As a seasoned crypto investor with a few years of experience under my belt, I’ve seen my fair share of market fluctuations and trends. The recent analysis by Willy Woo regarding the Bitcoin Spent Output Profit Ratio (SOPR) has piqued my interest.

A financial analyst has interpreted the recent developments in Bitcoin‘s market as indicating that profitable selling may have ended, making way for a “refreshing correction” or “revitalizing adjustment” in the cryptocurrency’s price trend.

Bitcoin SOPR Suggests Profit-Taking From Investors Has Cooled Off

Analyst Willy Woo shares insights in a recent post on X regarding the current trend of Bitcoin Spent Output Profit Ratio (SOPR). The SOPR is an essential on-chain metric that reveals whether Bitcoin investors as a group are currently selling their coins at a profit or a loss.

If the metric value surpasses 1, it can be interpreted as an indication that on average, traders in this sector are likely making a profit by transferring coins at the moment. Conversely, when the indicator shows a negative value, it suggests that more often than not, sellers in the market are realizing losses.

As a researcher, I would interpret an SOPR (Spend Output Profit Ratio) of 1 as indicating a balance between gains and losses for investors at present. This means that the total profits being made from selling are equivalent to the total losses incurred, resulting in a neutral position for these investors – they are simply breaking even.

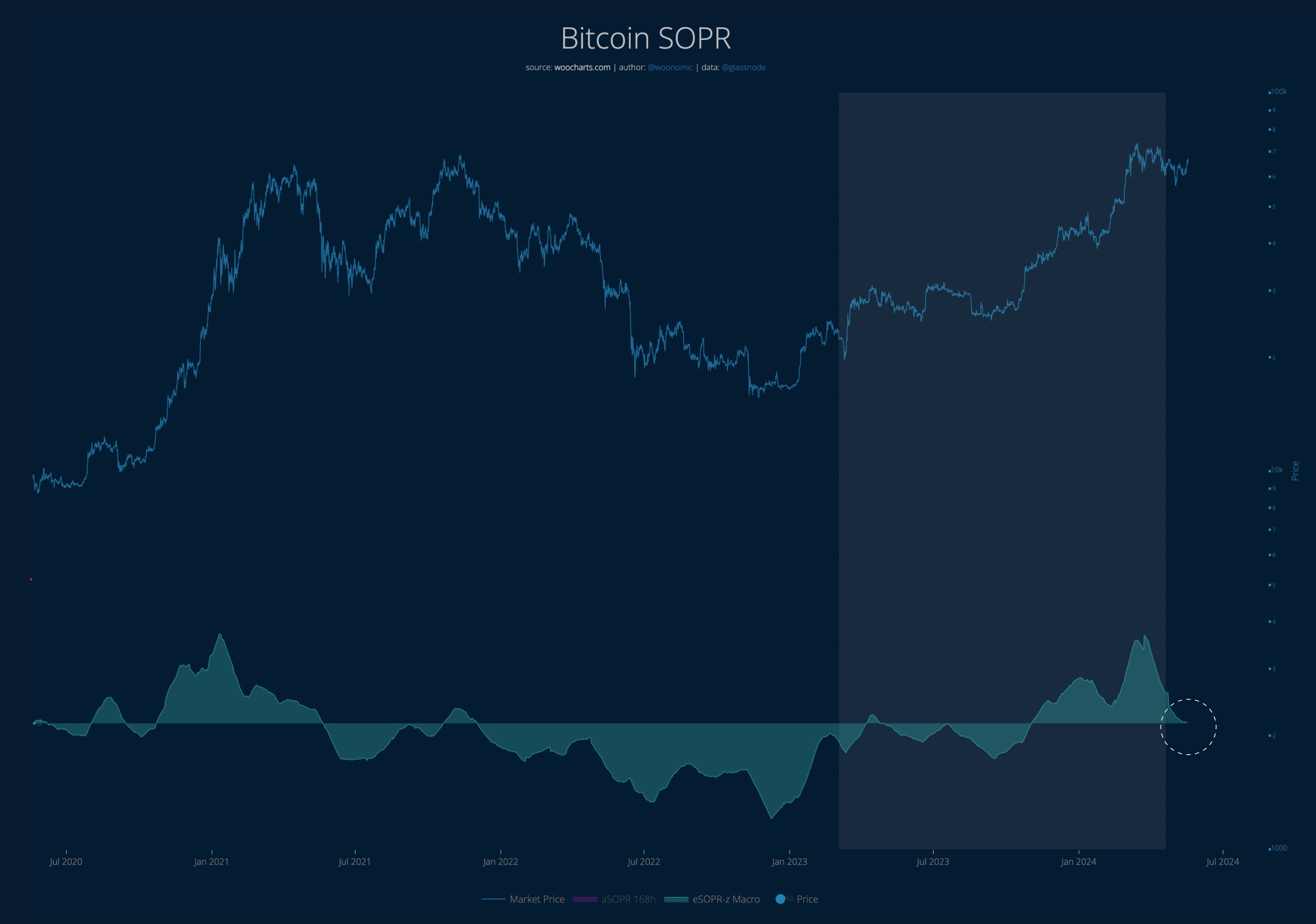

Now, here is a chart that shows the trend in the Bitcoin SOPR over the last few years:

In the graph before you, it’s clear that the Bitcoin SOPR (Spend Output Probability Ratio) reached significantly high, positive values. This occurred during Bitcoin’s previous price surge as it approached a new record high (ATH).

Based on the graph’s representation, it appears that investors were actively cashing out substantial profits during this market surge. This trend can be seen to have emerged around the beginning of the 2021 bull market as well.

