As a researcher with a background in blockchain technology and decentralized finance (DeFi), I find the ongoing development at EigenLayer, particularly the launch of their new token EIGEN, to be an intriguing and complex topic. The project has garnered significant attention for its innovative approach to DeFi through restaking, which allows users to deposit Ethereum (ETH) to help operate the network and earn higher rewards.

As a dedicated researcher delving into the dynamic realm of cryptocurrencies, I’m thrilled to share that the crypto community is buzzing with excitement over the recent launch of EigenLayer’s innovative new token, EIGEN. This highly anticipated digital asset has swiftly made headlines and generated significant buzz within the industry this year.

Based on Bloomberg’s report, the initiative has garnered considerable interest due to its innovative take on decentralized finance (DeFi), as well as its contentious move to bar users from specific regions such as the US, China, and Canada, from obtaining tokens during the distribution.

EigenLayer Challenges And Opportunities in Token Distribution

In Seattle-based DeFi protocol EigenLayer’s innovative approach, they present the idea of “staking Ethereum anew.” By depositing ETH, users contribute to managing the Ethereum network and in turn, can earn enhanced rewards.

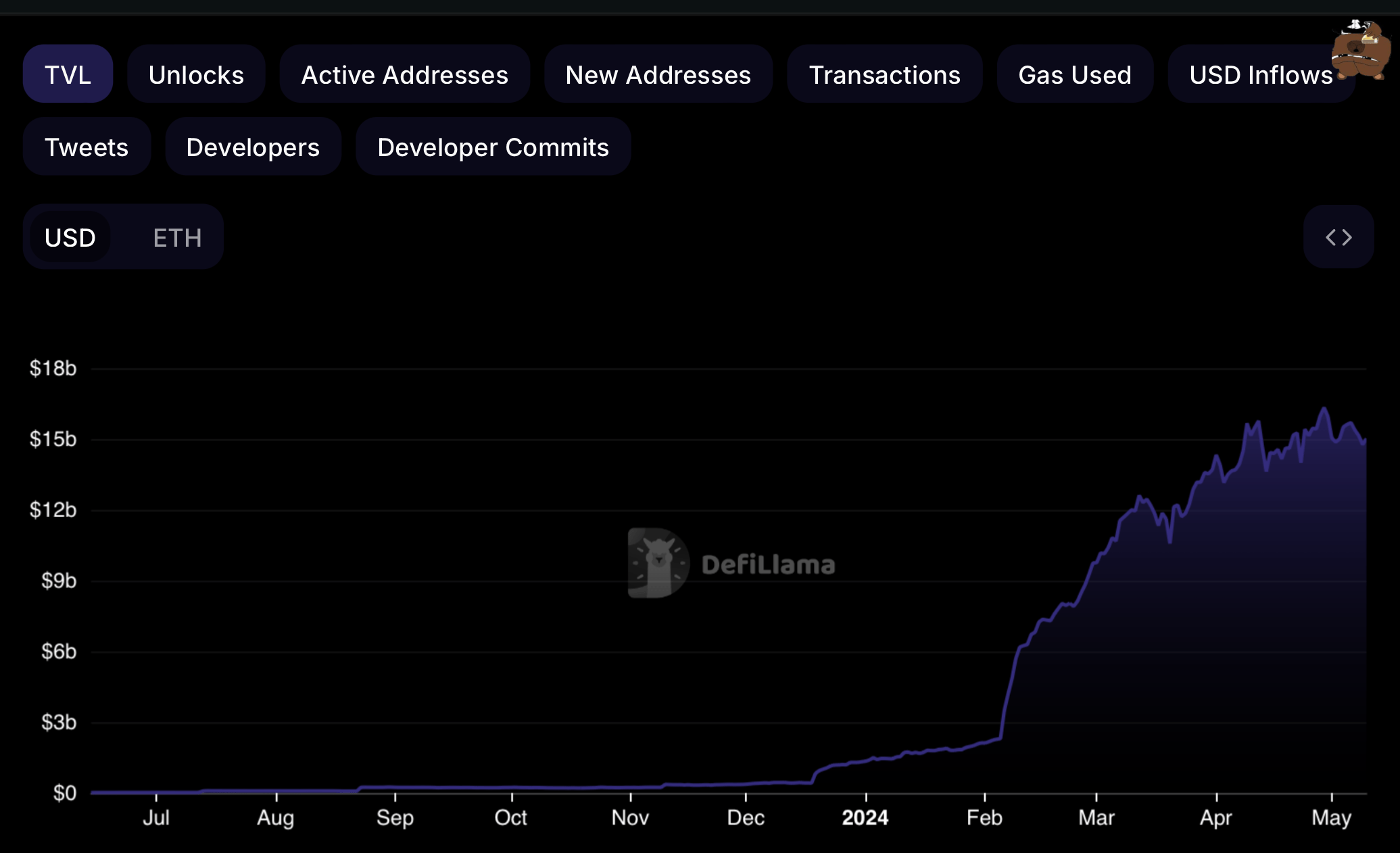

As a data analyst, I’ve examined the figures from DeFiLlama and found that since its launch in 2023, EigenLayer has amassed more than $15 billion in assets under management. This substantial growth underscores the burgeoning appeal and potential of this innovative approach.

As a crypto investor, I’m excited about the upcoming launch of the EIGEN token. The distribution of these tokens will kick off with an airdrop, which is essentially a method of dispersing tokens to individuals based on specific conditions. One such condition is a points system that recognizes and rewards early adopters for their commitment to the project.

