As a researcher with a background in cryptocurrency and blockchain technology, I find the recent decline in Bitcoin mining difficulty to be a positive development for the industry. The combination of lower Bitcoin prices and increasing equipment costs since the last halving has put pressure on high-cost mining rigs, leading to closure and a decrease in overall hashrate.

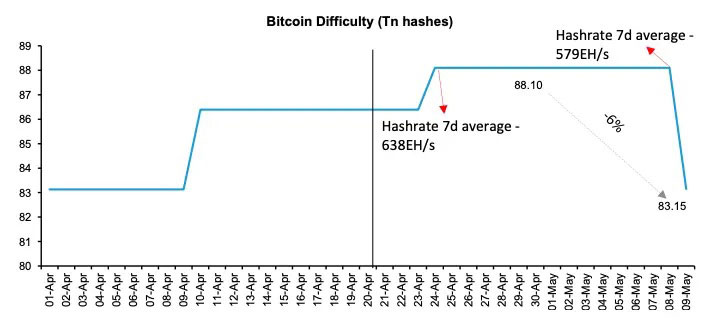

As a researcher studying the Bitcoin market, I’ve noticed that miners have recently experienced some much-needed relief due to a significant decrease in mining complexity. This measure, which quantifies the computational effort required to validate transactions and generate new coins, dropped by approximately 6% – marking the largest decline since late 2022. In my opinion, this reduction in mining complexity is a welcome development for Bitcoin miners as it allows them to maintain their profitability amidst increasing competition and rising operational costs.

Photo: Bernstein

Bernstein’s report reveals that the decrease in Bitcoin’s mining difficulty is attributable to two primary factors: a drop in Bitcoin prices and escalating costs for mining equipment since May 2020’s halving. The financial strain brought about by these pressures compelled the shutdown of high-cost mining rigs, subsequently reducing the network’s hashrate – the collective processing power ensuring Bitcoin’s security.

Bitcoin Mining’s Strategic Advantage

As a researcher studying the Bitcoin mining industry, I have discovered that Riot Platforms (RIOT) and CleanSpark (CLSK) stand out as the leading miners with the lowest production costs. Their financial strength, evident in robust balance sheets and substantial cash reserves, empowers them to navigate market volatility more efficiently than their competitors.

The Bernstein report points out that a brief interruption in Bitcoin’s price is beneficial for existing lower-cost miners. During this period, hashrates stay stable, enabling larger miners to push forward with their substantial investment plans in both capital expenditures (capex) and mergers and acquisitions (M&A), thereby increasing their market presence as competitors face challenges.

As a crypto investor, I can tell you that the report underscores the significant opportunity for miners to profit from a potential increase in Bitcoin’s price. To put it simply, when the price of Bitcoin starts to rise, miners stand to earn substantial revenue due to their increased production capacity.

The Key to the Next Bull Run?

Bernstein does not foresee a significant price decrease for Bitcoin, but instead expects a phase of price stability before a possible surge. The pathway to initiating the next bull market, as per Bernstein’s perspective, hinges on heightened institutional investment. Notably, the report underscores the significance of spot exchange-traded funds (ETFs) in drawing investments from registered investment advisors (RIAs), wealth management platforms, and other institutional funds.

Bernstein believes that CleanSpark and Riot Platforms will outshine the market, resulting in better-than-average performance. On the other hand, Marathon Digital is predicted to align with the market trend and perform on par.

Photo: TradingView

Based on TradingView’s data, the current price of Bitcoin is at $62,980, representing a modest 0.42% increase over the past day. However, this is a 6.26% decrease from its price one month ago. Notably, Bitcoin has breached the significant support threshold of $61,000, potentially leading it to reach $65,000 if it continues to trend upward.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- Green County secret bunker location – DayZ

- The Righteous Gemstones Season 4: What Happens Kelvin & Keefe in the Finale?

2024-05-13 20:24