As a seasoned crypto investor with a keen interest in on-chain data and market trends, I’ve learned that the Ethereum exchange netflow is an essential metric to monitor for potential price movements. The recent spike in positive Ethereum exchange netflow, as reported by IntoTheBlock, has raised some concerns.

Recent data from Ethereum‘s blockchain reveals a substantial increase in the exchange outflow, potentially indicating a bearish trend for the cryptocurrency’s value.

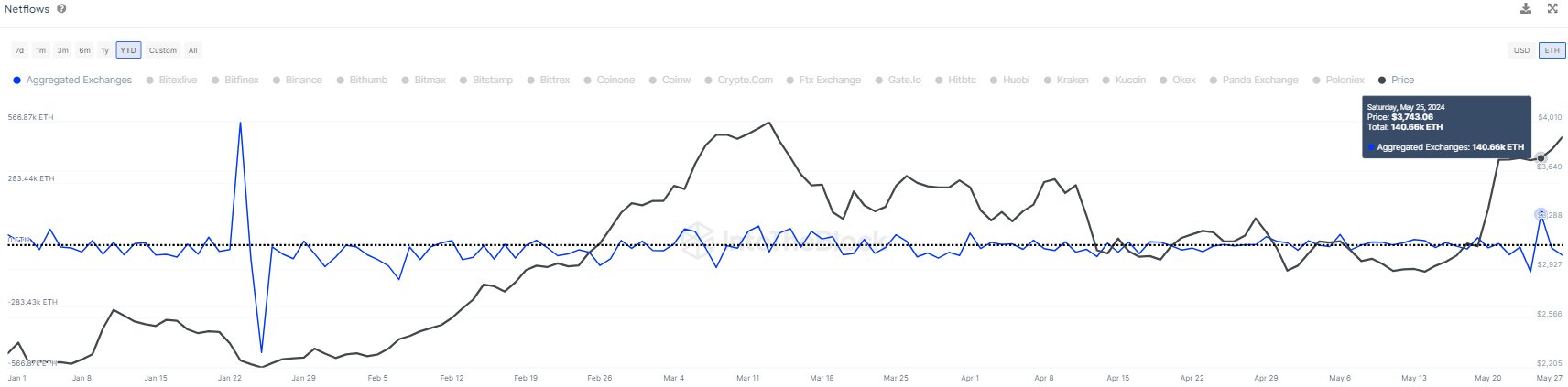

Ethereum Exchange Netflow Registered A Large Positive Spike Recently

As a researcher studying trends in the cryptocurrency market, I’d like to bring your attention to a recent post by IntoTheBlock on their market intelligence platform. In this post, they delve into the latest developments surrounding the exchange netflow metric for Ethereum.

“The ‘exchange netflow’ term signifies an on-chain metric that monitors the total inflow or outflow of a specific cryptocurrency between wallets linked to centralized exchanges.”

When the value of this metric is positive, it signifies that investors are currently depositing more tokens than they’re withdrawing on these platforms. This is often due to sellers transferring their tokens to exchanges in order to sell them. Consequently, such a trend may indicate bearish price movements for the asset.

While the net flow shows outflows exceeding inflows at present, this might be indicative of investors hoarding the coin, which could potentially be a positive sign.

Here is a chart illustrating the development in Ethereum exchange outflows from the beginning of the year 2024 onwards.

The Ethereum exchange inflow has seen a significant increase lately, with approximately 140,660 Ether being transferred into exchanges during the peak of this surge.

With the present value of the cryptocurrency, that sum amounts to approximately $547 million. Such a large figure represents the biggest influx of funds from these central entities since the beginning of the year.

As a researcher observing market trends, I’ve noticed that large inflows into exchanges are often indicative of selling activity. This occurs when investors choose to cash out their profits or give in to fear, uncertainty, and doubt (FUD). However, intriguingly enough, following these deposits, the asset’s price has experienced an upward trend instead.

The whales’ inflows may indicate that they haven’t chosen to sell those coins yet or hadn’t intended to sell at all. Alternatively, it could mean that market demand has been sufficient to absorb any selling that the whales might have done.

If the whales intended to sell Ethereum but have not executed their trades yet, there’s a possibility that Ethereum may experience downward pressure in the market.

As a crypto investor, I’m curious to observe how the price of this cryptocurrency will unfold in the upcoming days. It remains to be seen whether those substantial deposits will have any discernible impact on the market.

ETH Price

Ethereum experienced a decline previously, but it has bounced back, with its value currently hovering above $3,900.

Read More

- Mufasa The Lion King: Fans go berserk in theaters as Mahesh Babu’s voice takes over the big screen; WATCH

- Kraven the Hunter’s Ending Explained & Spoilers Explained

- Sebastian Harrison Confronts LA Fire, Narrowly Escapes Death

- What Time Does Will Trent Season 3 Release on ABC & Hulu?

- Veteran Kannada actor Sarigama Viji passes away at 76 due to age-related ailments

- Who Is Kelly Reilly’s Husband? Kyle Baugher’s Job & Relationship History

- Apple Ready to Pay $95 Million Over Siri Privacy Lawsuit

- Who Is Mandy Moore’s Husband? Taylor Goldsmith’s Job & Relationship History

- Yes, Drake Maye & Ann Michael Hudson Are Now Engaged

- Justin Bieber Clarifies ‘Someone Went on My Account & Unfollowed’ Hailey Bieber

2024-05-28 20:46