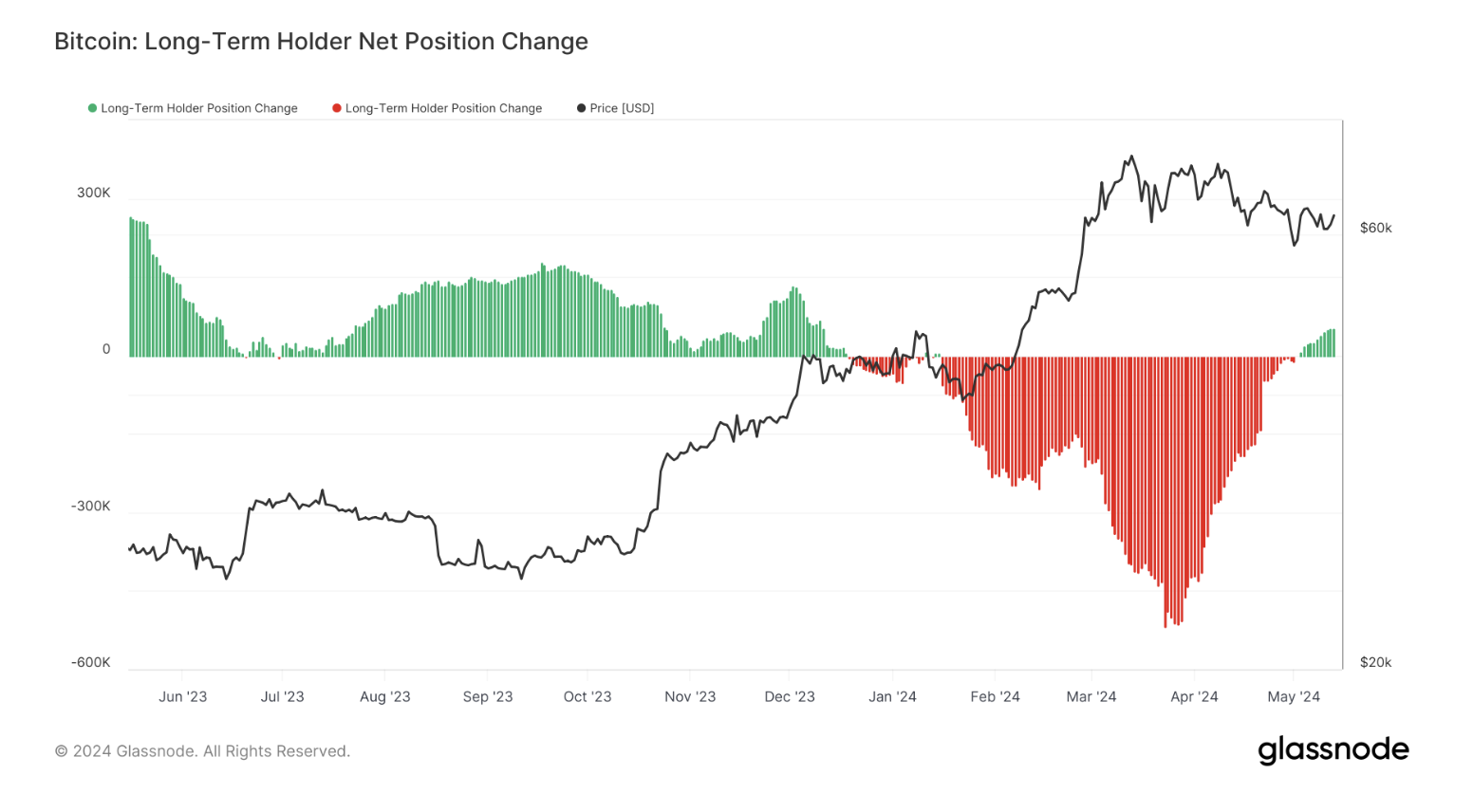

As a researcher with extensive experience in the cryptocurrency market, I find the current trend of long-term Bitcoin holders accumulating large quantities of BTC to be an encouraging sign. The data from Glassnode suggests that these seasoned investors are taking advantage of Bitcoin’s lower price to increase their holdings, which strengthens the belief that they anticipate a potential upside for the cryptocurrency.

Based on Glassnode’s latest findings, it appears that long-term Bitcoin investors are actively purchasing more coins during this price downturn. Their increased holdings add credence to the notion that these investors are optimistic about Bitcoin’s future value and expect potential growth despite market instability.

Long-Term Holders Pay $4.3 Billion For 70,000 BTC

Based on Glassnode’s analysis, individuals who had previously sold over a billion Bitcoins during late 2023 are now purchasing the cryptocurrency again. This trend could be considered a possible indication of an upcoming bull market for Bitcoin.

Long-term Bitcoin investors have a tendency to sell their coins at price peaks and purchase more during market downturns or significant price drops. Their buying behavior during market bottoms often signals their belief in an upcoming price recovery, resulting in profitable returns.

Contrariwise, speculative buyers tend to jump into the cryptocurrency market during random price hikes, potentially indicating that the cryptocurrency’s value might soon reach its zenith.

As a long-term Bitcoin investor with a stake above $61,000, I view the current market situation as an excellent opportunity to buy more. Recently, I’ve added a significant amount – around 70,000 BTC worth over $4.3 billion – to my existing holdings.

A few crypto analysts are in agreement with the belief that Bitcoin will experience significant growth during the upcoming bull market, potentially reaching new record-breaking heights. In early March, before the halving event, Bitcoin broke through $73,000 for the first time ever, establishing a new all-time high.

As a market analyst, I believe that the ongoing bull market may continue to drive Bitcoin prices upward. Enhancing market conditions and escalating investor interest could significantly contribute to this trend. Consequently, early investors who have held onto their Bitcoin could potentially reap substantial profits.

Additionally, the highly anticipated U.S. inflation report due out on May 15 could serve as another significant reason for long-term investors’ substantial bitcoin purchases. Given that the U.S. Consumer Price Index (CPI) continues to hover at historically high levels, and the Federal Reserve (FED) has yet to adjust interest rates, Bitcoin is viewed as a viable hedge against inflationary pressures. As such, it offers investors protection from potential wealth erosion due to inflation.

Bitcoin Whales Display Opposite Trend

As a researcher studying the cryptocurrency market, I’ve come across some intriguing insights from Santiment’s blockchain analytics. It appears that Bitcoin’s large-scale investors, referred to as “whales,” are exhibiting a trend contrary to that of long-term holders.

Large-scale Bitcoin transactions by whales have noticeably dropped off, according to our analytics platform’s observation, suggesting a pause in their BTC hoarding activities.

The downward trend in this cryptocurrency’s value overlaps with a decrease in its on-chain transactions and activity levels during the past few weeks.

According to crypto expert Ali Martinez’s recent analysis, Bitcoin’s trend of accumulation is currently showing a value nearer to zero. This finding suggests that larger investors have been disposing of their Bitcoins instead of acquiring new ones.

In spite of Bitcoin’s recent decline, Martinez has revealed that the TD sequential indicator suggests it could be a good time for purchasing bitcoins. The cryptocurrency’s price currently hovers around $62,000 on major exchanges, marking a 6.38% drop over the past month based on CoinMarketCap data.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-05-15 23:10