As a researcher with a background in the crypto industry, I’ve witnessed the significant trend of new tokens entering the market with low circulating supplies but high valuations. This market structure raises serious concerns about the long-term sustainability of these assets after Token Generation Events (TGEs).

New findings from Token Unlocks indicate a notable pattern in the cryptocurrency sector. Numerous tokens are debuting with minimal circulating quantities yet high evaluations. The prevailing market setup ignites apprehensions regarding the long-term gains for investors following Token Generation Events (TGE). According to Binance Research, approximately $155 billion value of tokens is slated to be released from 2024 to 2030. This potential surge in available tokens poses a risk for significant selling pressure unless there’s a substantial boost in purchasing intent and financial inflows.

Understanding the Market Dynamics

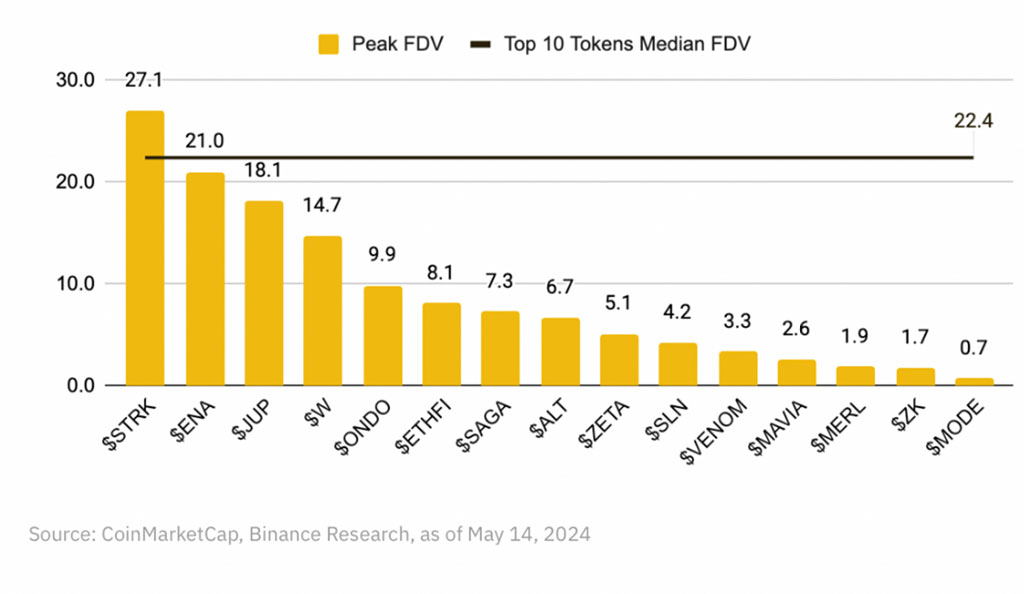

Examining the relationship between market capitalization and Fully Diluted Valuation (FDV) for tokens introduced in 2024, a significant proportion of their total supply remains unexplored. Many newly introduced tokens possess minimal circulating supplies, with several falling below the 20% threshold. The scant availability of these tokens in the market, coupled with substantial FDVs, underpins their elevated valuations that mirror or even surpass those of established Layer-1 or DeFi tokens. This discrepancy arises due to the lack of demonstrated user engagement for many new tokens.

To maintain constant prices for these tokens in the upcoming years, approximately $80 billion in fresh investments are required to offset the increased supply. This is a significant hurdle, given the unpredictability of market trends.

Multiple elements have played a role in this development. The surge of personal investment has fueled heightened evaluations, while an upbeat market outlook has reinforced these lofty assessments.

Implications For Investors and Project Teams

In today’s market, it is essential for investors to carefully choose their investments due to the complex conditions. To successfully maneuver through this scenario, investors would be wise to concentrate on certain critical aspects. Analyzing unlock schedules and vesting schedules is crucial in determining potential surges in supply and subsequent selling pressures.

Analyzing valuation ratios such as Market Cap to Revenue and Market Cap to Total Value Locked in relation to those of competitors and historical data can yield more enlightening information than focusing solely on Market Cap. Furthermore, evaluating a project’s progress and identifying market fit indicators like daily active users and transaction volume is essential. Additionally, the caliber of the project team and the level of community engagement are significant factors in predicting future prosperity.

When it comes to project teams, it’s important for them to carefully consider the design of their token economics. Striking a balance between the amount initially issued and the schedule for future token releases is essential to prevent excessive selling pressure and maintain market stability. Clear communication about the distribution plan can strengthen investor trust.

It’s essential to zero in on the basics as well. Make sure projects deliver high-quality, market-demanded products. A robust user base and a cohesive team can pique and retain investors’ attention.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-05-20 18:18