As a seasoned crypto investor with a keen interest in Ethereum (ETH), I find the recent trend in ETH options for June particularly intriguing. The bullish sentiment among traders is palpable, as evidenced by their concentrated bets on higher strike prices, specifically above $3,600. This optimistic outlook is further underscored by the substantial positioning of call contracts with a notional value exceeding $1.8 billion.

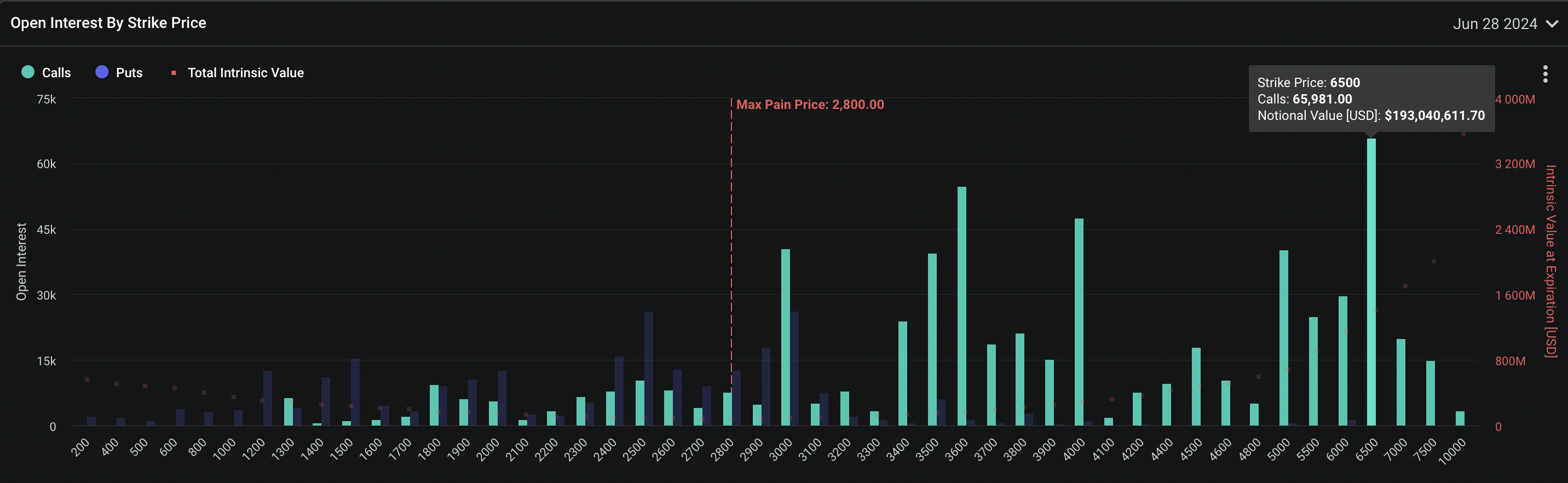

There’s a significant preference among Ethereum (ETH) option contracts for June towards higher strike prices, with a strong concentration at price points above $3,600.

According to information from Deribit, there’s a significant position taken by traders in the form of calls on Ethereum reaching or exceeding a certain price. This trend suggests a strong optimism towards Ethereum’s short-term growth. The preferred strike price for these bullish wagers is set at an ambitious $6,500.

Options Market Bullish On Ethereum

Significantly, contracts known as options grant traders the privilege, without the mandatory commitment, to acquire (for call options) or dispose of (for put options) the underling asset at a predetermined price prior to the expiration date.

As a researcher studying financial derivatives, I can explain that call options are preferred by traders who hold the belief that the underlying asset’s value will rise in the future. By purchasing a call option, they secure the right to buy the asset at a predetermined price (strike price) in the future, allowing them the potential to profit from the expected price increase and sell at a higher market price.

As a crypto investor, I’ve noticed an intriguing trend in the Ethereum options market lately. The preference for call options is quite pronounced, and the aggregate open interest reflects this bias towards higher strike prices. In simpler terms, there are more investors betting on Ethereum prices to rise rather than stay put or decline. It will be interesting to see how this plays out in the coming days.

The prevalence of calls focusing on Ethereum prices above $3,600 indicates that a notable group of investors anticipates Ethereum’s price growth towards greater heights by June’s end.

