As an experienced analyst, I believe that the recent transfer of 1,000 ETH ($3 million) by the Ethereum Foundation to a multi-signature wallet is a cause for concern in the crypto community. The Foundation’s history of selling large quantities of ETH prior to market downturns has left many wondering if another sell-off could be imminent and if this could signal the market top.

The Ethereum Foundation, a non-profit entity backing Ethereum’s infrastructure, recently moved a substantial quantity of Ether. This development has piqued interest within the cryptocurrency sphere, fueling discussions about potential market peaks.

Ethereum Foundation Moves 1,000 ETH

As an on-chain analyst, I’ve come across some intriguing news. The Ethereum Foundation recently moved 1,000 ETH, equivalent to approximately $3 million, into a multisignature wallet with the address 0xbc9, according to the latest update from on-chain analytics platform SpotOnChain, shared via their X (previously Twitter) account on May 8. This transaction raises some concerns given that the Ethereum Foundation has made other transactions since the beginning of this year.

As a researcher studying Ethereum transactions, I’ve uncovered some intriguing data from the platform. The Ethereum Foundation reportedly sold 1,766 Ether for approximately 4.81 million DAI, with an average price of around $2,725 per ETH. These sales took place in multiple small batches using the same multi-signature wallet. Notably, according to SpotOnChain’s analysis, these transactions have historically preceded price declines.

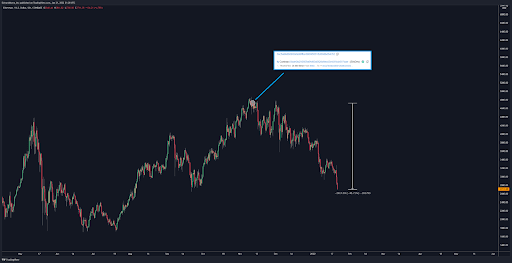

Noting the Ethereum Foundation’s past history, it’s important to point out that they have been criticized for selling Ethereum (ETH) at market peaks. This raises questions about whether their pre-drop sales were merely coincidental. In 2022, NewsBTC disclosed that following the Foundation’s sale of 20,000 ETH, Ethereum underwent a significant 40% price decline. Likewise, in the year prior, ETH experienced a prolonged downtrend after the organization sold off approximately 35,000 ETH.

Colin Wu, a journalist, disclosed previously that Vitalik Buterin, Ethereum’s founder, had successfully convinced the Ethereum Foundation to sell approximately 70,000 Ether at the peak of 2018 to finance developers’ work. This sale, as per Wu, was a routine procedure, but it also indicated that the Foundation believed a market downturn or bear market was imminent.

Based on Wu’s disclosure, it seems reasonable to infer that the Ethereum Foundation may possess insight into the market peak, leading them to consistently sell ETH prior to substantial price drops.

An ETH Decline May Already Be On The Horizon

An expert crypto analyst, recognized as Shin Forex, has forecasted that Ethereum might plunge down to a minimum of $2,500 in the near future. According to his analysis, there’s been a noticeable decline in funds moving into the Ethereum marketplace. This trend could impact Ethereum’s value negatively, as it indicates decreased investor enthusiasm towards the token.

Based on technical analysis, Shin Forex announced that the Ethereum-Bitcoin pair (ETH/BTC) has breached its prior support level of 0.05. Historically, Ethereum has suffered substantial declines when this occurred in market trends during 2016 and 2019. Consequently, the analyst anticipates that ETH will likely continue to plunge, potentially reaching a low of $2,500.

Currently, Ethereum is priced at approximately $3,000 based on information from CoinMarketCap.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-05-10 13:16