As an experienced crypto investor, I’ve seen my fair share of market volatility in the world of Ethereum. The recent price surge has sparked renewed optimism among some analysts, but I remain cautiously optimistic.

As a crypto investor, I’ve experienced quite the rollercoaster ride with Ethereum (ETH) lately. Following a harsh price correction last week, ETH has bounced back slightly, leading me to ponder if this is the initiation of a prolonged bull market or just a brief respite before another downturn.

Ethereum Rallies, But Questions Linger

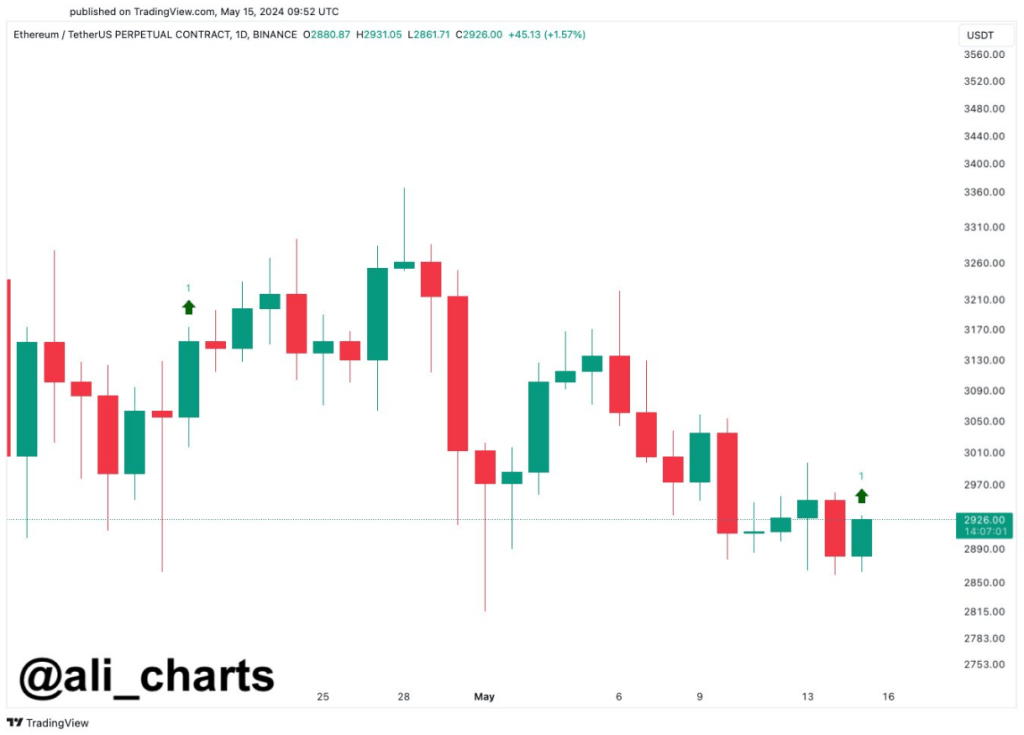

In the past 24 hours, Ethereum (ETH) experienced a 3.7% increase, fueled by a broader upswing in the cryptocurrency market. This development follows a substantial price decrease that led ETH to reach a low of $2,850. Some analysts are now hopeful, with prominent crypto commentator Ali predicting the possibility of a “one to four candlestick rebound” based on a bullish indication he detected in Ethereum’s price chart.

As an analyst, I’d interpret this as follows: On Ethereum’s daily chart, the TD Sequential indicator has triggered a buy signal for me. This implies that I believe $ETH may experience a recovery ranging from one to four candlesticks in the near future.

