As a long-term crypto investor with experience in holding Ethereum (ETH), I’m concerned about the recent selling pressure on the second-largest cryptocurrency. The continuous downturns have kept Ethereum just above the $3,000 support level, and new holders face the risk of experiencing losses.

As a researcher studying the cryptocurrency market, I’ve noticed that Ethereum (ETH), the world’s second-largest digital asset, has been experiencing persistent selling pressure. The price of Ethereum hovers slightly above the significant support level of $3,000. In contrast to Bitcoin, Ethereum has underperformed in recent times, meaning it hasn’t performed as well in terms of price growth. New investors holding ETH face a potential risk of incurring losses.

According to the cryptocurrency analysis firm Glassnode, Ethereum speculators have been instrumental in keeping the altcoin’s price near $3,000. The month of April experienced a significant downturn for both Bitcoin and Ethereum, marking their largest monthly price decrease since the FTX incident in April 2022. Glassnode further stated:

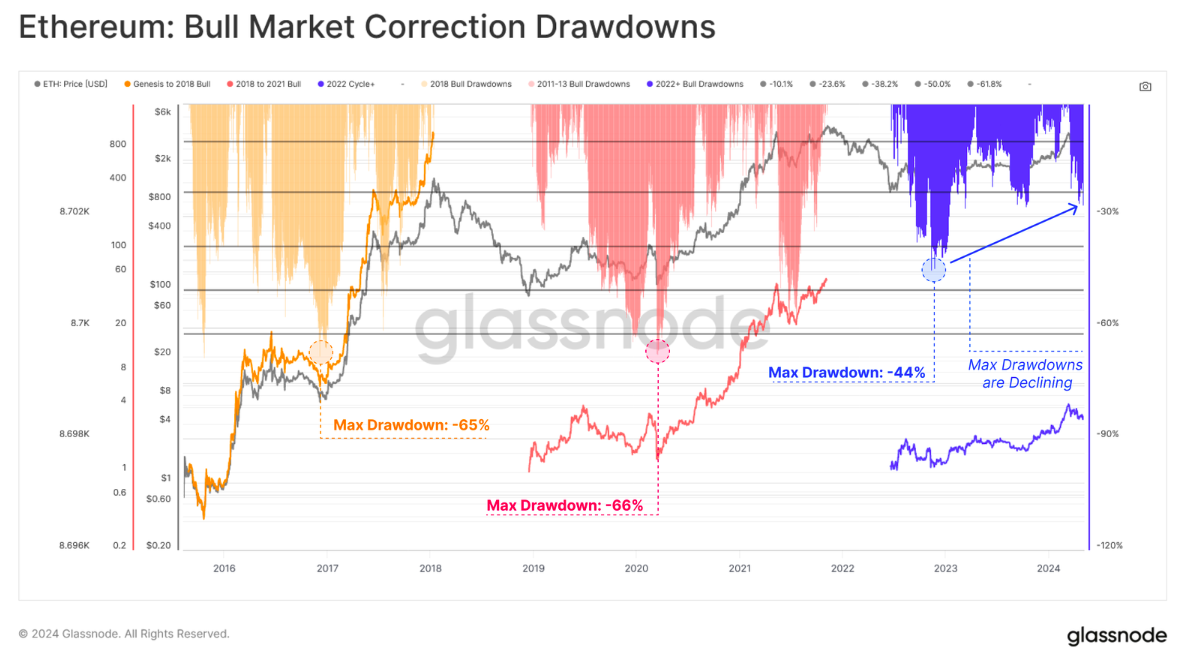

It’s important to acknowledge that Ethereum has experienced its most pronounced decline during the current market cycle, reaching a staggering -44%. In contrast, Bitcoin’s deepest drawdown came in at -21%. This discrepancy underscores Ethereum’s relatively poor performance over the past two years, which is further reflected in a weaker ETH-to-BTC exchange ratio.

