As a seasoned crypto investor with a keen interest in Bitcoin’s fundamentals, I find Ki Young Ju’s analysis intriguing. The Hashrate/Market Cap Ratio is an insightful metric that sheds light on the potential upside for Bitcoin’s price based on network fundamentals.

The head of analytics company CryptoQuant has shared insights on how the underlying components of the Bitcoin network might justify a triple-sized market capitalization.

Bitcoin Hashrate/Market Cap Ratio Could Reveal Ceiling For Cycle

As a crypto investor, I’m always keeping an eye on the latest insights from industry experts. In his newest post on CryptoQuant, Ki Young Ju, the founder and CEO, discussed how analyzing Bitcoin’s network fundamentals could provide clues about its potential market cap growth.

BTC functions as a digital currency that relies on the proof-of-work (PoW) protocol for validation. In this setup, individuals referred to as miners engage in a competition by utilizing their computational resources to have an opportunity to append the subsequent block to the blockchain.

As a crypto investor, I understand that miners bear the ongoing expense of electricity to operate their computing equipment. To cover these costs, they typically sell the rewards they receive for validating transactions on the blockchain. The value of these rewards is fixed in Bitcoin (BTC), and they are distributed at a relatively consistent rate. However, since the worth of Bitcoin in US Dollars (USD) can fluctuate significantly, this USD value becomes the primary variable impacting miner finances.

The economy of mining industries holds significant influence over the value of cryptocurrencies, particularly Bitcoin. Miners are concerned with the Hasrate, which denotes the total computational power they have linked to the Bitcoin network.

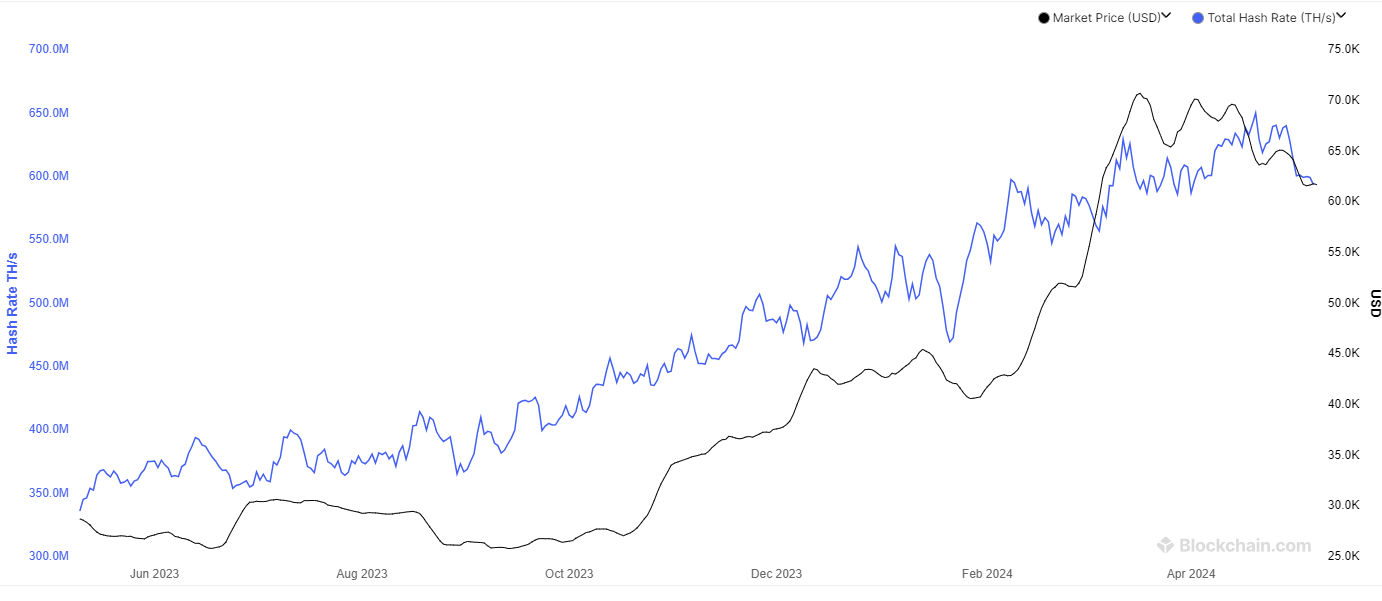

The following chart illustrates the development of the 7-day moving average for this Bitcoin metric over the past twelve months.

During this timeframe, as illustrated by the graph, the Bitcoin Hashrate has experienced a significant upward trend. This surge can primarily be attributed to the price rally that Bitcoin has undergone within this period.

