As a researcher with experience in analyzing cryptocurrency markets, I find the recent price action of Bitcoin intriguing. The sideways grind and low volatility we’ve seen over the past few weeks might seem dull to some, but based on historical data, it could be setting the stage for significant gains.

As an analyst, I’ve observed that Bitcoin‘s price has reclaimed the $70,000 mark following several weeks of relatively stable trading. While this extended period of sideways movement may appear uneventful, it’s essential to note that historical data suggests such quieter phases can sometimes precede Bitcoin’s most impressive price surges.

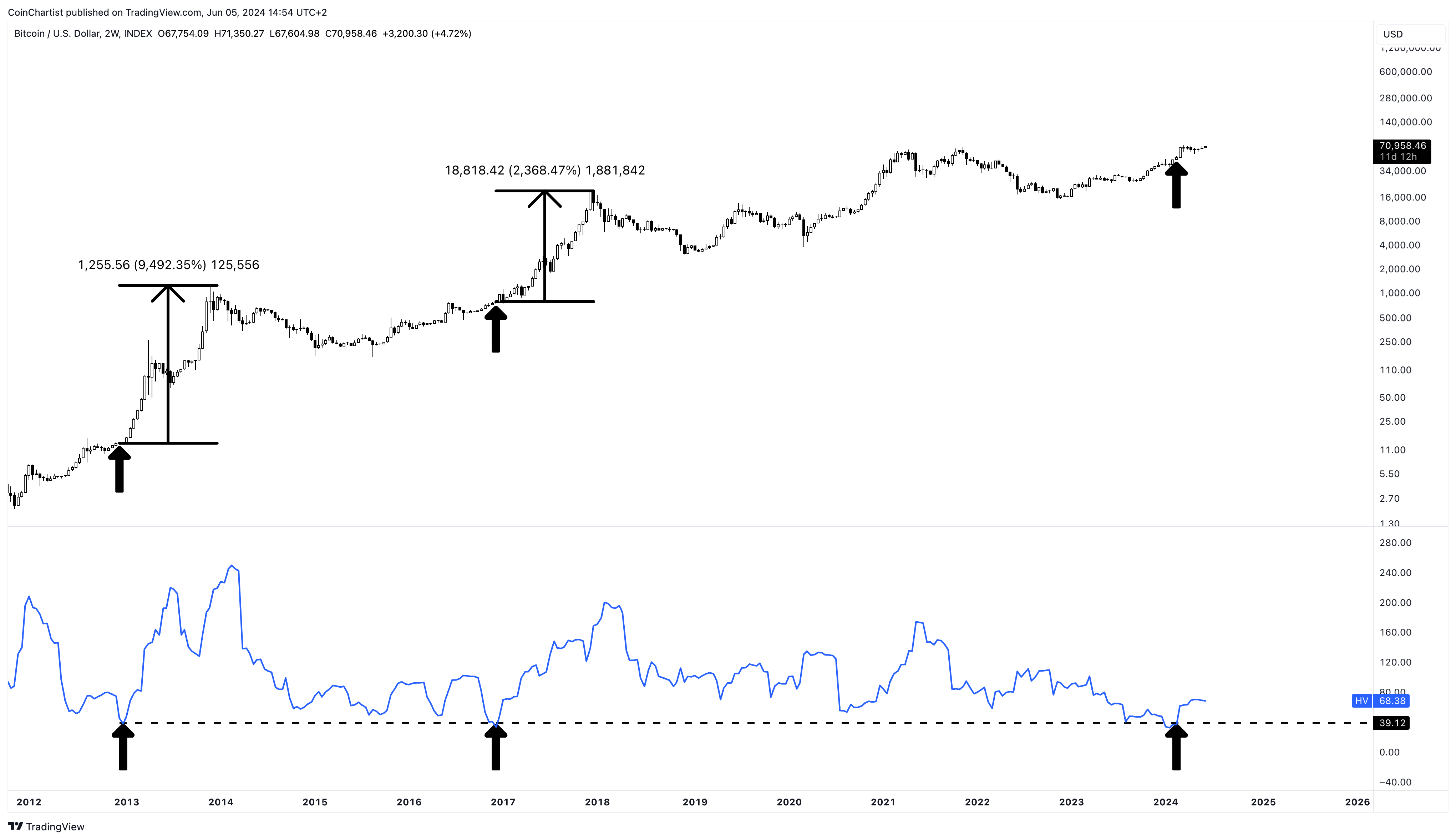

Bitcoin Historical Volatility Reaches Record Low

Volatility is commonly viewed in a unfavorable light due to its inherent instability and unpredictability. According to Oxford Languages, volatility signifies the propensity to fluctuate significantly and unexpectedly, frequently with detrimental consequences. In the financial sector, this term denotes the extent and speed of price swings within a designated timeframe.

As a technical analyst, I employ the historical volatility metric to assess the level of price fluctuations in an asset’s past performance, such as Bitcoin. By comparing volatility throughout its entire price history, I can distinguish between periods of high and low market turbulence for this particular asset.

As a crypto investor, I’ve noticed something intriguing about the BTCUSD chart on a 2-week timeframe. The top cryptocurrency by market cap, Bitcoin, seems to be coming out of an unusually low volatility phase. This isn’t just interesting; it’s significant. You see, the last two times Bitcoin experienced such lackluster price action were in 2015 and early 2017.

As a market analyst, I can tell you that the return of the cryptocurrency signal could indicate several possibilities for the market and investors who have been patiently holding during the recent price stagnation.

Third Time Is A Charm: Can BTC Climb 200-500%?

The market’s volatility exhibits a recurring pattern. Following phases of heightened volatility and dramatic price swings, there are extended periods of subdued price movement. Once this quietude is broken, it typically results in another burst of volatile price action, similar to the conditions preceding the tranquil phase.

As a researcher studying the behavior of Bitcoin’s price movements, I can tell you that volatility can be calculated and even forecasted through the concept of “implied volatility.” However, predicting the direction in which this volatility will manifest is a challenging task. Given the general association of volatility with unfavorable market conditions, there’s always a possibility that the current low volatility period could be disrupted by a significant downturn in Bitcoin’s price.

As a researcher studying the trends in the Bitcoin market, I’ve noticed that the last two price movements have indicated some positive growth, with an upward trend recently emerging. However, it’s important to acknowledge that the astronomical rallies of over 9,000% and 2,000% seen in 2013 and 2017 are unlikely to occur again for Bitcoin against the US Dollar (BTCUSD). Nevertheless, based on current market analysis, Bitcoin could experience a significant surge of between 200% and 500%.

If Bitcoin’s price reaches $70,000 per coin at a 2x multiplier, its peak during this cycle could hit around $140,000. A 5x increase from the current levels might bring the price up to $350,000 per coin. While it’s theoretically possible for Bitcoin to soar even higher, a 5x move is more likely given the concept of diminishing returns.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

2024-06-05 16:34