-Breaking Demand For Bitcoin ETFs

As a crypto investor, I’ve noticed with excitement the remarkable success of Bitcoin ETFs launched by industry giants like BlackRock and Fidelity Investments. These ETFs have left an indelible mark on the ETF sector’s annals as some of its most triumphant debuts.

As a researcher studying the cryptocurrency market, I’ve discovered that these particular products have had a profound impact on the investment landscape. Specifically, they’ve caused a notable shift in the center of gravity – or the epicenter of activity – moving it from Asia to the United States.

As the Head of Digital Asset Strategy at Fundstrat, I, Sean Farrell, have observed substantial inflows into spot Bitcoin Exchange-Traded Funds (ETFs). The current macroeconomic conditions present a favorable landscape for the cryptocurrency market. The economy is expanding at a steady, non-recessionary rate, and indicators suggest that disinflation is on the horizon.

BlackRock’s iShares Bitcoin Trust, boasting a massive $21.4 billion in assets, has taken the lead as the largest Bitcoin investment fund globally, outpacing Grayscale’s Bitcoin trust (GBTC) with its $20.1 billion. Meanwhile, Fidelity Wise Origin Bitcoin Fund (FBTC), with $12.3 billion in assets, occupies the third spot.

In early 2023, the SEC, known for its hesitance towards digital assets, granted approval for spot Bitcoin ETFs following a court decision that overturned its legal action against Grayscale.

The SEC continues to express concerns over the digital asset sector’s adherence to regulatory guidelines. However, there is growing support in Congress for creating more definitive laws regarding cryptocurrencies.

BTC Options Traders Target $100.00

Alongside the rising Bitcoin ETF investments, there’s growing enthusiasm among options traders regarding Bitcoin’s prospective growth. The focus of open interest lies predominantly on call options with target prices set at $75,000, $100,000, and $80,000.

Luuk Strijers, Deribit’s CEO and head of the largest crypto options exchange, expressed optimism in the Bitcoin options market based on traders’ forecasts. These traders believe that new peak prices for Bitcoin are imminent due to robust Bitcoin ETF investments, speculations about US and European central bank rate reductions, and the recent authorization of an ETH ETF.

As a researcher studying the cryptocurrency market, I’ve observed that despite Bitcoin dipping slightly from its peak of $73,700 in March, investors continue to pour funds into Bitcoin ETFs. The anticipation of potential interest rate cuts fuels this optimism among traders. Moreover, call options with expiration dates in late June and December are experiencing heightened activity, suggesting a favorable perspective towards Bitcoin’s short-term and long-term prospects.

At the moment of publication, Bitcoin, the most significant cryptocurrency, has managed to hold its position above the $70,000 mark. Over the past week, this digital currency has increased by 5%, leading to a present value of $71,320.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Green County map – DayZ

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-06-07 21:05