As a crypto investor with some experience under my belt, I have to admit that Ethereum’s recent performance has been disappointing. The second-largest cryptocurrency by market cap seems unable to make any significant moves above the $3,100 level, and this lack of progress is causing concern among investors.

Over the past few weeks, Ethereum has underperformed, causing unease among its investors. The cryptocurrency hovers just above the $3,100 mark without achieving substantial gains. This stagnation suggests fragile foundations, potentially setting the stage for a drop in price.

Ethereum Fails To Make Meaningful Moves

Markus Thielen, the Research Head at 10x Research, has raised concerns over Ethereum’s price action in a recent report he shared with NewsBTC. He notes that although Ethereum’s price movement remains closely linked to Bitcoin‘s, with an R-Square of 95%, Ethereum has underperformed significantly as Bitcoin reached new all-time highs.

As an analyst, I’d say that Thielen looks back at Ethereum’s (ETH) previous bull market and notes how its surge was linked to emerging sectors within the network, specifically decentralized finance (DeFi) and non-fungible tokens (NFTs). This led to a significant increase in demand as users clamored to acquire ETH, paying high gas fees for transactions on the blockchain. In response, the price followed suit, reflecting this heightened interest and adoption.

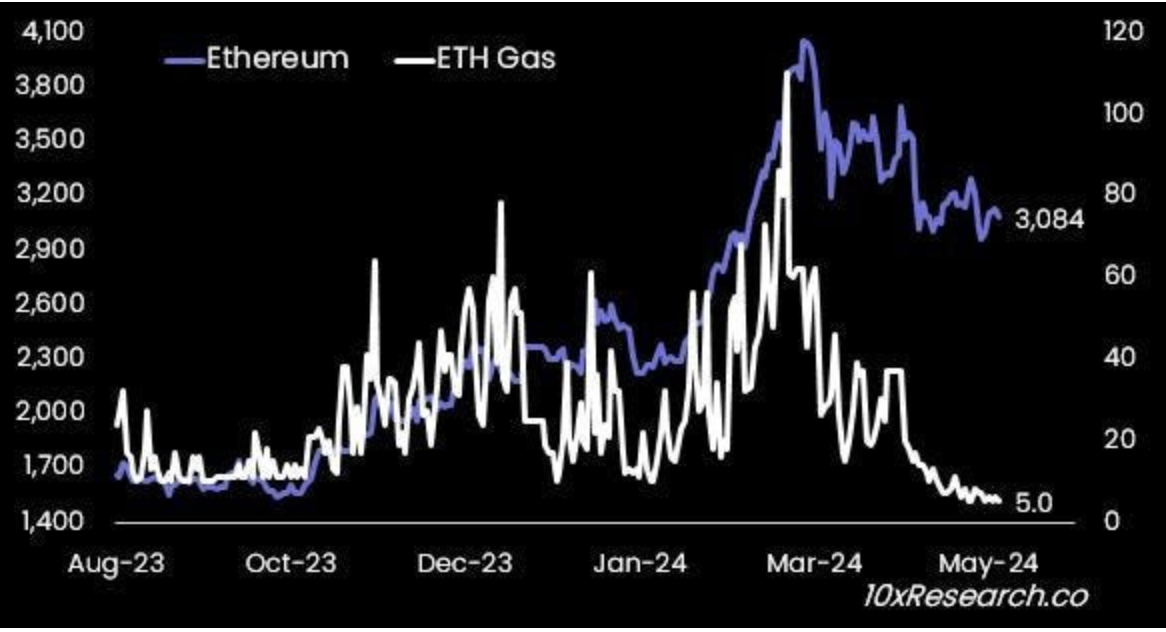

As a researcher, I’ve noticed that Ethereum has struggled to keep up with the pace set by its initial surge in adoption. This can be chalked up to its inability to deliver necessary upgrades in a timely manner. Thielen points out that the long-awaited Denver upgrade, which addressed high gas fee issues, arrived three years too late. By 2024, when the upgrade was finally implemented, users had already started migrating to Layer 2 networks. Moreover, during this period of delay, other Layer 1 networks have experienced significant growth, with Solana being a notable example.

The researcher elaborated that Ethereum’s shaky foundations are no longer just influencing its own price, but have also caused a ripple effect to Bitcoin. According to Thielen, “Ethereum’s tenuous fundamentals pose a barrier for Bitcoin by hindering substantial fiat currency investment into the crypto market.”

Better To Short ETH

As a crypto investor, I’ve closely followed Thielen’s analysis of Ethereum and its impact on stablecoin usage. In 2021, Ethereum held a significant share of stablecoin transactions with popular coins like USDT and USDC. Yet, the high transaction fees have led users to explore alternative networks. Surprisingly, blockchains such as Tron (TRX) are now taking the lead in stablecoin transactions, leaving Ethereum struggling to keep up.

As a researcher studying Ethereum (ETH), I’ve discovered an intriguing development: following the implementation of EIP-1559, or the London Hard Fork, in 2021, Ethereum experienced deflation for the first time. This shift occurred due to a faster rate of ETH being burned than minted. However, more recently, I’ve observed that Ethereum’s issuance is once again becoming inflationary.

In recent months, Thielen points out, the situation has shifted as more ETH has been created than destroyed. Specifically, approximately 74,000 new ETH have entered circulation versus the 43,000 that were burned. This increase in supply, combined with a decrease in staking rewards – now sitting at 3%, less than the 5.1% of Treasury Yields – has made it challenging for Ethereum to sustain bullish momentum.

Based on the current situation, it’s more advisable for investors to consider going short on Ethereum rather than long on Bitcoin. According to Thielen, Ethereum’s foundations are unstable, and this discrepancy between fundamentals and market prices has not yet been reflected in ETH valuation.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

2024-05-08 00:05