As a seasoned crypto investor with a deep understanding of technical analysis and market trends, I find Willy Woo’s latest analysis on the Bitcoin VWAP Oscillator particularly intriguing. The historical trend between this indicator and BTC price movements is compelling, suggesting that a potential bull run could be on the horizon.

An analyst has shared insights about the Bitcoin oscillator’s data, implying that there is potential for significant growth in the ongoing crypto rally based on their interpretation.

Bitcoin VWAP Oscillator Could Imply Potential For Further Upside

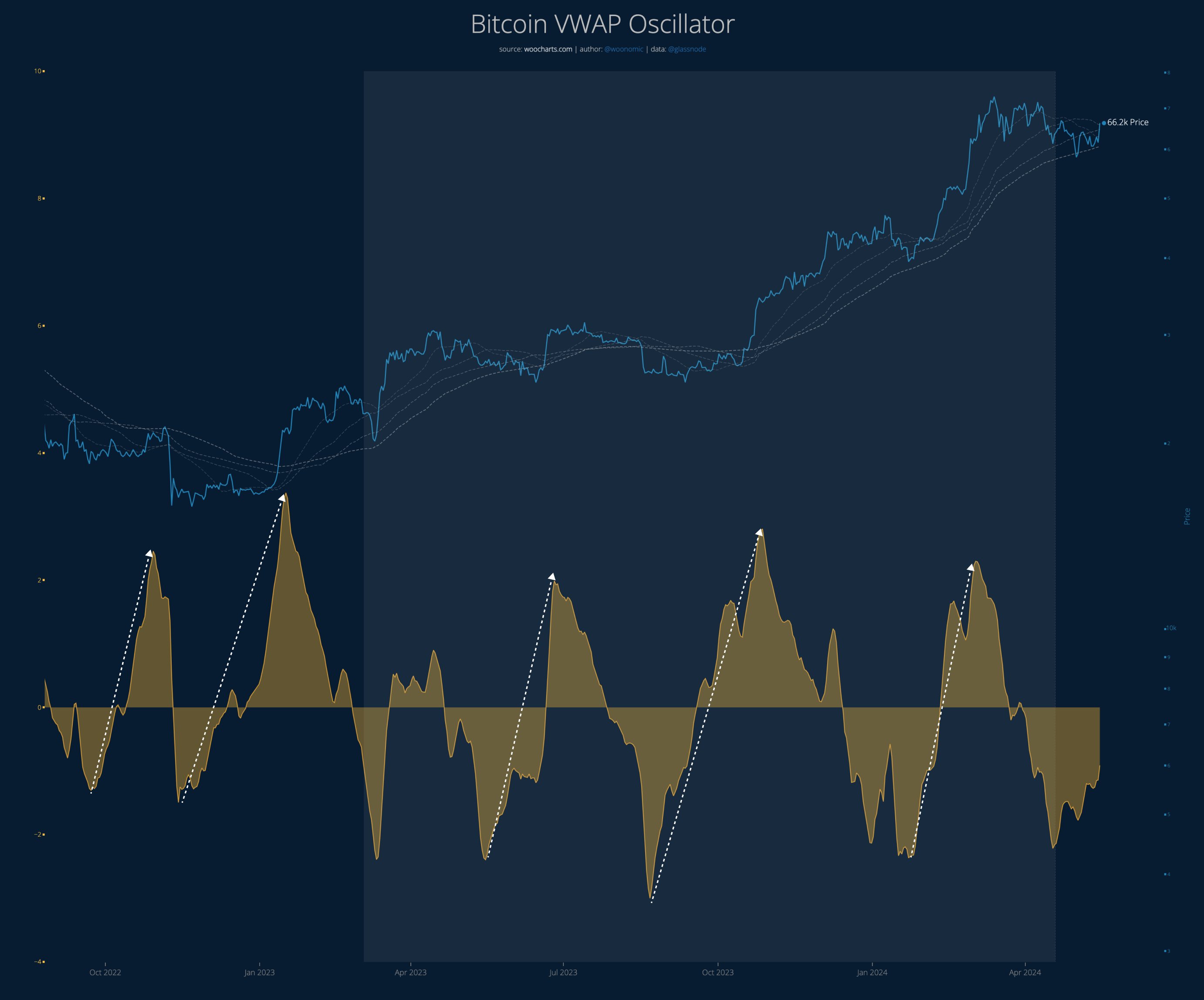

Analyst Willy Woo shared insights in a recent update on X about the current trend of Bitcoin’s Volume-Weighted Average Price (VWAP) Oscillator and its potential implications for the cryptocurrency’s future price movements.

The Volume-Weighted Average Price (VWAP) is a calculation that determines the typical price of an asset, considering both price changes and trading volumes, and assigns greater significance to prices that correspond with larger trading amounts.

In simpler terms, the assets with greater trading activity (volume) have more influence on the calculation of the average price compared to those with minimal trading activity.

In the context of Bitcoin trading, the Volume Weighted Average Price (VWAP) is a technical analysis tool that historically relies on data from spot exchanges. However, in this specific discussion, the VWAP employs the on-chain Bitcoin volume instead, which is publicly accessible due to the blockchain’s inherent transparency.

The VWAP (Volume Weighted Average Price) itself isn’t the significant factor in this context, but rather the relationship between it and the BTC (Bitcoin) spot price, as previously discussed. This relationship is expressed through the VWAP Oscillator, which calculates the difference between the two and typically hovers around zero.

