As a seasoned crypto investor with a keen interest in on-chain analytics, I find Glassnode’s latest report on Bitcoin intriguing and insightful. The suggestion that the demand for Bitcoin is still modest but improving is in line with my observations of the market.

According to Glassnode’s analysis, Bitcoin‘s recent dip below $70,000 might be due to insufficient demand at present. This potential lack of demand could potentially lead to further price increases in the future.

Demand For Bitcoin Is Still Modest

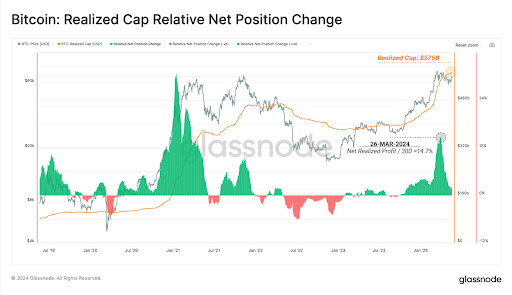

In their recent market analysis, Glassnode noted that the inflow of new capital into the Bitcoin network has decelerated significantly from its peak. This observation was drawn from the Realized Capitalization metric, which calculates the value of each Bitcoin based on the last transaction it was involved in. According to Glassnode, the current Realized Capitalization of Bitcoin stands at approximately $574 billion.

The platform disclosed that the addition of funds to Bitcoin has significantly decreased since it reached its peak price of $73,750. This is markedly different from the time prior to this peak, during which Glassnode reported “extraordinarily steep inflows,” amounting to $3.38 billion daily.

Currently, according to Glassnode, the Realized Cap is continuing to reside in profitable territory and is moving closer to reaching a balanced state. Notably, Bitcoin’s relatively low demand was instrumental in triggering this latest price surge due to diminishing selling pressure from experienced investors.

In simpler terms, Glassnode expressed optimism about Bitcoin’s future but believed it could improve further with increased investment. Notably, there’s a possibility of more money flowing into Bitcoin soon as Spot Bitcoin ETFs have recently seen net inflows instead of outflows.

The data from Farside Investors indicates that Bitcoin ETFs have experienced approximately $700 million in total inflows during this week. More notably, on May 21st, these funds recorded a substantial daily inflow of around $305.7 million. Remarkably, BlackRock’s iShares Bitcoin Trust (IBIT) reported its most profitable day ever on the same date, with an impressive influx of roughly $290 million.

Some Positive Key Takeaways

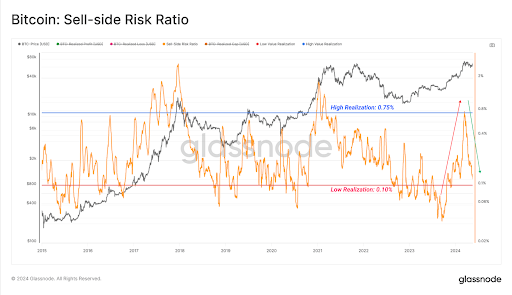

According to Glassnode’s analysis, certain significant on-chain indicators have shown promising signs for Bitcoin’s future trend. Notably, they mentioned that Bitcoin’s Sell-Side Risk Ratio has experienced a substantial decrease, implying that the market has regained balance during this price correction.

To evaluate market instability, they calculated the difference between the greatest and least prices over the previous 60-day period. Their findings indicated that “volatility is shrinking to usual degrees following extended periods of price stability and potentially signaling impending significant market shifts.”

Currently, there are 3.36 million Bitcoins in the Short-term holder (STH) category. Among these, approximately 2.14 million BTC experienced a market correction and now represent an unrealized loss for their owners. This finding from Glasnode indicates that a significant portion of Bitcoin held by this investor group is currently underwater, potentially mitigating the risk of price volatility or top-heaviness in the market.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-05-23 19:17