As a researcher with extensive experience in the blockchain and cryptocurrency space, I find the growth of Layer 1 (L1) blockchain Aptos during Q1 of the year quite intriguing. The network’s impressive surge in key metrics, such as circulating market cap, revenue, and network activity, is a clear indication of its potential and growing investor interest.

Based on Messari’s findings, Layer 1 blockchain Aptos witnessed significant advancements in essential metrics during the initial three months (Q1) of the year. This progression was primarily fueled by Bitcoin‘s price surge to unprecedented peaks and heightened investment in the sector.

As a researcher studying the cryptocurrency market, I’ve observed that Aptos’ native token, APT, hasn’t performed as well in terms of price growth when compared to other leading digital currencies.

Aptos Network Activity Surges

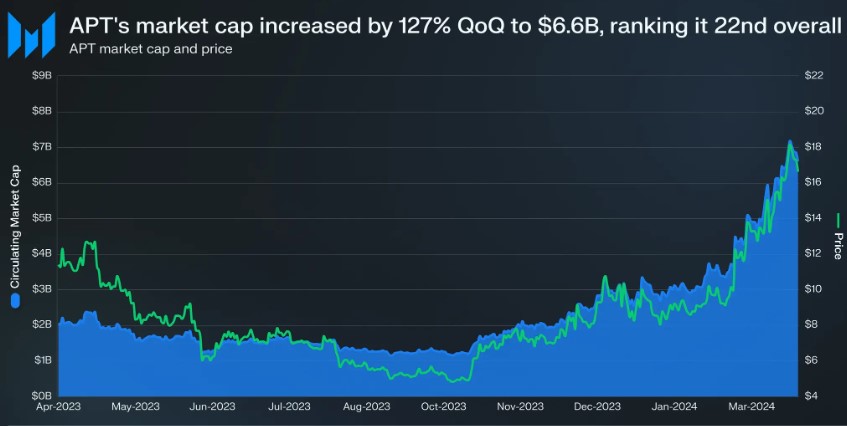

The report brought to light the significant growth of Aptos’ market capitalization, which surged by 127% between quarters and reached a value of $6.6 billion.

As a successful crypto investor, I’ve observed that among projects with comparable market values, none have surpassed the remarkable growth of APT quite like it did. Consequently, its market cap ranking has climbed from the 33rd spot to a more prestigious 22nd place. Surprisingly enough, despite this impressive progression, the price of APT only saw a more subdued rise of 76% during the last quarter.

The total earnings from Aptos, comprised of all collected fees, increased by 37% to reach $475,000 in US dollars. Conversely, when expressed in terms of APT, the revenue amounted to fewer tokens, representing a 10% decrease. Despite the burned tokens generated from Aptos revenue, inflation has not seen significant reduction as a result.

The annualized rate of APT inflation initiated at 7%, and it is planned to decrease by 1.5% every year until it reaches a level of 3.5%. By mid-October, the inflation rate had dropped slightly below 6.9%. Furthermore, there was added pressure on inflation due to the distribution of the genesis supply, with approximately 31% having been released by the end of Q1.

In the first quarter, Aptos observed a notable surge in networking activity. The number of daily transactions and active addresses experienced impressive jumps, recording a 66% and 97% quarter-over-quarter growth rate respectively.

As an analyst examining the data, I’ve observed a significant decrease in average transaction fees, which went from 0.0011 APT ($0.014) quarter over quarter to 0.0006 APT ($0.007). Simultaneously, there was a substantial growth in daily new addresses, with an increase of around 91% QoQ to approximately 44,000. Additionally, the weighted average one-month retention rate experienced a considerable uptick of 82% QoQ, reaching 14%.

APT Staked Tokens Decrease 5%

With respect to APT staking, there was a 5% decrease in the amount staked, bringing it down to approximately 861 million tokens. In contrast, when calculated in US Dollars, the market capitalization of staked APT experienced a substantial 68% increase quarter-over-quarter and exceeded fourteen billion dollars.

The chart demonstrates that Aptos witnessed significant expansion in its Decentralized Finance (DeFi) sector, as indicated by a substantial quarter-over-quarter surge of 376% in Total Value Locked (TVL), reaching a noteworthy sum of $573 million.

Based on Messari’s analysis, the price appreciation of APT wasn’t the sole cause of this rise. Instead, Total Value Locked (TVL) in APT terms surged by 170% quarter over quarter. Furthermore, Aptos’s stablecoin market capitalization almost doubled as well, hitting a value of $97 million during the same period.

APT Struggles To Break $8.80 Resistance

Although there have been favorable advancements, the value of APT‘s token has encountered difficulties. Over the past month, it has dropped by more than 16%, leading to a modest 2.7% growth in value since the beginning of the year. In contrast, other prominent cryptocurrencies have achieved significant increases of twenty or thirty percent.

At its current price of $8.46, APT has encountered difficulty breaking through its closest price barrier at $8.80, resulting in a period of price stabilization between $8.20 and $8.70 during the last month.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-05-14 01:34