Kunal Goel, an analyst at Messari, pointed out that the upcoming airdrop served as a significant motivation for users to deposit funds into EigenLayer’s platform.

As a crypto investor, I’ve noticed that there’s been a lot of buzz and anticipation surrounding this new token distribution event. However, my enthusiasm has been dampened by the realization that some individuals who amassed points during the event are now unable to claim their tokens. This is due to the fact that they used Virtual Private Networks (VPNs) or reside in countries that have been excluded from participating in this token distribution.

As a crypto investor, I understand that Robert Drost, from the Eigen Foundation, made it clear that excluding certain assets was essential for us to comply with complex and sometimes ambiguous regulatory requirements.

As a crypto investor, I understand that adhering to regulatory guidelines and exercising responsibility are essential components of navigating this complex and evolving market. However, the difficulty lies in the fact that the regulatory landscape is often unclear and subject to change.

This sentiment was echoed by Nick Cote, co-founder of Secondlane, who noted:

It’s disappointing when issuers fail to disclose jurisdictional limitations upfront, only to discover later that you’re ineligible for rewards due to reasons X, Y, or Z.

Impact On The Broader DeFi Ecosystem

The restaking service offered by EigenLayer marks a significant change in the Ethereum network, enabling applications to harness the vast pool of transaction validators more effectively.

As an analyst, I would describe it this way: By utilizing this service, I can boost my Ethereum (ETH) staking returns beyond the standard 3% rate. However, it’s important to note that these enhanced yields come with added risks.