The chart below shows the trend of this Bitcoin indicator over the past couple of years.

As a crypto investor, I’ve been closely monitoring the Bitcoin VWAP Oscillator’s performance over the past few months. The graph clearly indicates that this metric has been lingering in negative territory during this period. Yet, there’s a silver lining – its value has been on an upward trend lately. If this positive momentum continues, we might witness the Bitcoin VWAP Oscillator approaching the neutral mark soon.

In the graph, Woo has identified a pattern between the indicator’s value and the cryptocurrency’s price history. Whenever the metric has reached a low point in the negative zone and subsequently bounced back upward, the digital asset has experienced notable price growth.

As a researcher studying market trends, I can tell you that the current price surge for the asset may persist until the VWAP Oscillator shifts back into positive territory and forms a peak. However, this event has not occurred yet in the case of this particular indicator. In simpler terms, there’s still ample opportunity for further growth or continuation of the trend before any potential reversal or consolidation happens. I can empathize with those holding short positions on Bitcoin, as it’s an uncomfortable position to be in at the moment.

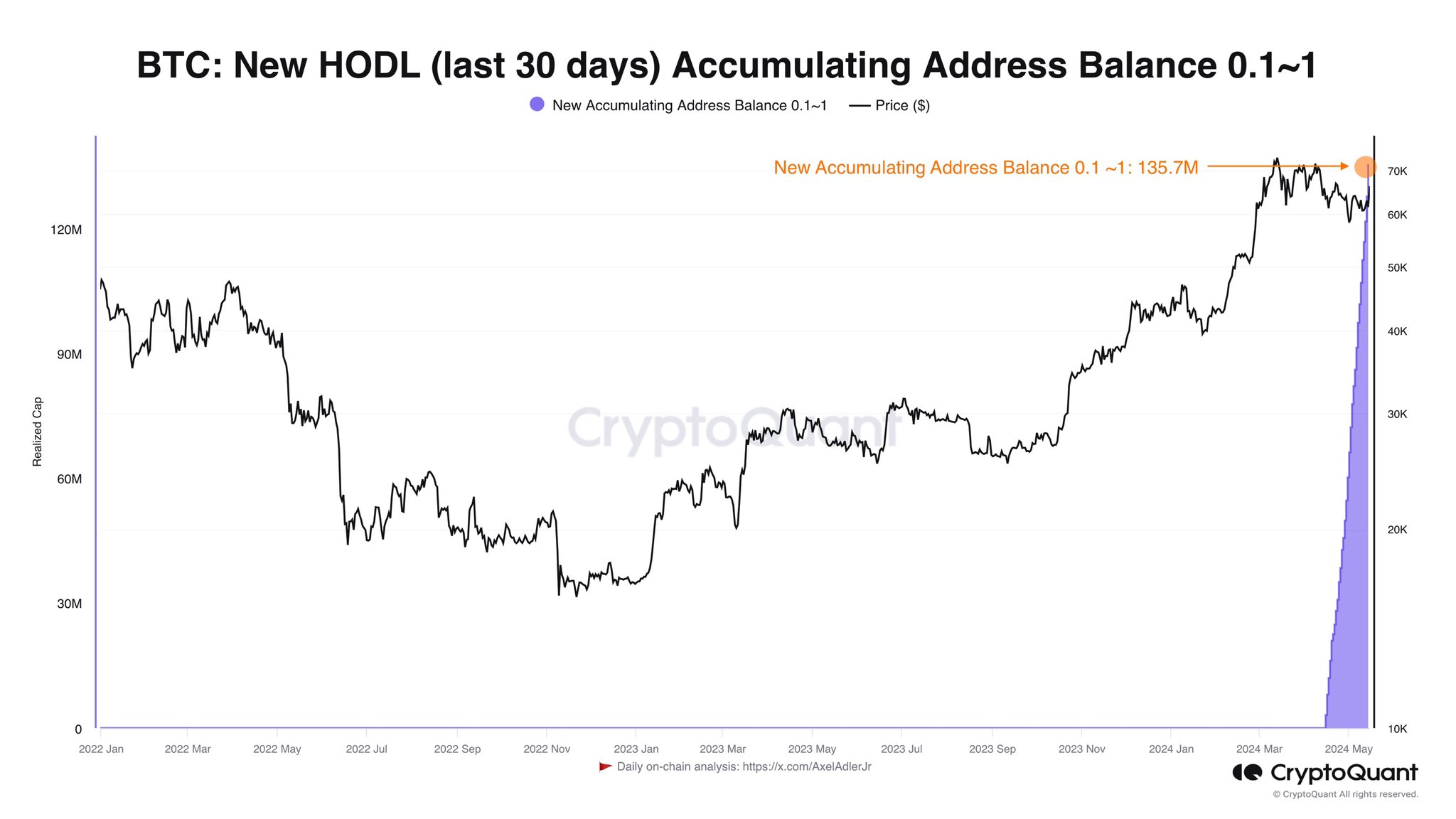

According to a recent analysis by Axel Adler Jr., the author of CryptoQuant, retail investors have purchased approximately $135.7 million of the asset during the last month.

BTC Price

At the time of writing, Bitcoin is floating around $65,000, up 5% over the last week.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Green County map – DayZ

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-05-17 07:16