As a long-term crypto investor with a few years of experience under my belt, the recent developments surrounding Mt. Gox and its ongoing repayment plan to creditors have piqued my interest. Having learned from past experiences such as the exchange’s infamous collapse in 2014, I understand that market events like these can significantly impact Bitcoin’s price dynamics.

As a researcher studying the cryptocurrency market, I’ve come across recent developments regarding Mt. Gox, the former Bitcoin exchange that experienced a significant downturn in 2014. Now, this defunct platform has begun distributing payouts to creditors who have been patiently waiting for their compensation.

On May 27th, over $9.4 billion worth of Bitcoin was released into circulation. This massive influx has triggered worries about market liquidity and price stability. In response to these concerns, CryptoQuant, a leading on-chain market intelligence platform, has delved into the possible repercussions of this event.

Potential Market Effects

As a researcher examining the Bitcoin transaction data, I’ve discovered that approximately 138,000 Bitcoins were transferred substantially from Mt. Gox in seven distinct transactions. The values of these transactions ranged from 4,000 to 32,000 Bitcoins each.

At first, all the Bitcoins were moved to a sole wallet, subsequently divided into three different wallets, each containing approximately 47,400 Bitcoins.

The addresses holding Mt. Gox’s assets are currently managed by its Rehabilitation Trustee, who has not initiated any creditor payouts so far. By gathering these funds together, the Trustee seems to be readying for future repayments as part of the Rehabilitation Plan.

Currently, transactions originating from trustee-managed wallets haven’t directly affected Bitcoin’s market. Yet, it’s important to keep in mind that potential repayments to creditors, scheduled for completion by October 31, 2024, may cause noticeable shifts in the Bitcoin market landscape.

As a crypto investor, I understand that CryptoQuant’s market impact hinges on several factors such as when and how the Trustee chooses to repay creditors. If they initiate repayments, a significant amount of Bitcoin could flood the market, potentially affecting liquidity and price stability. The firm emphasized this point by stating: “Our analysis suggests that the Trustee’s repayments could have a substantial impact on the Bitcoin market.”

The recent Bitcoin transactions originating from the Mt. Gox Rehabilitation Trustee’s wallets haven’t put any immediate pressure on selling, as these coins have remained within the same entity and haven’t been made accessible for public trading yet.

Bitcoin Price Gravitates Towards ‘Level 3’ At $91,000

I, as a Bitcoin analyst, share my perspective on the ongoing concern regarding the possible negative effect on Bitcoin’s price caused by Mt. Gox’s repayment plan. At present, it is essential to examine the current Bitcoin price ranges for a clearer understanding of the situation.

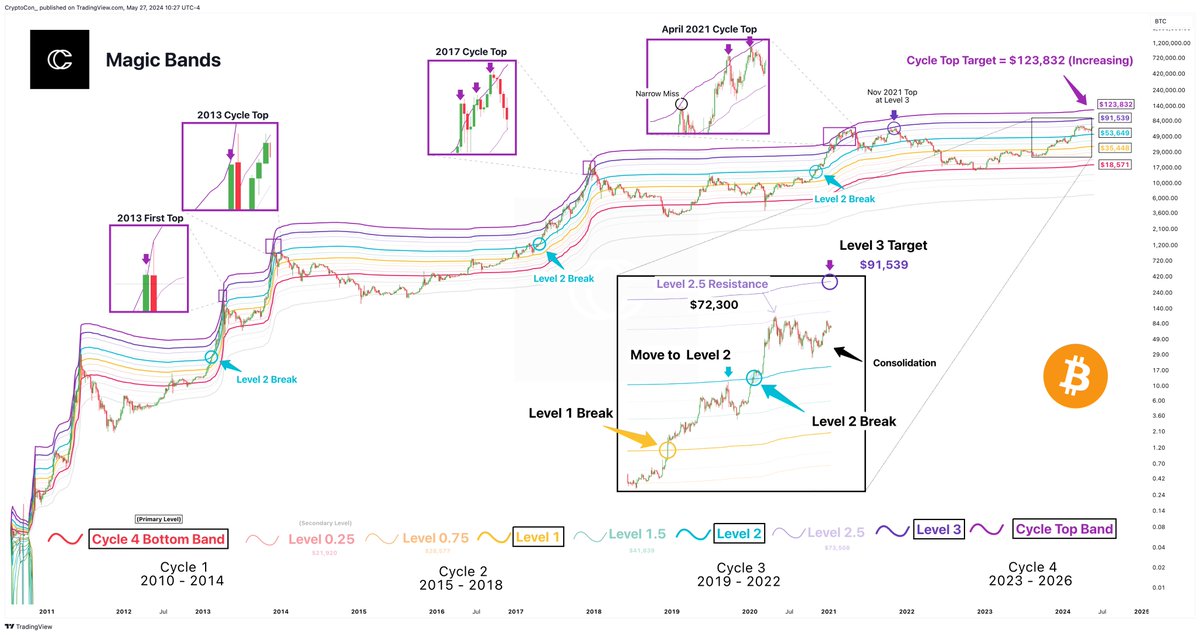

As a crypto investor, I keep a close eye on Bitcoin price bands – these are particular price zones where analysts and I focus our attention in order to anticipate market trends. These bands function like magnetic forces, drawing the Bitcoin price towards certain levels.

According to the graph presented, the price level of $91,539, labeled as “Level 3,” has gained notable significance as a potential target. Despite the current price fluctuations hovering around “Level 2.5,” the analyst is convinced that the market trends suggest a gradual pull toward “Level 3.”

As a financial analyst, I’ve observed that according to Crypto Con’s analysis, historical trends indicate that Bitcoin’s price may peak around $123,000 before entering its next cycle. This is a common observation in the “bitcoin parabola” pattern.

Currently, Bitcoin, the leading cryptocurrency in the market, was priced at $67,400 during my composition of this text. However, it has been struggling to hold its ground above the significant resistance level of $70,000. Should it manage to surmount this hurdle, there is a possibility for Bitcoin to challenge its previous all-time high of $73,700, which was attained on March 14.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-05-30 05:46