— Ali (@ali_charts) May 15, 2024

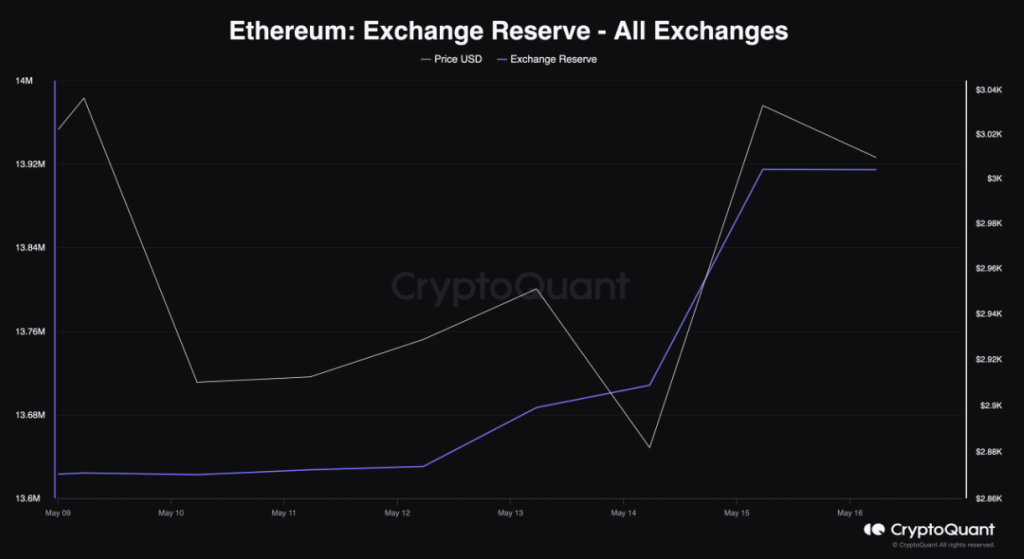

Yet, some remain skeptical. An examination of on-chain statistics presents contrasting indicators. According to CryptoQuant’s analysis, Ethereum’s exchange reserves have surged noticeably in recent days, implying that investors could be disposing of their ETH instead of amassing it.

The findings from Santiment’s data add evidence to this trend, showing a rise in Ethereum’s exchange supply during the last week.

As a crypto investor, I’ve noticed that the actions of large investors, or “whales,” can be confusing at times. While there hasn’t been any noticeable change in Ethereum’s supply held by the largest addresses, it’s important to consider that this could signify two possible scenarios. On the one hand, whales might have decided to hold their positions steady and not make any major transactions recently. On the other hand, they could be carefully planning their next moves behind the scenes, waiting for the right moment to enter or exit the market without causing significant price fluctuations. Ultimately, only time will reveal which interpretation is accurate.

According to some perspectives, this could be interpreted as whales exhibiting caution and adopting a watchful stance, possibly intending to buy back in once the market reaches its peak.

Undervaluation Hints At Potential Growth

As a crypto investor, I’ve noticed that there have been conflicting signs in the market regarding Ethereum’s price direction. However, certain metrics offer encouraging hints for potential price growth. Specifically, Ethereum’s Network Value to Transactions (NVT) ratio, as assessed by Glassnode, has experienced a substantial decrease over the past week. This could suggest that the current market price does not accurately reflect the underlying network activity and transaction volume. Consequently, there is a possibility that the ETH price may increase in the near future to better align with its fundamental value.

Market Sentiment, Technical Indicators Send Conflicting Messages

Currently, the outlook for Ethereum’s price prediction is made more intricate due to the varying market opinions regarding its future value. While certain analysts are growing optimistic, as indicated by the surge in positive sentiment towards ETH on social media, other technical indicators present a murkier perspective.

In simpler terms, the RSI and MFI indices have dropped lately, which might be a sign that the current market upward trend is weakening. On the other hand, the MACD indicator has shown a bullish signal, implying that the uptrend may persist.

A Potential Bull Run For Ether

As a crypto investor, I’ve noticed Ethereum’s price surge and some encouraging on-chain metrics, which have me hopeful for an impending bull run. However, I’m hesitant to make a definitive call based on conflicting signals from exchange reserves, whale activities, and technical indicators. The reserves indicate potential sell pressure, while the behavior of large investors and the readings from my preferred technical tools offer mixed messages. It’s essential for me to closely monitor these factors and consider alternative perspectives before making any investment decisions.

Read More

- POPCAT PREDICTION. POPCAT cryptocurrency

- Who Is Finn Balor’s Wife? Vero Rodriguez’s Job & Relationship History

- The White Lotus’ Aimee Lou Wood’s ‘Teeth’ Comments Explained

- General Hospital Cast: List of Every Actor Who Is Joining in 2025

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- Kingdom Come Deliverance 2: How To Clean Your Horse

- Who Is Al Roker’s Wife? Deborah Roberts’ Job & Relationship History

- One Piece Chapter 1140 Release Date, Time & Where to Read the Manga

- Clare Crawley Subtly Reacts to Matt James & Rachael Kirkconnell Split

2024-05-16 21:05