As a researcher with a background in financial markets and cryptocurrencies, I find the current situation in the Bitcoin market intriguing. The growing optimism among options traders, as indicated by the increasing demand for call options with ambitious strike prices, is a strong signal of their bullish outlook. This trend is further corroborated by data from exchanges like Deribit.

The cryptocurrency market is abuzz with excitement as Bitcoin options traders prepare for potential significant price increases in September, which they predict will occur.

The derivatives market is showing strong belief in Bitcoin reaching the $100,000 threshold, as indicated by a large number of traders placing wagers on this outcome.

Bitcoin Market Optimism Amidst Whale Movements

Industry analysts have identified a notable surge in Bitcoin options, indicating increasing confidence among traders. Based on data from QCP Capital, there’s been a marked change in the market for risk reversals: calls are currently more expensive than puts.

This observation by QCP Capital signifies a growing preference for anticipating potential price hikes over safeguarding against possible price drops.

As an analyst, I’ve observed a strong preference among traders for call options with striking prices set at $75,000 and $100,000 for September delivery. This preference indicates a robustly bullish outlook held by market participants.

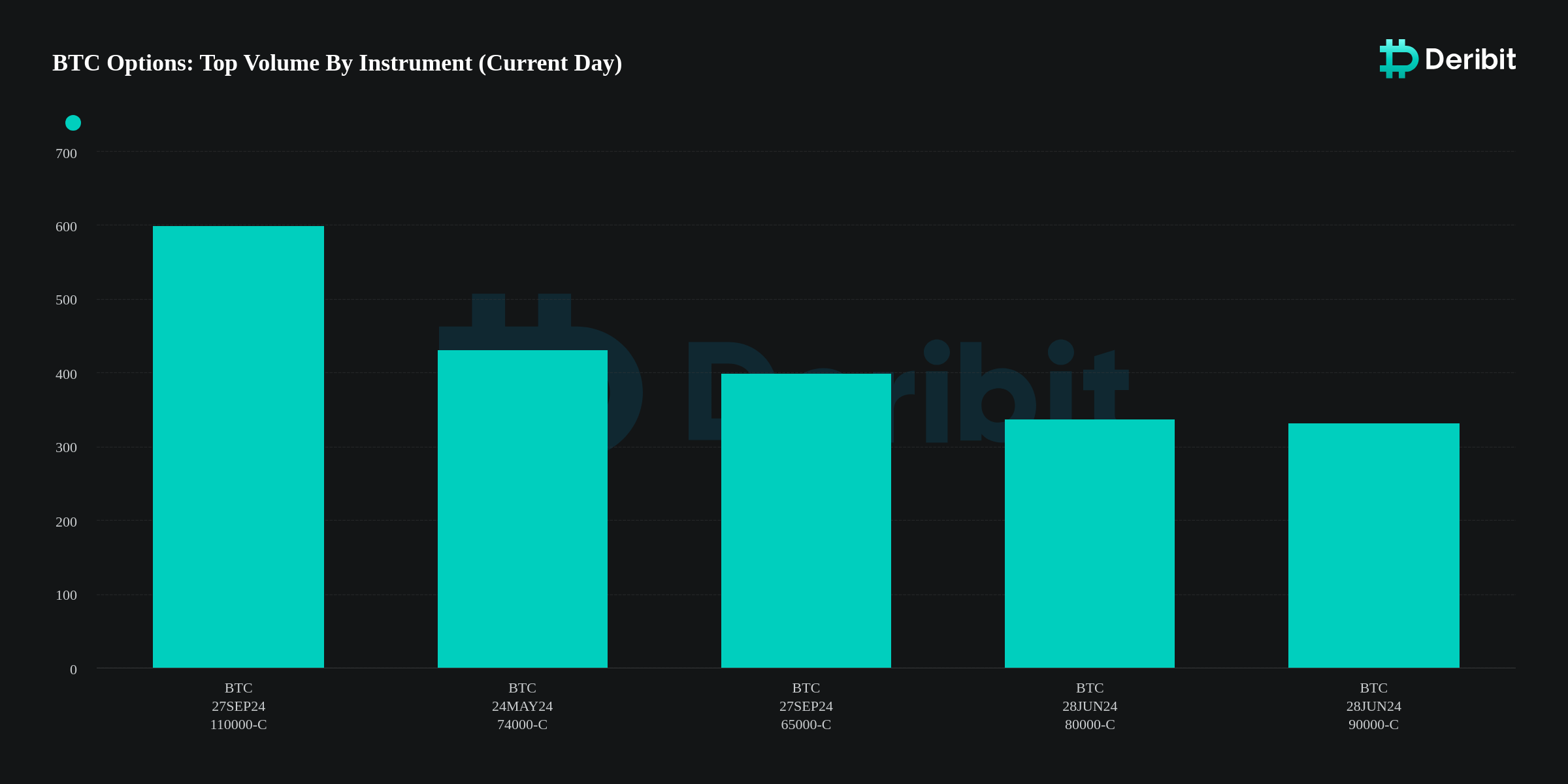

As an analyst examining the Deribit derivatives exchange data, I’ve noticed a notable trend: The call options with a strike price of $110,000 for Bitcoin, expiring at the end of September, are currently experiencing the most significant trading activity.

The vibrant activity in the bitcoin options market signifies traders’ optimistic views regarding its price growth. This suggests that numerous investors are placing wagers on a substantial increase in bitcoin’s value before the third quarter comes to an end.

