As an experienced financial analyst, I’ve seen my fair share of market reactions to regulatory news, and the Ethereum (ETH) community’s response to the renewed ETF approval rumors is one for the books. Based on the data presented in this article, it’s clear that investors on Binance have aggressively longed Ethereum in response to the potential approval of ETH spot ETFs.

As a researcher studying market trends on Binance, I’ve observed some intriguing patterns in response to Ethereum ETF news. Data indicates that users have been actively buying Ethereum, suggesting a strong demand and bullish sentiment towards the cryptocurrency following ETF announcements.

Ethereum Net Taker Volume On Binance Has Just Seen Its Biggest Candle Ever

According to Maartunn, the community manager at CryptoQuant, there has been a significant rise in Ethereum Net Taker Volume following whispers that ETH spot Exchange-Traded Funds (ETFs) may receive approval once again.

In simpler terms, “Net Taker Volume” is an indicator measuring the gap between the buying and selling volumes for Ethereum (ETH) in the form of taker orders on a specific centralized exchange.

When the metric’s value is positive, it indicates that more buyers or those holding a long position are transacting than sellers or short position holders on the platform at present. This imbalance suggests a prevailing bullish attitude among investors.

From my perspective as a crypto investor, when the indicator turns negative, it implies that a significant number of traders on the exchange are more inclined towards selling rather than buying, leading to a higher volume of short positions over long ones.

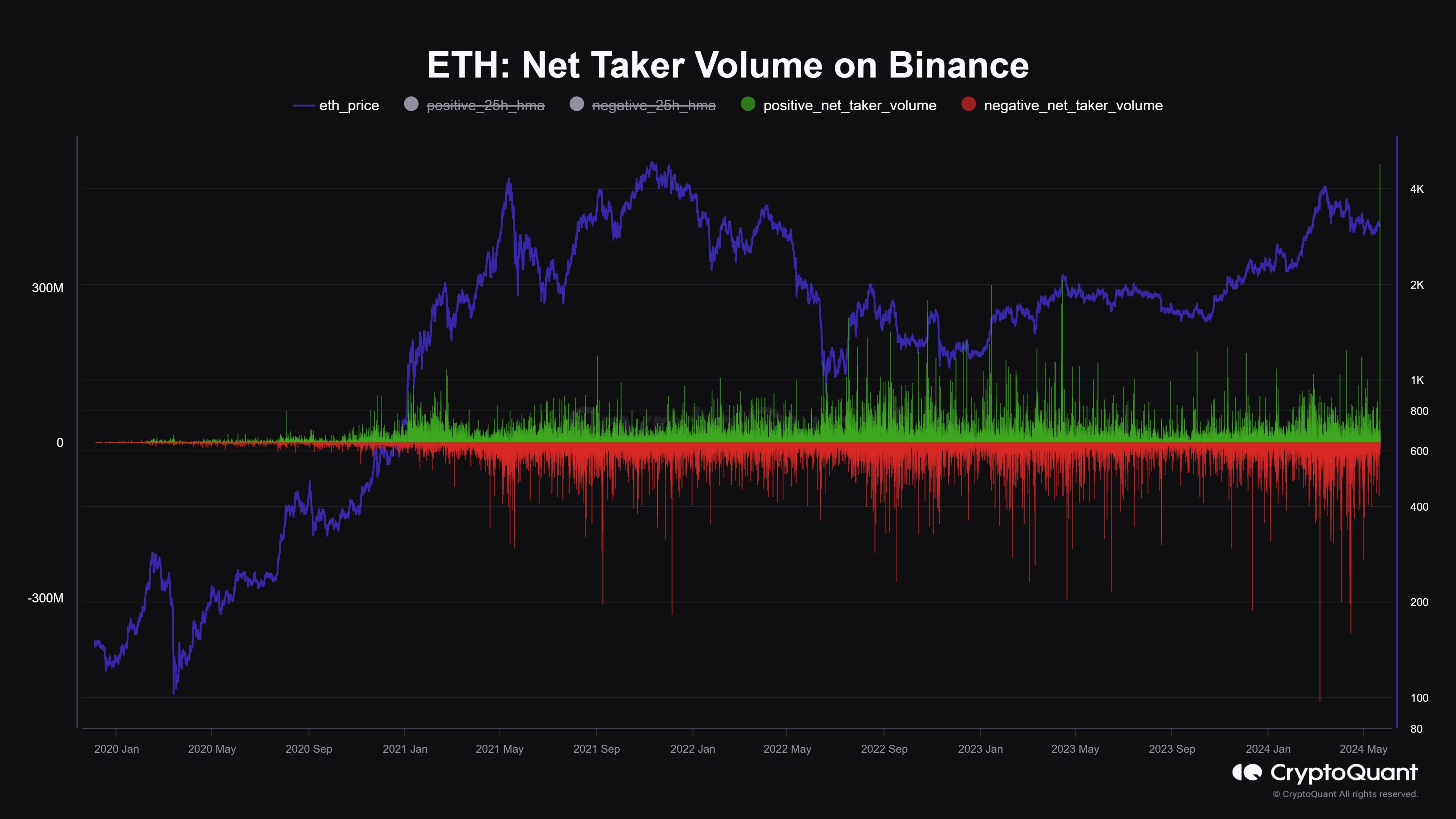

Here’s a chart illustrating the development of Ethereum’s net trading volume on Binance over the past few years.

The graph above indicates a significant surge in Ethereum Net Taker Volume on Binance, suggesting that investors have recently purchased a substantial number of Ethereum contracts as long positions.