- Courtesy: Glassnode

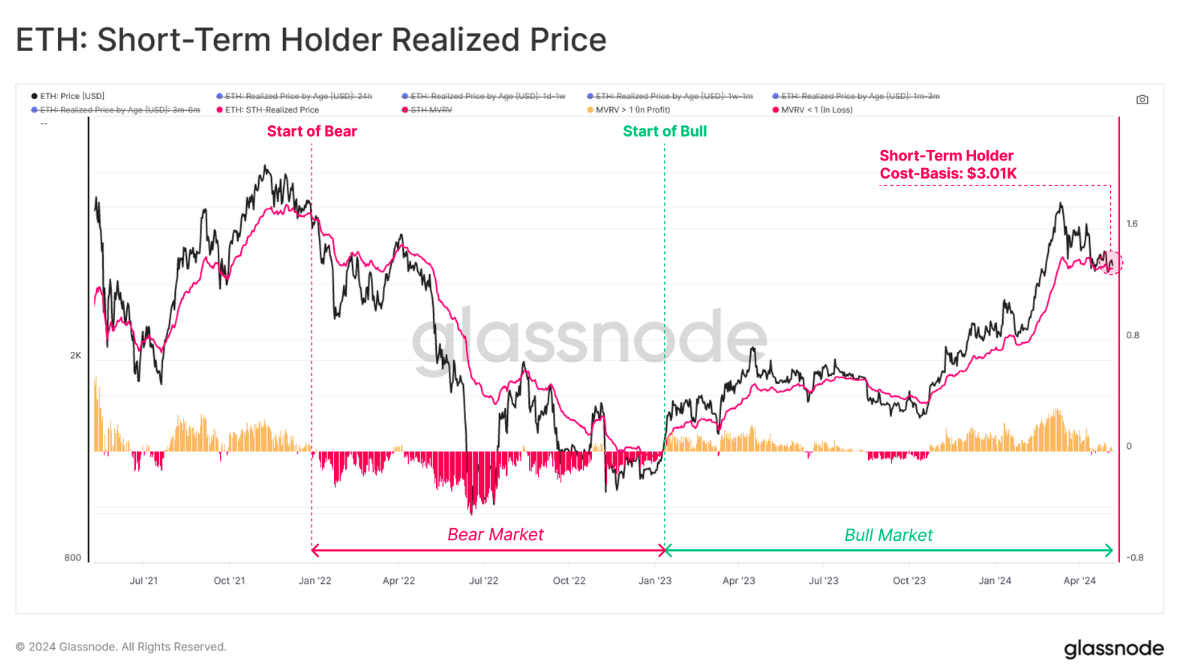

With the easing of Ethereum (ETH) price declines, some investors are now confronted with potential losses on their holdings. Specifically, short-term investors, who own Ethereum for 155 days or fewer, collectively have a cost basis of around $3,000.

As an analyst, I’ve been monitoring Ethereum’s market metrics closely. One particular metric that stands out is the Market Value to Realized Value Ratio (MVRV). Currently, this ratio indicates that a fresh market drop could potentially trigger heightened anxiety among Ethereum holders. In simpler terms, if Ethereum’s price declines significantly, it might cause panic selling due to holders realizing losses on their investments. This is a warning based on the current market conditions.

The current price spread between Ethereum’s STH-MVRV is only slightly higher than the market value. This might indicate that the current market price is quite near the purchase cost for recent investors. A market downturn could potentially cause these buyers to panic sell.

Currently, long-term investors (LThs) appear hesitant to sell in large quantities despite having earned substantial profits, as they remain uncertain about the market conditions.

Dencun Upgrade Is Making Ethereum Inflationary Again

Expert response:

Based on my analysis as a CryptoQuant expert, I’ve noticed that the daily growth rate of ETH‘s supply has significantly increased since the Merge event. Prior to the Dencun upgrade, Ethereum’s higher network activity led to more fees being burned, resulting in less ETH being supplied. However, post-Dencun upgrade, the amount of fees burned has become decoupled from network activity. In simpler terms, fewer ETH tokens were previously being created due to the burning of transaction fees, but now, this relationship no longer holds true.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Etheria Restart Codes (May 2025)

- Is There a MobLand Episode 11 Release Date & Time?

2024-05-10 16:27