As a crypto investor, I’ve noticed that following the price peak (all-time high or ATH), the asset has undergone consolidation. This consolidation period has led to a decrease in the indicator’s value as well. According to Woo’s chart analysis, the metric is now close to hitting the neutral mark.

Two months after peak profit-taking, it seems that investors’ eagerness to reap profits may have waned. As an analyst, I view this as a positive development for the cryptocurrency market, given that the capital influx is now on the rise once more for this specific coin.

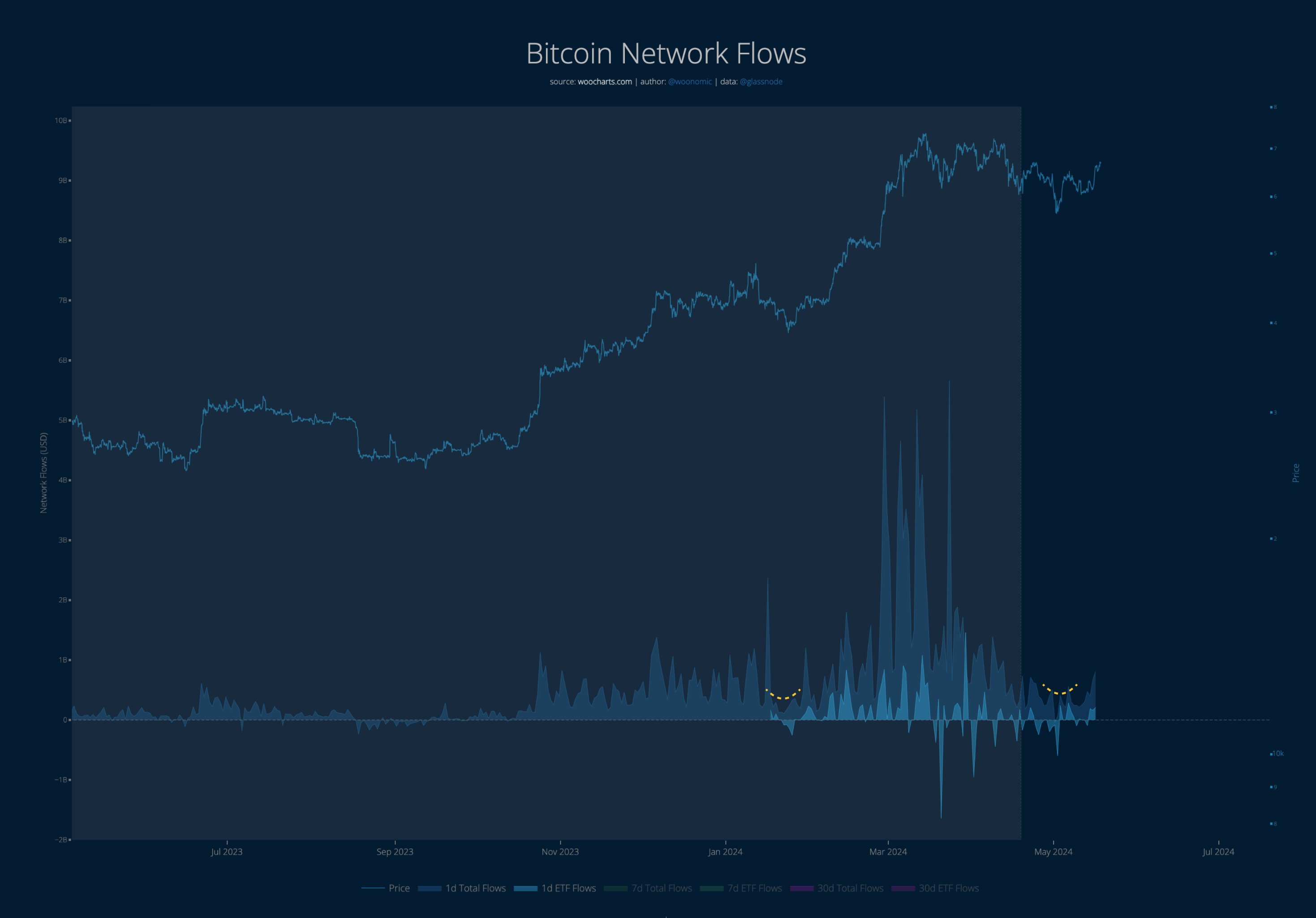

Based on the graph, it’s clear that the trend of Bitcoin network activity showed a consistent decrease during the previous consolidation period. However, more recently, there has been an uptick in investment inflows towards Bitcoin.

I’ve noticed a pattern that mirrors an earlier occurrence this year. Following the approval of spot exchange-traded funds (ETFs), there was a significant shift in investment flows, leading to a downturn in the market. However, after this reversal, the cryptocurrency experienced a surge and reached its all-time high (ATH).

BTC Price

Yesterday, I noticed a dip in Bitcoin’s price below the $66,000 mark, causing some concern amongst investors that the recent surge might have lost steam. Fortunately, this downturn was short-lived as the coin regained its footing and surpassed $67,000 once again today.

Read More

- POPCAT PREDICTION. POPCAT cryptocurrency

- Who Is Finn Balor’s Wife? Vero Rodriguez’s Job & Relationship History

- The White Lotus’ Aimee Lou Wood’s ‘Teeth’ Comments Explained

- General Hospital Cast: List of Every Actor Who Is Joining in 2025

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- Kingdom Come Deliverance 2: How To Clean Your Horse

- Who Is Al Roker’s Wife? Deborah Roberts’ Job & Relationship History

- One Piece Chapter 1140 Release Date, Time & Where to Read the Manga

- Clare Crawley Subtly Reacts to Matt James & Rachael Kirkconnell Split

2024-05-20 22:16