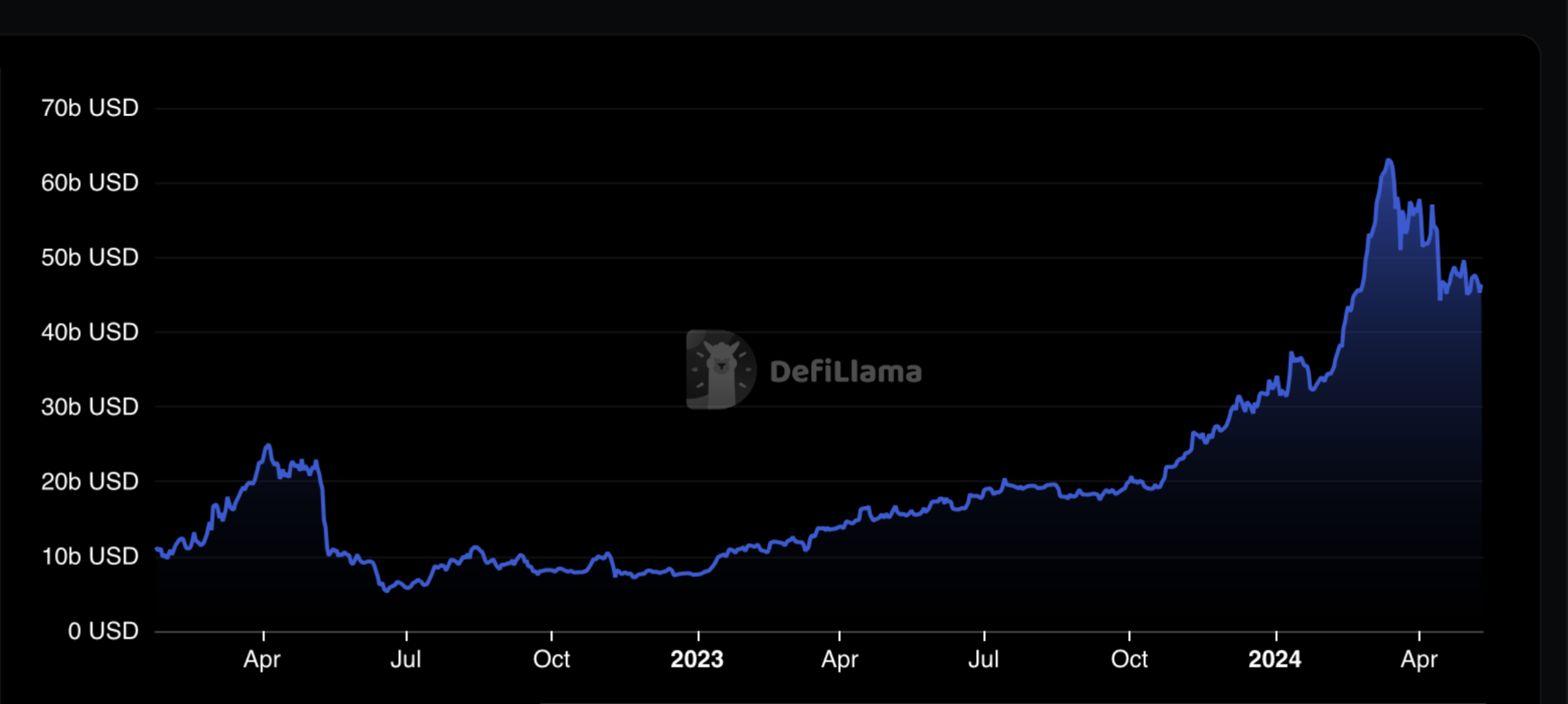

I’ve analyzed the latest developments in the Decentralized Finance (DeFi) sector, and my findings reveal that EigenLayer has experienced remarkable growth, positioning itself as the “second most popular DeFi application,” according to a Bloomberg report. This rise in popularity comes at the cost of liquid staking protocols such as Lido and Rocket Pool, which have witnessed substantial outflows over the past few months.

Based on DeFiLlama’s data, the total value locked in liquid staking protocols has dropped by over 20% from their peak of over $63 billion reached in March.

As a crypto investor, I’ve noticed an intriguing development in the Ethereum (ETH) ecosystem. According to a recent analysis from IntoTheblock, approximately 4% of all ETH is now being staked using EigenLayer. This data underscores the burgeoning popularity of this project.

EigenLayer recently surpassed $15B in TVL.

As a researcher studying the Ethereum ecosystem, I’ve discovered that approximately 4% of all Ether (ETH) and an impressive 40% of liquid staking token (LSTs) supply are currently being re-staked with EigenLayer.

— IntoTheBlock (@intotheblock) April 26, 2024

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-05-11 02:10