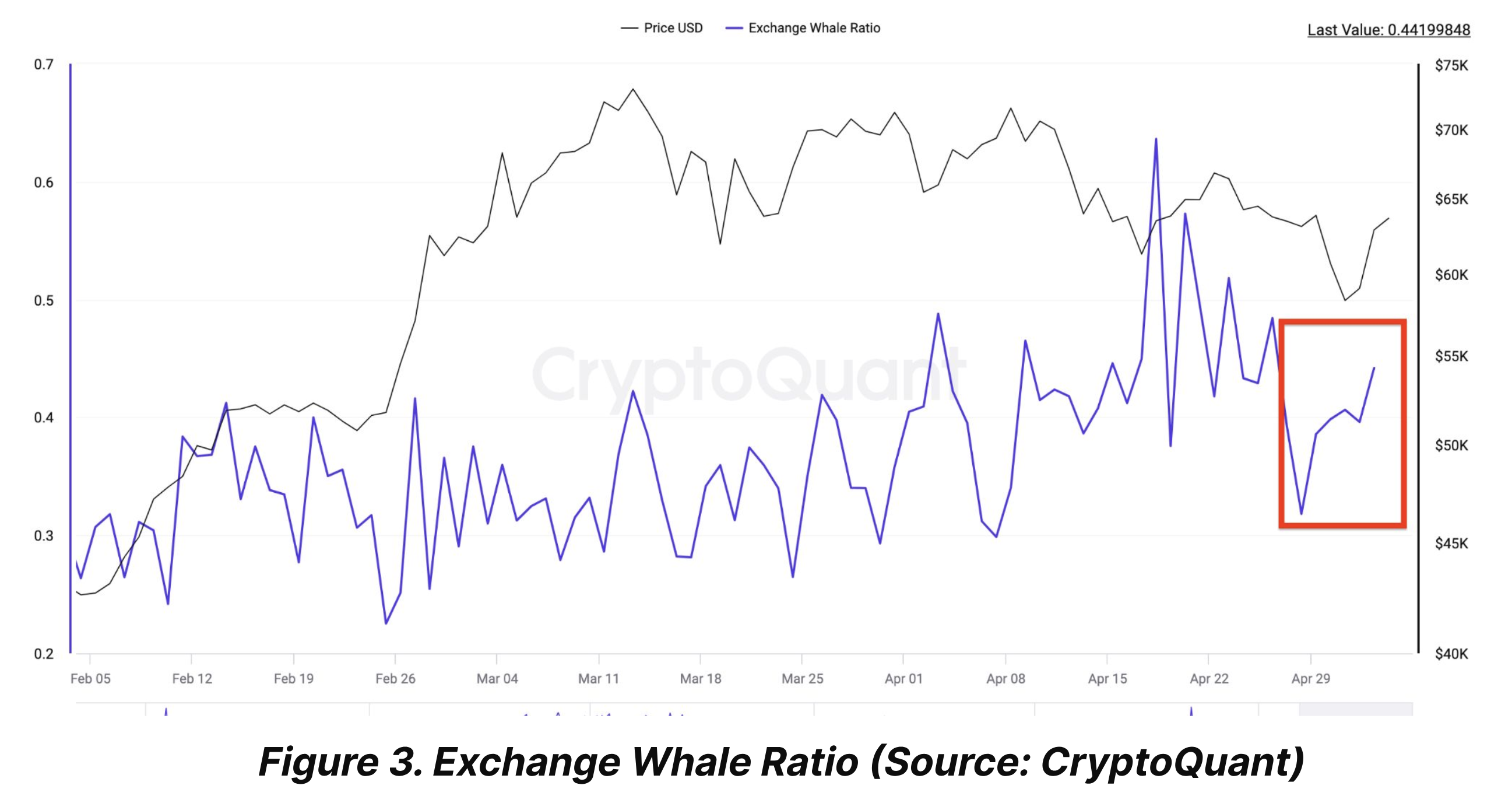

Despite the overcast skies, Bitfinex analysts have identified possible signs of upcoming market turbulence in the Bitcoin sector. Notably, there has been a noticeable increase in the number of Bitcoin whales transferring their coins to exchanges. This metric, referred to as the whale ratio, can serve as an indicator of large-scale transactions that may lead to short-term price fluctuations.

Major players might be contemplating selling, potentially leading to heightened selling activity in the market.

As a researcher studying the cryptocurrency market, I’ve recently come across some intriguing insights from Bitfinex’s Alpha report. Specifically, it appears that short-term Bitcoin holders are currently facing a critical juncture, with the realized price of $58,700 serving as a significant support level. However, I’d like to add an important caveat: the heightened exchange activity from whales could potentially cause substantial price volatility in the near future.

Long-Term Perspectives And Market Recoveries

As an analyst, I’ve observed some pressure on the Bitcoin market recently, causing it to dip from its peak above $73,000 in March. However, despite these short-term challenges, Bitcoin has demonstrated remarkable resilience. Over the past week, its price has risen by 5.8%, and within the last 24 hours, it has seen a further boost of 2.8%. These gains have brought the current trading price to approximately $63,791.

Enhancing the belief in Bitcoin’s longevity, Michael Saylor of MicroStrategy expressed his perspectives on what could drive Bitcoin’s price upward in the future.

From his point of view, the rejection of cryptocurrency ETF applications, including those for Bitcoin alternatives, by regulatory bodies will strengthen Bitcoin’s position as a unique and dominant digital currency.

Saylor revealed that this regulatory barrier could possibly attract more institutional investments towards Bitcoin, given its unique and essential role in the cryptocurrency market—unmatched and irreplaceable.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-05-08 04:16