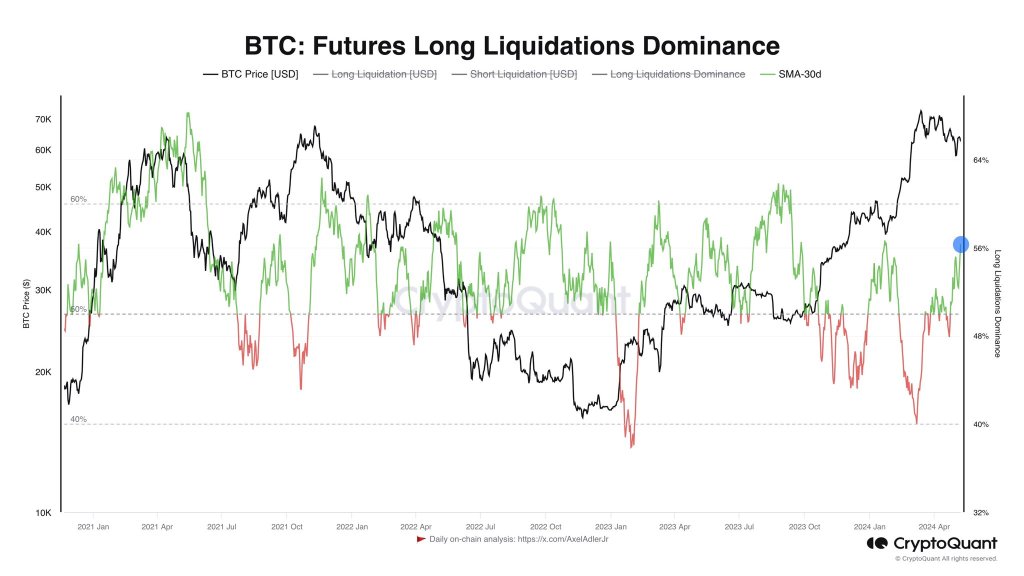

As a researcher with experience in cryptocurrency markets, I find the current Bitcoin trend intriguing. The recent price decline following the unsuccessful attempt to break above $66,000 has left many traders feeling uncertain about the future direction of BTC. However, a closer look at on-chain data, as shared by one analyst using CryptoQuant, offers a more nuanced perspective.

Bitcoin‘s price has been declining since it couldn’t surpass the $66,000 mark in early May, dampening expectations of quick price increases following the Halving event. An analyst on platform X provided intriguing on-chain data that presents a more complex perspective than just a recent loss of investor confidence.

Bitcoin Open Interest Remains Low: Bullish?

I, as an analyst, notice an intriguing trend based on CryptoQuant data. It seems that traders utilizing leveraged positions on perpetual trading platforms such as Binance are more inclined to close their existing positions than initiating new ones. This situation is indicated by a monthly change in Open Interest reading of -20%.

As a crypto investor at this point, I notice an increasing trend of traders closing their positions rather than opening new ones. This pattern implies that the majority of traders are adopting a cautious approach, preferring to watch the price action unfold before making any moves.

Although the number of Bitcoin job openings has reduced, it’s crucial to understand that this doesn’t necessarily mean BTC is in decline or that an anticipated price surge is invalidated. Instead, some analysts view this trend as a tactical maneuver by traders, who remain cautiously optimistic and are not selling off due to pessimistic outlooks.

In a different post, the analyst expressed that the Bitcoin market benefits from the ongoing sell-off and pessimism to amass short positions. Short positions established at current prices predict that Bitcoin’s price will keep declining, potentially dropping below $56,500.

As a researcher studying financial markets, I’ve observed that an increase in the number of short positions can lead to a potential “short squeeze.” In such circumstances, the price of the security suddenly surges due to a mass buying frenzy from shorts looking to cover their positions and avoid greater losses. This results in a significant price increase, which can be quite dramatic and potentially profitable for long position holders.

BTC Inside A Trade Range: Will $60,000 Fail?

Although the cryptic indications from on-chain information suggest possible gains, the prices continue to be constrained within a limited bandwidth. Last week, the bulls were unable to break through the $66,000 resistance mark, thus reaffirming the strong advancement witnessed since May 3.

Bitcoins encountering resistance and sliding downward towards the psychologically significant price point of $60,000. A drop beneath this threshold could potentially accelerate the decline to hit the earlier low of $56,500 reached in May.

Moving forward, traders will keep a keen eye on price developments post-Halving on April 20. Some market experts, considering the recent approval of spot Bitcoin exchange-traded funds (ETFs) and institutional investment, anticipate significant price increases right away.

Despite this situation, prices have not dropped as expected. They remain stable in the face of volatile investments in spot Exchange-Traded Funds (ETFs). Additionally, the US Federal Reserve has yet to reduce interest rates.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-05-09 22:16