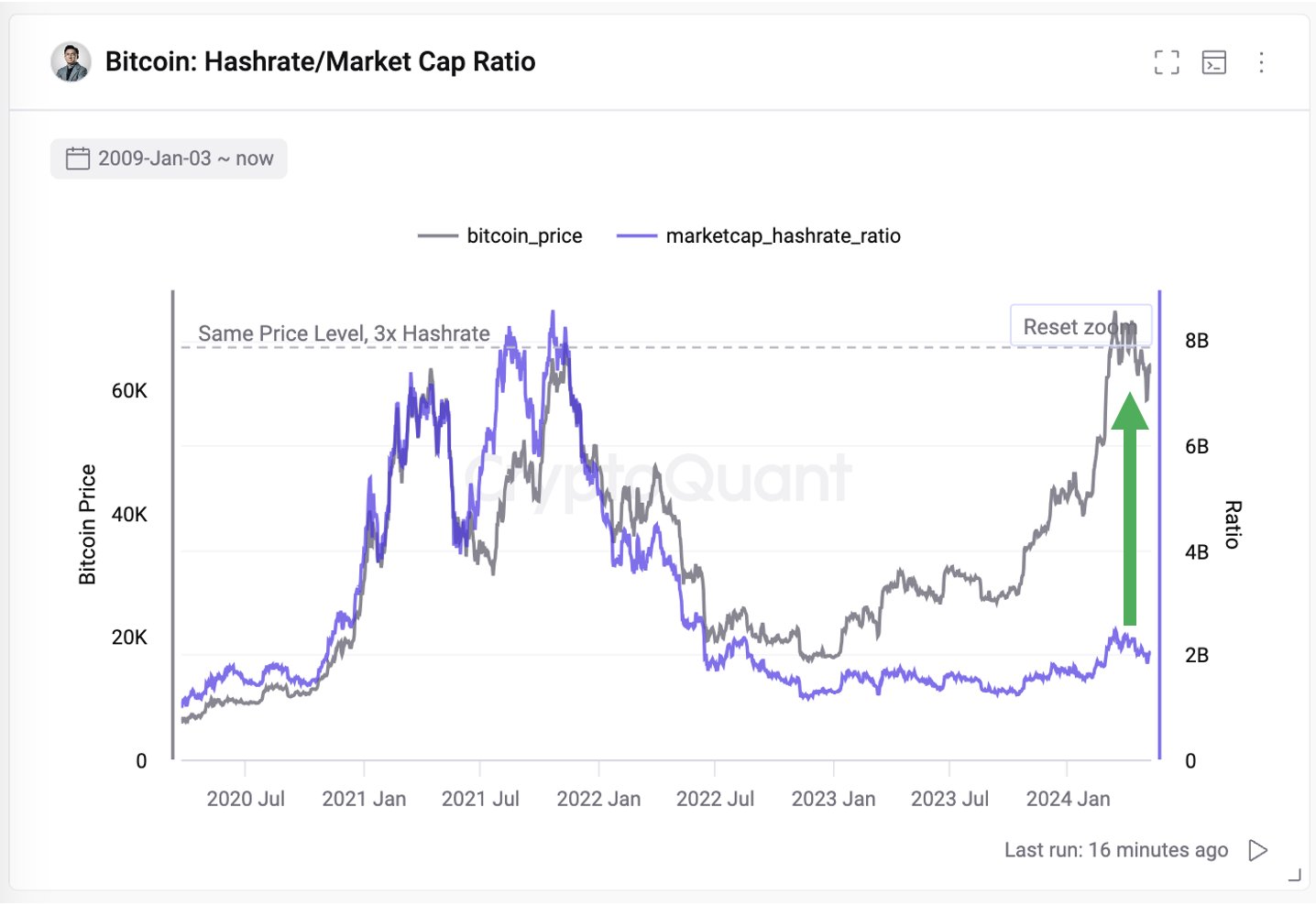

The CEO of CryptoQuant proposes using the “Hashrate-to-Market Cap Ratio” as a way to understand the connection between this essential figure and the value of a cryptocurrency asset. This ratio signifies the proportion of the digital currency’s market capitalization relative to its hashrate, providing insight into the relationship between the two.

Here is the chart shared by Ju that shows the trend in this metric over the last few years:

The graph indicates that the Bitcoin Hashrate-to-Market Cap Ratio has been relatively low, as compared to the peak levels it reached during the 2021 bull market.

Despite the asset’s price being relatively the same as before, the reason for this persistence is due to the network’s Hasrate being over three times greater than it was previously.

If the ratio is significantly higher than in the prior cycle’s peak, indicating that the cycle top will likely occur at a similar ratio this time, then it’s reasonable to expect the asset’s market capitalization could nearly triple from its present value.

As a crypto investor, based on the current network analysis I’ve conducted, I believe that the fundamental strengths could potentially support a price tag of $265,000.

BTC Price

At the time of writing, Bitcoin is trading at around $62,300, up more than 9% over the past week.

Read More

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-05-09 05:10