As an analyst, I’ve observed a significant surge in the indicator’s value, reaching a peak of $530 million. This marks the largest spike this cryptocurrency has experienced to date.

“Maartunn observes that traders on Binance are eagerly anticipating news about an Ethereum ETF as if it were their last chance. This isn’t unexpected, given the significant impact a spot ETF could have on Ethereum, following the market’s experience with Bitcoin.”

Prior to the ETF approval, positive news about Bitcoin (BTC) had boosted its price. Initially, the approval itself caused a downturn in the market. However, as investors began pouring capital into Bitcoin through these new investment vehicles, the coin experienced a significant surge and reached a new record high (ATH).

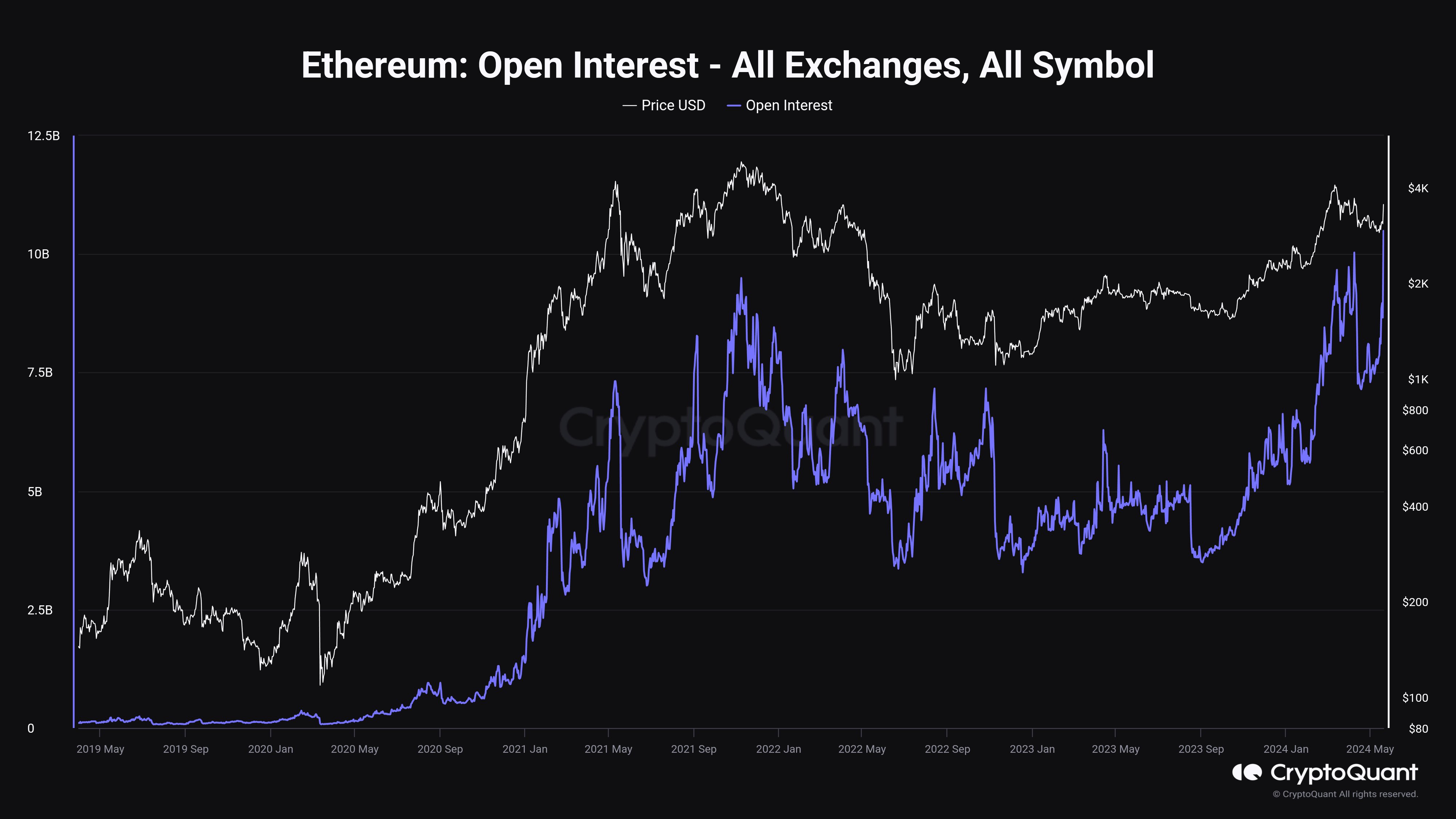

As a researcher studying the cryptocurrency market, I’ve noticed an intriguing development in a recent CryptoQuant post. Specifically, the analyst drew attention to a significant increase in Ethereum’s open interest. Open interest refers to the total number of ETH-based positions that are currently active on all derivative exchanges.

As an analyst, I wouldn’t find it surprising that the open interest for Ethereum derivatives has reached a new all-time high (ATH). Given the significant increase in long positions taken by users, this trend was bound to occur.

As a crypto investor, I’ve noticed that intense speculation often results in heightened volatility for coins like Ethereum. This is because the risk of large liquidations becomes significantly higher during such periods. Therefore, when I see an Open Interest spike for Ethereum, I can’t help but feel a sense of caution. It may be a sign that turbulent times lie ahead for this cryptocurrency.

ETH Price

To date, Ethereum has surpassed the $3,800 mark in the rally sparked by ETF news – a threshold it last crossed back in mid-March.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-05-21 18:04