As a researcher with experience in cryptocurrency analysis, I find Rekt Capital’s perspective on the potential Bitcoin peak intriguing. His historical analysis of past price trends following the Halving event aligns well with current market movements. The fact that Bitcoin has demonstrated a consolidation period and a slower cycle acceleration rate compared to previous cycles suggests that we may be in for a longer bull run.

Expert Rekt Capital has proposed a possible timeframe for Bitcoin‘s peak in this current bull market based on historical price patterns, as outlined in his analysis. By studying the present price behavior of Bitcoin in relation to past bull market peaks that occurred after the Bitcoin Halving event, Rekt Capital offers this estimation.

Bitcoin Peak On The Horizon

On May 9, Bitcoin’s price dipped under the $61,000 mark, indicating a possible downtrend. However, Rekt Capital remains unfazed by this development. He posits that the more Bitcoin hovers around its current pricing and the $70,000 threshold post-Halving, the slower the cycle will become, aligning with the historically consistent Halving pattern. Based on past trends, Rekt Capital anticipates a bull market peak for Bitcoin between September and October of next year.

I’ve observed that Bitcoin’s price action over the past two months has resulted in a decline in the rate at which the current market cycle is advancing. This cycle’s acceleration, which previously took approximately 260 days to complete, now seems to be progressing more quickly at around 210 days.

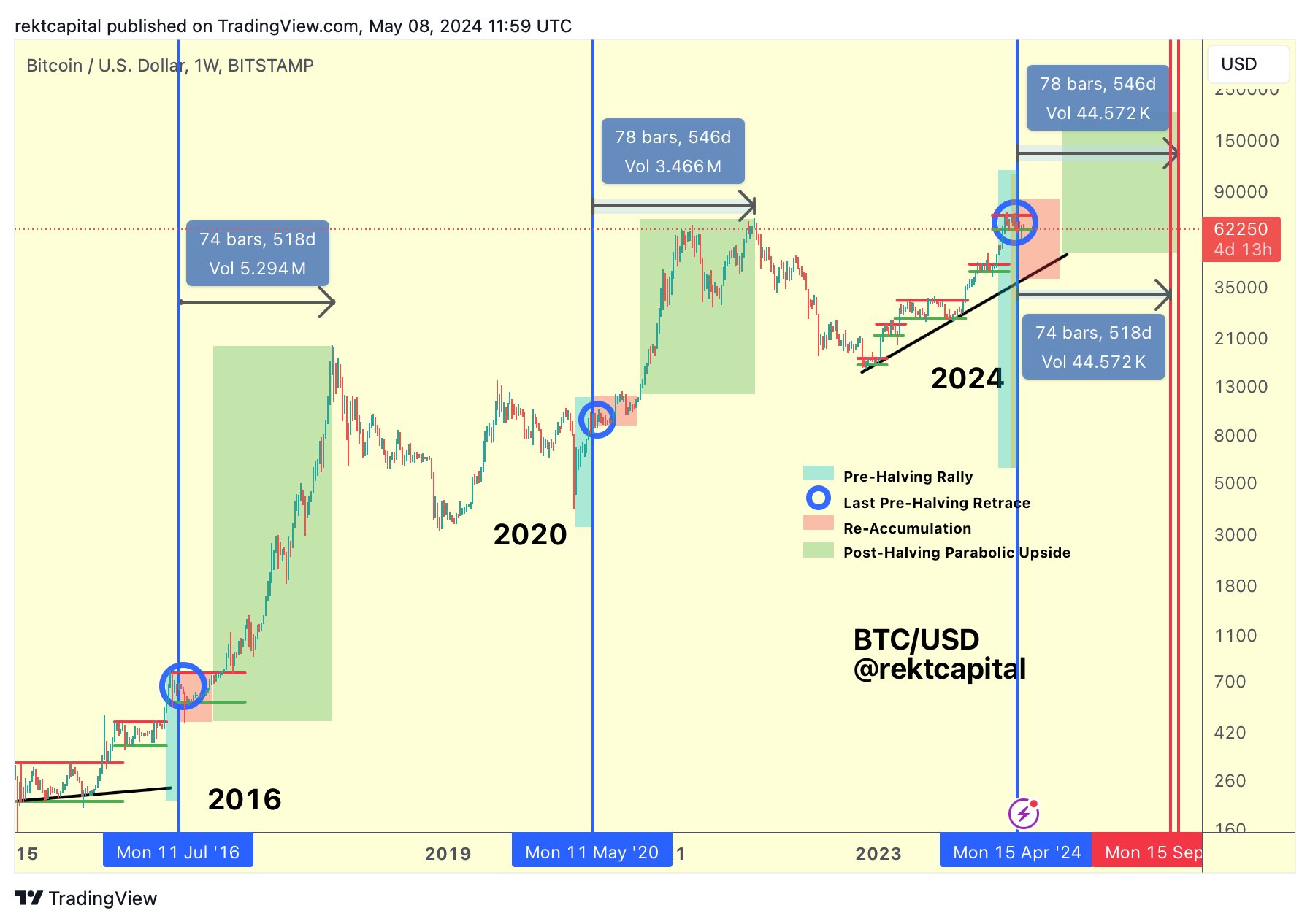

In the first Bitcoin cycle between 2015 and 2017, the cryptocurrency reached its market peak around 518 days after the halving event. Conversely, during the Bitcoin cycle from 2019 to 2021, it took roughly 546 days for the digital asset to hit its maximum value following the halving.

If BTC continues to follow these trends and the next bull market peak happens between 518 and 546 days after the Halving event, then it is likely that Bitcoin’s peak in this cycle will occur within those timeframes. The expert believes that the longer it takes for Bitcoin to stabilize following a Halving event, the stronger the alignment will be with the typical Halving cycle patterns.

Possible Retracement Before An Uptrend

The analyst believes that Bitcoin may undergo a significant correction, causing some investors to doubt the ongoing bull market. However, Rekt Capital advises against selling during this time, as the market is expected to recover and continue its upward trend. Wise investors recognize that periods of panic and accumulation frequently coincide.

At present, Bitcoin’s price has been trending downwards following a brief uptick on Wednesday. The cryptocurrency is now hovering around the $60,700 mark after failing to surpass the resistance level at $65,500 yet again.

Related Reading:

Currently, Bitcoin (BTC) is exhibiting a favorable trend on a weekly basis with a gain of more than 4%. However, on a daily timeframe, its value is decreasing by around 2.29%, causing it to trade at $60,860 as of now.

As an analyst, I’ve observed a decrease of 2.45% in trading volume and a decline of 2.20% in market capitalization over the past 24 hours.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Green County map – DayZ

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-05-09 19:16