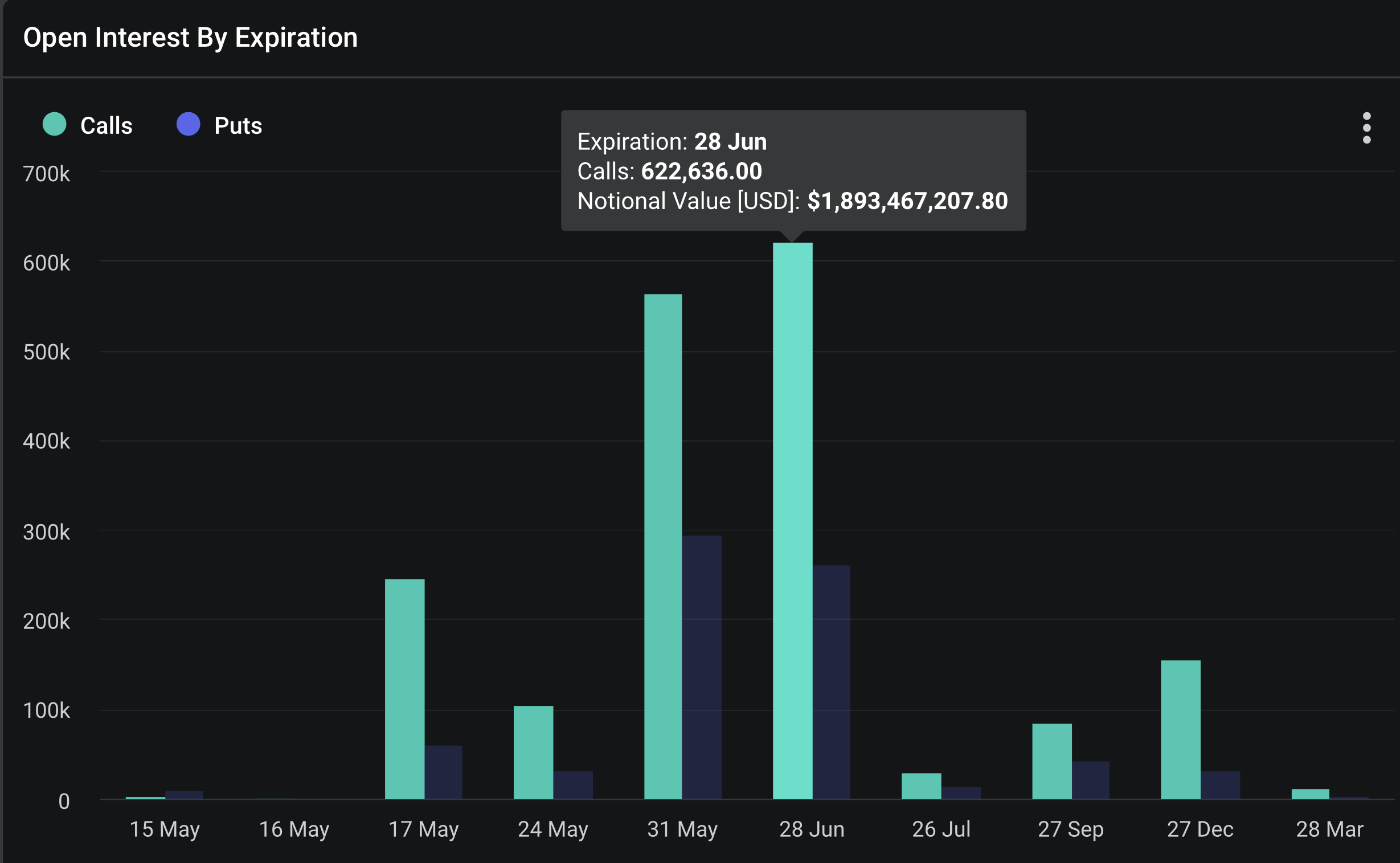

As a crypto investor, I’m keeping a close eye on Deribit data which indicates that around 622,636 Ethereum call contracts are due to expire by the end of June. With a total notional value exceeding $1.8 billion, this significant positioning underscores the market’s collective belief in Ethereum’s potential price increase.

The data reveals that the largest open positions are centered around the $6,500 strike price, amounting to a notional value of approximately $193 million.

The level of focus on Ethereum by traders indicates their bullish outlook, boosting the cryptocurrency’s market value. Significantly, this optimism is amplified when options contract holders choose to exercise their rights as Ethereum’s price nears or exceeds predefined thresholds (strike levels).

I, as an analyst, recognize that Ethereum is presently experiencing a mild setback. Over the past week, its value has dipped by 5.4%, and within the last day, it has decreased by 2.2%, causing its price to fall below $2,900. This downward trend intensifies the importance of forthcoming market factors that could drastically impact Ethereum’s cost.

Regulatory Decisions And Technical Indicators: A Dual Influence on ETH’s Path

A notable development coming up is the SEC’s verdict on various proposals for Ethereum-based ETFs, anticipated by May 25th.

A crucial choice lies before us: granting approval may trigger a surge of institutional investments towards Ethereum, significantly increasing its value. Alternatively, a refusal could weaken the optimistic outlook and possibly instigate additional price declines.

As a crypto investor keeping a close eye on technical analysis, I’m noticing some promising signs that Ethereum might be gearing up for a rebound. One such indicator is the “Bullish Cypher Pattern,” as identified by the respected analyst Titan Of Crypto. Right now, Ethereum finds itself at the important 38.2% Fibonacci retracement level – a significant support zone in numerous bull markets throughout history.

As an analyst, I’ve observed historically that this level has served as a catalyst for Ethereum’s price to surge higher, implying a potential substantial increase in its value.

#Altcoins #Ethereum Bounce incoming.

In a bull market, the Bullish Cryptocurrency Pattern unfolded flawlessly, hitting every predicted target. At present, Ethereum is located at the 38.2% Fibonacci retracement level, also referred to as the “first stop” in such a market.

I expect a bounce from this level.

— Titan of Crypto (@Washigorira) May 12, 2024

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-05-14 21:05