As a researcher with a background in blockchain technology and financial markets, I have closely followed the Bitcoin market for several years. The latest correction, which saw Bitcoin drop over 20% from its all-time high, has understandably raised concerns among investors. However, based on my analysis of the current market conditions and trends, I remain bullish on Bitcoin’s long-term outlook.

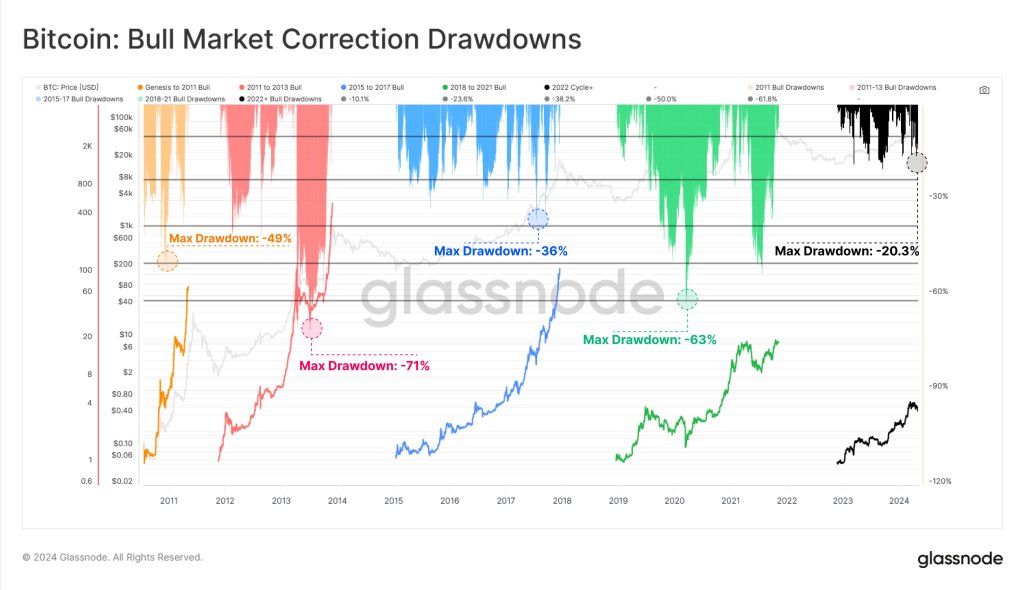

Bitcoin experienced a significant downturn following the FTX crash in November 2022, marking its most substantial correction since then. The cryptocurrency plunged more than 20% from its peak price of approximately $74,000. Nevertheless, Glassnode analysts, while discussing their insights on X, maintain a guarded sense of optimism.

Bitcoin Drops 20% From March High, But Glassnode Is Bullish

According to Glassnode’s analysis, Bitcoin’s long-term upward trend remains strong despite occasional corrections, which have not resulted in significant price drops. This assessment indicates an enhancement in the cryptocurrency’s market condition, as liquidity increases and volatility decreases.

After hitting record highs in March 2023, Bitcoin has faced challenges in continuing its upward trend. At the moment, Bitcoin has a solid support level at approximately $60,000. However, it’s essential to keep an eye on the resistance level around $56,500 if the price takes a downturn. Conversely, should prices rebound and surpass $66,000, Bitcoin could experience a significant rally, potentially reaching heights of $72,000 or even beyond to $74,000.

To put it simply, while fundamental factors are the key drivers for bulls to find footing and prices to surge, price structures may provide temporary support. However, it’s important to note that significant price movements have historically been triggered by external market events.

According to Glassnode’s analysis, the strong overall trend favoring Bitcoin is currently marked by decreased market volatility. This stability contributes to the continued uptrend. Furthermore, shallow corrective phases, as identified by Glassnode, signal a maturing market that attracts more institutional investors.

Whales Accumulating As Institutions Eye BTC

As a data analyst, I’ve observed that my confidence in the current market trend remains unshaken. Based on on-chain data, it appears that one significant investor, referred to as a “whale,” has seized this opportunity presented by relatively low prices and recent corrections to accumulate more coins for their holdings.

Over the past week, I’ve observed a significant purchase by a prominent crypto investor, or “whale,” of over 100 Bitcoins. With this latest acquisition, their total Bitcoin buying in the current month has exceeded 7,257 coins. This bold accumulation indicates that even at these multi-year high prices, I believe Bitcoin could still be underestimated by the market.

As a cryptocurrency analyst, I’d like to share my perspective: The Bitcoin market could experience further positive momentum. For example, this week brought news that former US President Donald Trump is now accepting cryptocurrency donations for his campaign. Previously, Trump had been dismissive of Bitcoin. This shift in stance has generated bullish sentiment among investors.

European regulatory bodies seem receptive to the idea of allowing Bitcoin investment within Undertakings for Collective Investment in Transferable Securities (UCITS) funds. Should this approval materialize, it would potentially result in additional billions of Euros flowing into Bitcoin from European institutions.

Such a step holds significant weight given that major banking institutions like Morgan Stanley and BNP Paribas have begun investigating possibilities for their clients to invest in Bitcoin.

Related Reading: Bitcoin Short Term NUPL Value Turns Negative, What This Means For Price

At a broad perspective, the increasing M2 money supply in the United States, causing apprehension among the Federal Reserve over high inflation, could potentially boost Bitcoin’s appeal. Bitcoin functions as a safe-haven asset and a hedge against inflation due to its inherently deflationary design, similar to gold.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-05-11 04:16