As an experienced financial analyst, I strongly believe that supply and demand dynamics play a pivotal role in shaping the price action of Bitcoin and other cryptocurrencies. The insights provided by Ali Martinez into the recent Bitcoin price fluctuations are both intriguing and enlightening.

As an analyst, I recognize the significance of understanding the factors that impact price movements in the intricate realm of cryptocurrency markets. Recently, I’ve gained valuable insights from renowned expert Ali Martinez regarding Bitcoin‘s price fluctuations. By employing the fundamental economic principle of supply and demand, he elucidated how market forces have influenced Bitcoin’s value trends.

Understanding Bitcoin Prices Through Supply And Demand

The price behavior of any asset, including cryptocurrencies, is influenced significantly by the basic economic principles of supply and demand. When the supply exceeds the demand, the asset’s price usually declines. Conversely, if demand surpasses the available supply, asset prices generally rise.

Ali Martinez has uncovered insights into a crypto asset’s price trends and holder actions by utilizing a specific method and additional on-chain indicators. His research reveals that changes in market demand for Bitcoin and the supply of this digital currency significantly impact its price trend.

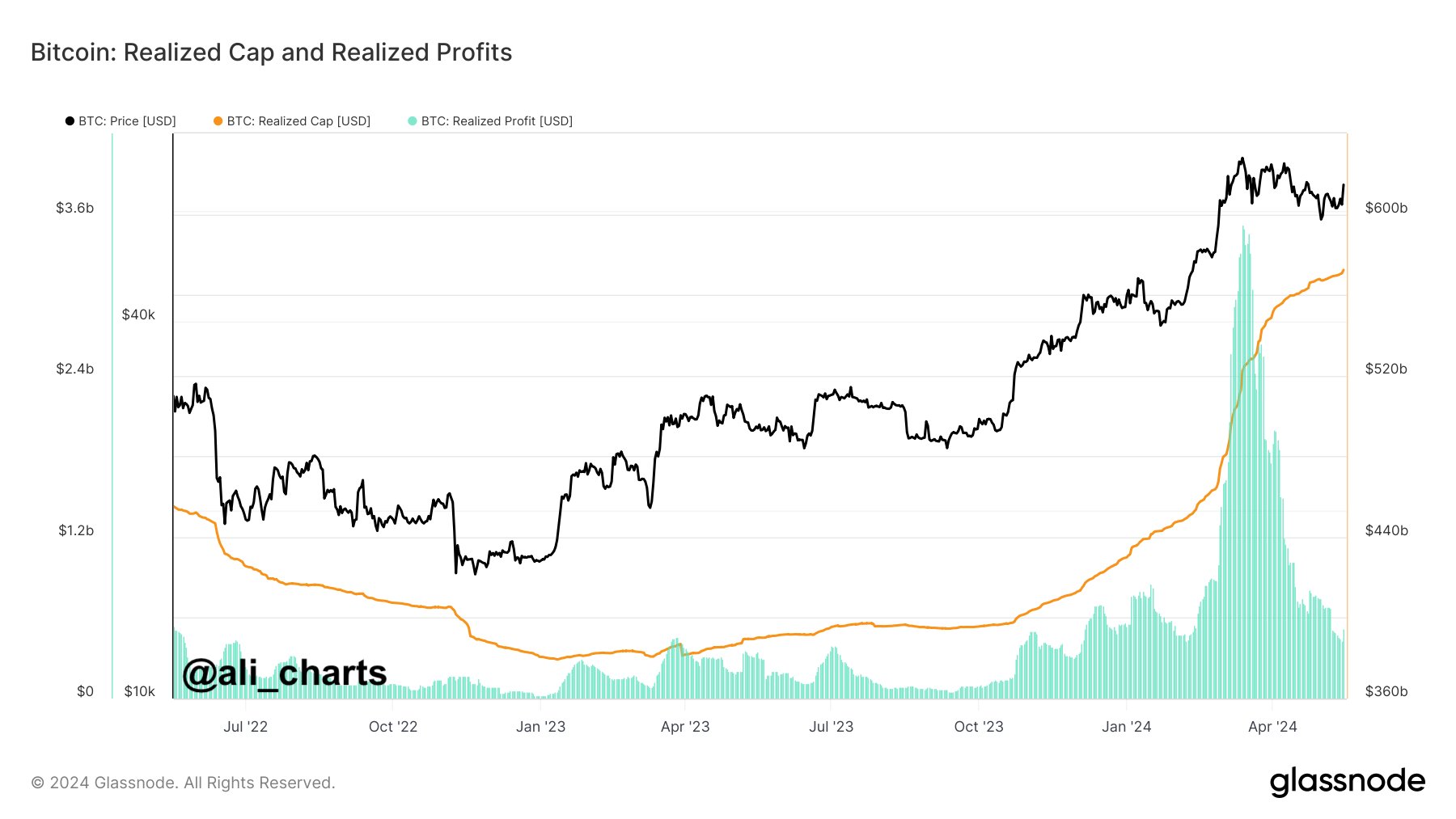

Based on Martinez’s findings, Bitcoin’s Realized Cap experienced a notable surge around mid-March when Bitcoin reached its record peak of $73,000. This trend suggests that many long-term Bitcoin holders probably realized their profits during this period.

After cashing in on substantial profits from selling Bitcoin holdings in March, many investors breathed a sigh of relief and subsequently purchased an additional 70,000 Bitcoins, feeling confident about the current market conditions.

During this time, as the Bitcoin market’s Bitcoin supply outpaced demand, the coin underwent a significant decrease in value from its peak at $73,000 down to $57,000.

Due to price instability, short-term Bitcoin holders are more prone to selling their assets. Consequently, when the price dipped below this group’s average purchase price, it sparked anxiety among investors. However, contrary to popular belief, the $65,500 level functioned as a collection point for these short-term holders.

Based on this concept, Martinez posits that the probability of Bitcoin’s price trending upwards will become more robust once the demand for the cryptocurrency surpasses the existing supply in the market.

Using BTC On Exchanges To Support The Principles

Martinez emphasized that the Bitcoins accessible on cryptocurrency exchanges can serve as evidence for the functioning of supply and demand principles. Moreover, he pointed out that over 30,000 BTC were transferred to personal wallets for long-term preservation in May, suggesting a strong belief among Bitcoin holders regarding its future value.

According to Martinez’s analysis using MVRV Extreme Deviation Pricing Bands, Bitcoin’s price experienced a significant increase and surpassed the +0.5σ pricing band at around $64,600. Historically, such a price surge has resulted in Bitcoin approaching the 1.0σ range, which is driven by heightened demand. Currently, this price level is estimated to be approximately $77,000.

Currently, the cost of Bitcoin stands at $66,275, representing a roughly 5.5% price hike over the last seven days. However, there’s been a noticeable 24% decrease in trading volume during this period. Concurrently, its market capitalization has experienced a slight rise of approximately 0.23%.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-05-17 18:04