As a seasoned crypto investor with a keen interest in on-chain analytics, I find Philip Swift’s perspective on the significance of global liquidity to Bitcoin’s price movement particularly insightful. Swift’s analysis aligns with my own observations, as I have noticed a strong correlation between the two throughout various market cycles.

Philip Swift, the founder of the on-chain analysis platform LookIntoBitcoin, pointed out the notable surge in global liquidity, reaching a new record high (ATH) recently. According to Swift, this trend is an important signal suggesting Bitcoin’s potential growth during the ongoing bull market.

The Most Important Indicator For Bitcoin

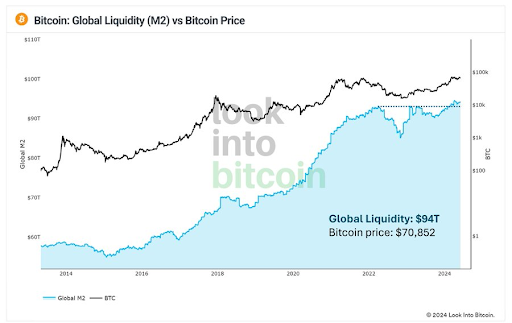

Expert: In this bull market, Swift emphasized that the global liquidity chart held the greatest significance as it recently reached an all-time high (ATH) of $94 trillion, edging closer to the $100 trillion milestone. According to his assessment, this trend might pave the way for new record-breaking heights for Bitcoin as well.

Global liquidity was around $90 trillion when BTC hit its previous ATH of $69,000 in the 2021 bull run. Additionally, Bitcoin’s price has risen above that level since global liquidity, thereby confirming the correlation between this global liquidity indicator and Bitcoin’s price. Swift claimed that Bitcoin’s rise is “inevitable” as long as global liquidity keeps trending.

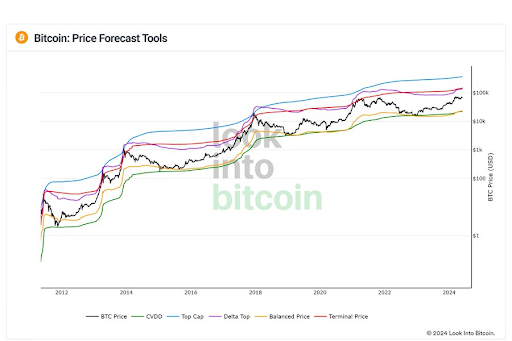

Swift stated that Bitcoin had significant room for growth after reaching a new all-time high of $73,750 in March. He brought up the Multiple of Realized Value (MVRV) z-score indicator as evidence, indicating that the leading crypto was still undervalued. In a recent Reddit post, the Bitcoin pioneer predicted that the price would surpass $100,000 before the market peak could be declared.

Swift asserted that the Bitcoin cycle peak markers were persistently ascending. These markers encompassed the delta top, terminal price, and top cap, which stood at $137,579, $148,390, and $364,541 respectively.

Similar to Swift’s observation, crypto expert Tarekonchain drew attention to the Market Value to Realized Value (MVRV) indicator for Bitcoin. He pointed out that Bitcoin had not yet reached its maximum peak based on this indicator. Consequently, the analyst anticipates that Bitcoin could attain new heights in this cycle and potentially surpass $100,000.

BTC On The Brink Of History

Crypto analyst Rekt Capital pointed out that Bitcoin could make a historical move if it manages to break through its current barrier soon. This event would mark the swiftest Bitcoin has ever emerged from a post-halving Re-Accumulation zone. A successful breach of this boundary would propel Bitcoin into the “parabolic phase” of its cycle, during which it’s anticipated to reach new peaks and possibly surpass $100,000.

It’s intriguing that Standard Chartered Bank foresaw Bitcoin’s potential price surge even before the US presidential election in November. The bank went on to estimate that Bitcoin could hit $100,000 during this time. Moreover, if Republican nominee Donald Trump wins the elections, the bank anticipates Bitcoin’s value could soar up to $150,000 by year-end.

As a market analyst, I’m observing that Bitcoin currently hovers around $71,000 during my analysis based on the most recent figures from CoinMarketCap. In the past 24 hours, it has shown an uptick in value.

Read More

- CNY RUB PREDICTION

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-06-07 20:11